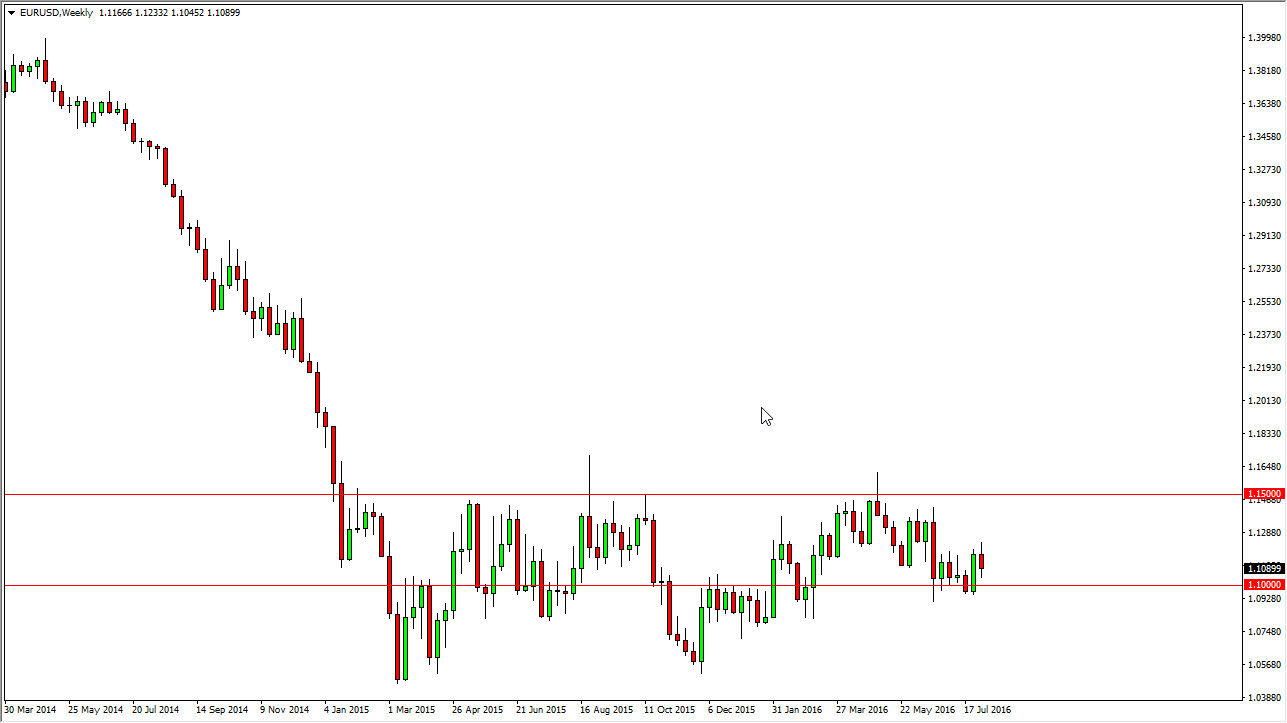

EUR/USD

The EUR/USD pair had a slightly negative week over the last 5 trading sessions, but it appears that we are still continuing to bounce around just above the 1.10 level. I expect that every time this market rallies, there will be selling opportunities given enough time. I think that we will more than likely continue to be very choppy, so short-term traders should continue to push the market lower.

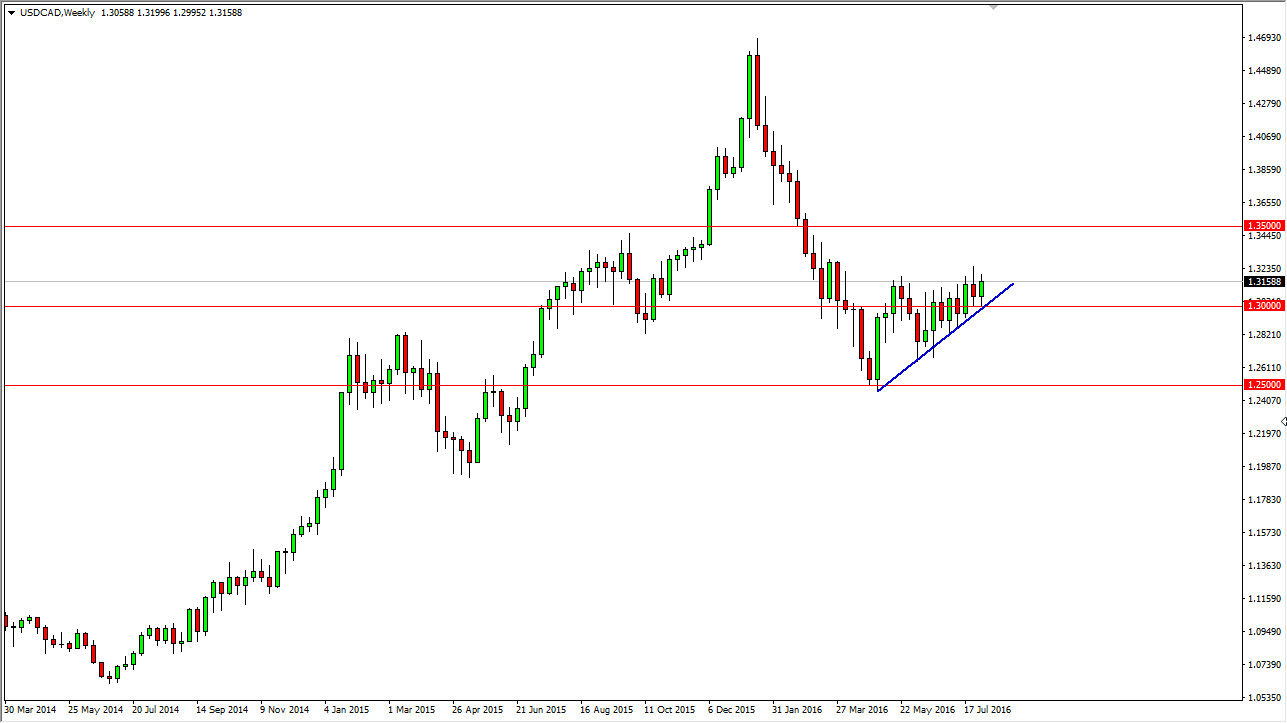

USD/CAD

The USD/CAD pair bounced off of the 1.30 level during the course of the week, which of course was also the sign that the uptrend line is still intact. With the oil markets looking soft overall, I believe that this market will continue to be one that you can buy again and again every time it dips a supply “value” going forward and perhaps extending towards the 1.35 level.

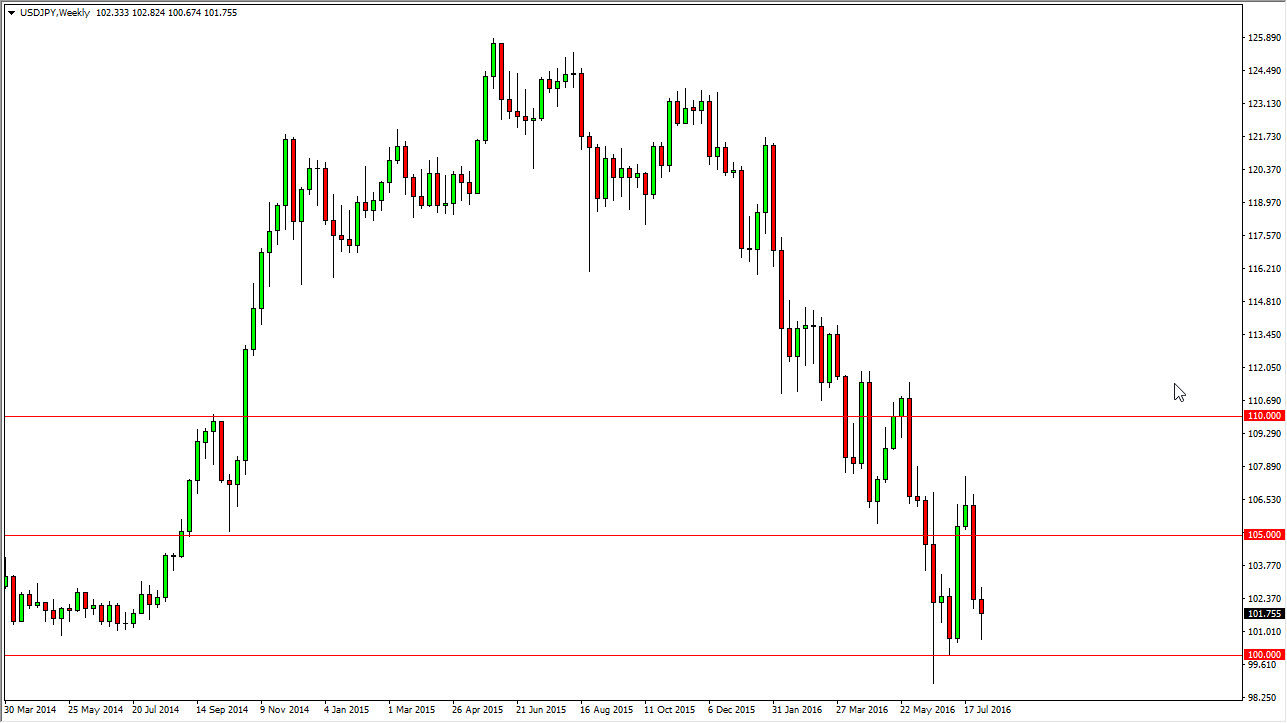

USD/JPY

USD/JPY fell initially during the course of the week, but found enough support near the 101 level to turn things around and form a nice-looking hammer. The jobs number of course coming out better than anticipated cost the US dollar to rally, and with that being the case, I believe that we are reaching towards the 105 level above. I believe that buying dips can be done, but keep in mind that we are going to be very choppy at these low levels. The Bank of Japan below continues to be the big deterrent to continued bearish pressure.

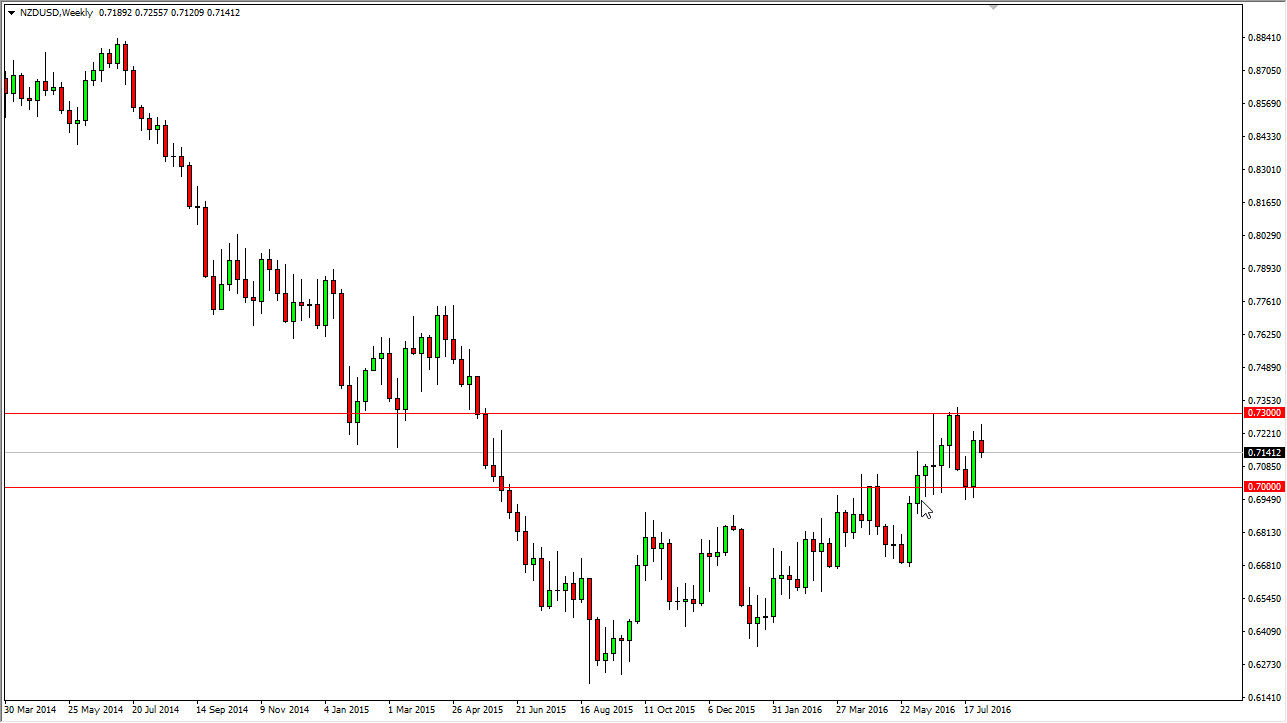

NZD/USD

The NZD/USD pair initially tried to rally during the course of the week but turned right back around for a bit of a shooting star. Having said that, we are still in the middle of a larger consolidation area with the support being found at the 0.70 level, and the resistance at the 0.73 level. I believe this week will see this market pull back slightly, but somewhere closer to the aforementioned support level the buyers will return.