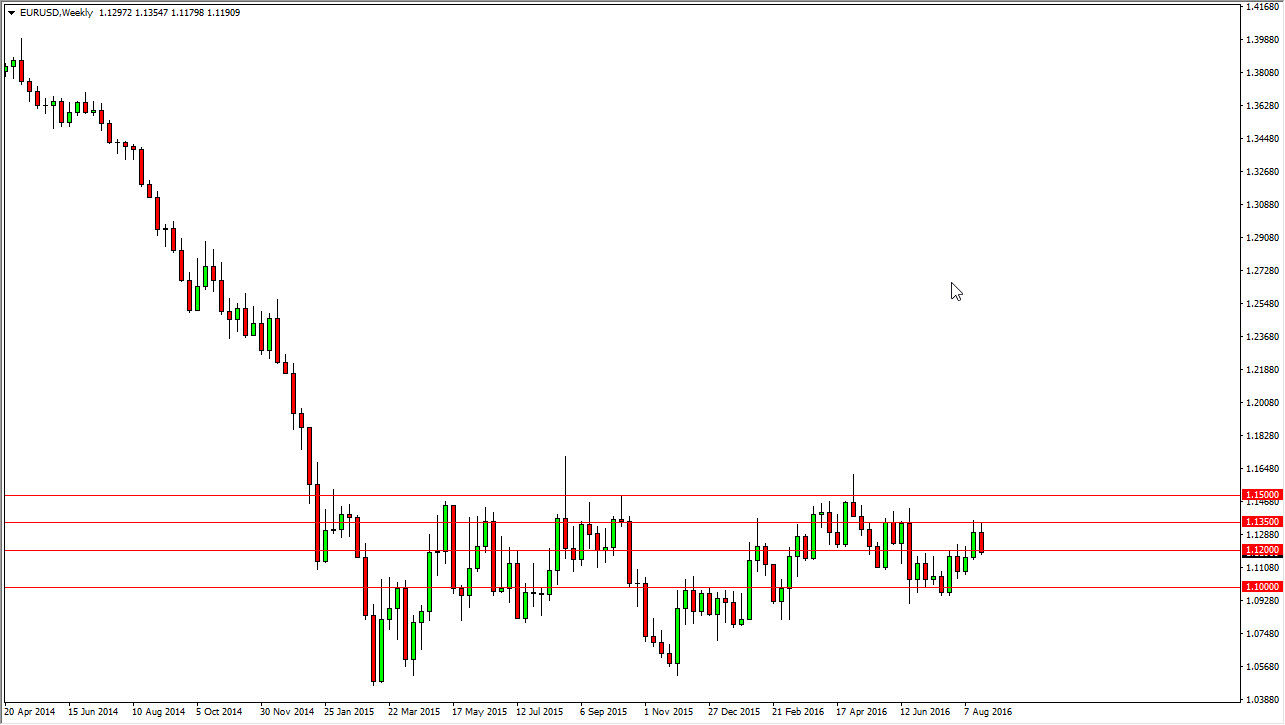

EUR/USD

The Euro initially tried to rally during the course of the week but turned right back around, especially on Friday, and fell apart. Because of this, I believe that anytime we see short-term rallies in this market it should offer a selling opportunity. I think that the market continues to be extraordinarily volatile, so obviously short-term charts will be needed in order to navigate what happens next. I do have a slightly negative bias at this point after the Friday collapse, but I do recognize that no particular move is going to last for any real length of time.

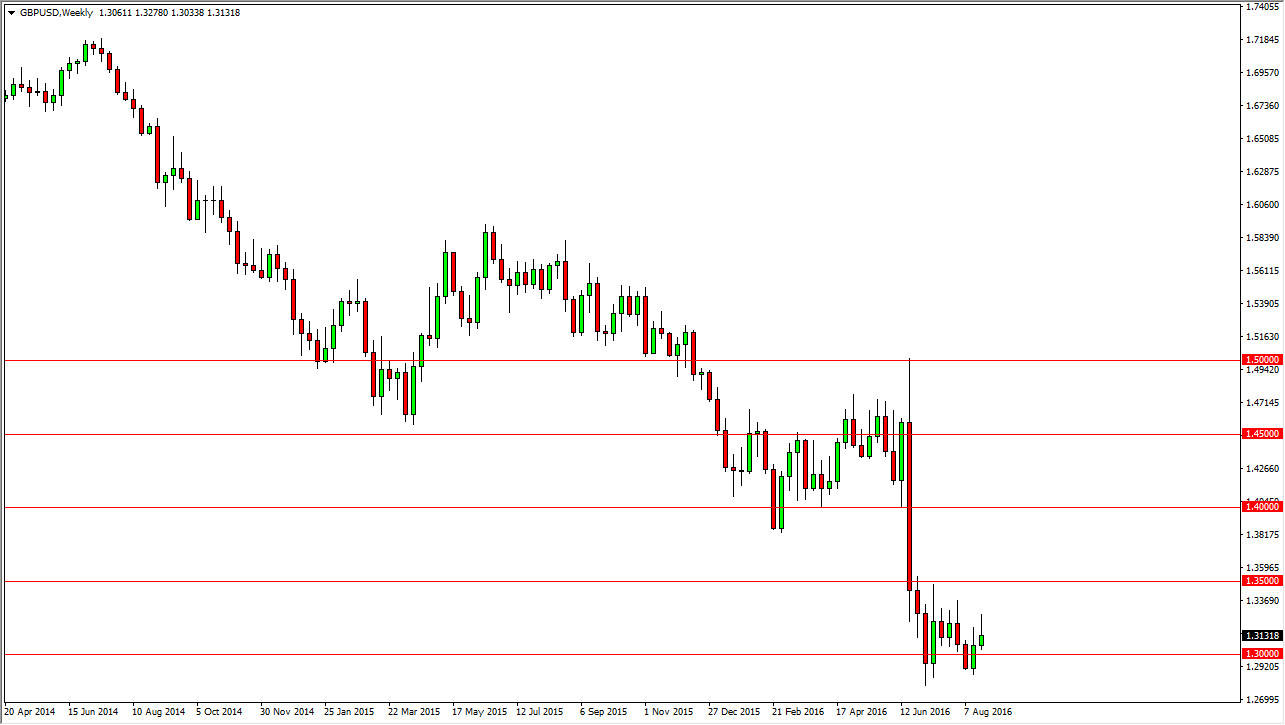

GBP/USD

The British pound initially tried to rally during the week but turned around as well, forming a shooting star for the week. Because of this, I believe that we are going to continue to see bearish pressure on the British pound, and as volume picks up, I would anticipate that more selling pressure should appear. I believe that we're going to the 1.25 level but I don’t think it’s going to be an easy move to make. With this being the case, it’s very likely that we will continue to see choppy and volatile moves.

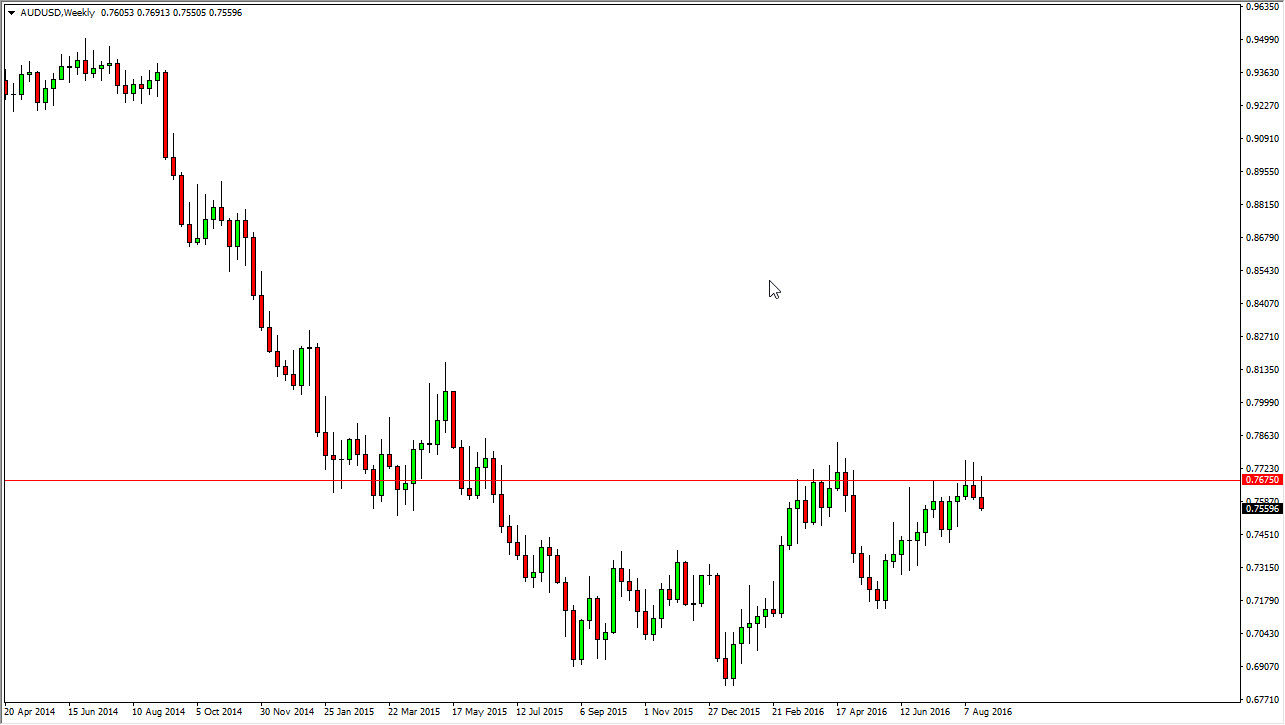

AUD/USD

The Australian dollar initially rallied during the week to turn right back around to form a shooting star. By doing so, it looks as if we are going to continue to try to grind lower. However, I do recognize that there is a lot of support below so it’s probably only a matter time before the buyers reemerge. In other words, I believe in short-term selling opportunities when it comes to the Aussie.

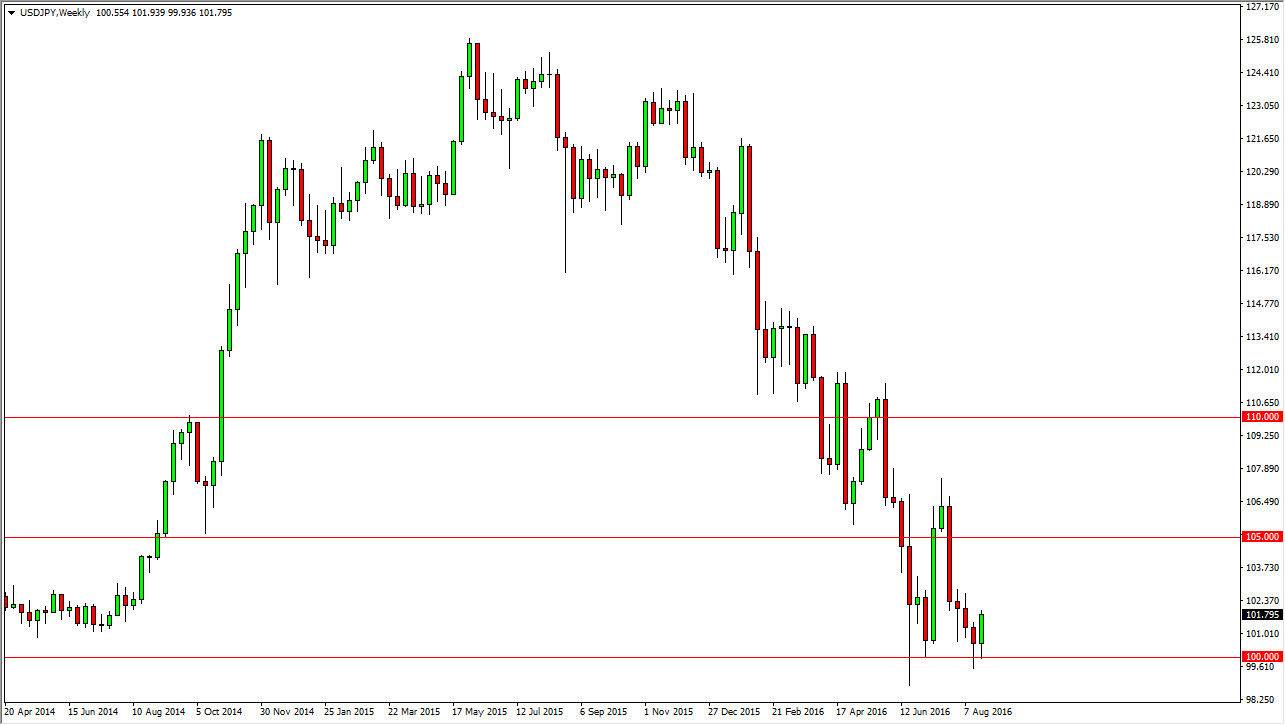

USD/JPY

The US dollar bounced off of the 100 level against the Japanese yen, and continues to show quite a bit of bullish pressure. Because of this, I believe that eventually we will continue to go higher but I recognize that volatility may be the way going forward for the short-term. I think that short-term pullbacks to show any signs or inclinations of bouncing should be thought of as potential buying opportunities.