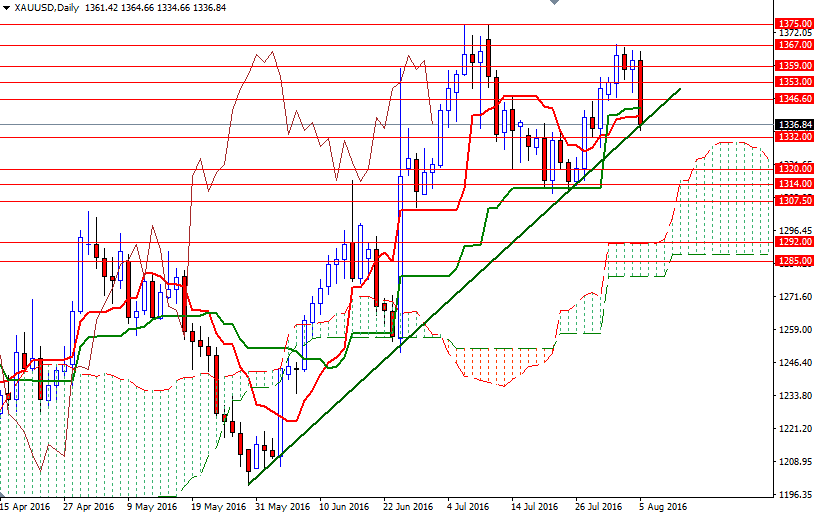

Gold prices sank 1.8% and settled at $1336.84 an ounce as strength in the dollar weighed on the market and drew investors away from the precious metal. The greenback jumped Friday after stronger-than-expected U.S. jobs data increased concerns that the Federal Reserve could raise interest rates in the coming months. Figures from the Labor Department showed that the economy added 255K jobs in July, well above consensus estimates of 180K, and average hourly earnings jumped 0.3%. A rally in U.S. equities also contributed further pressure on gold. Renewed confidence in the U.S. economy pushed the S&P 500 and Nasdaq to record highs.

Friday's decline, dragged XAU/USD back to the 1339/2 area occupied by the Ichimoku clouds on the 4-hour. Closing around the bottom of the trading range is a negative sign but in addition to 4-hourly cloud, there is also a short term bullish trend line in the same area so it will be a strategic place for the bears to conquer, if they intend to test the supports at 1326 and 1320. Breaking down below the 1320 level might lead to further downward pressure. In that case, I think we will be heading back towards 1307.50-1304 region. On its way down, support can be seen at 1314.

On the other hand, if prices bounce from here, keep an eye on the 1340 level. The bulls have to push prices back above the 1340 so that they can revisit the 1346.60-1345 resistance zone. A breakout above 1346.60 could foreshadow a move up to 1353/2.Once we get through that barrier, that will probably bring more buyers in and open a path to the 1359.