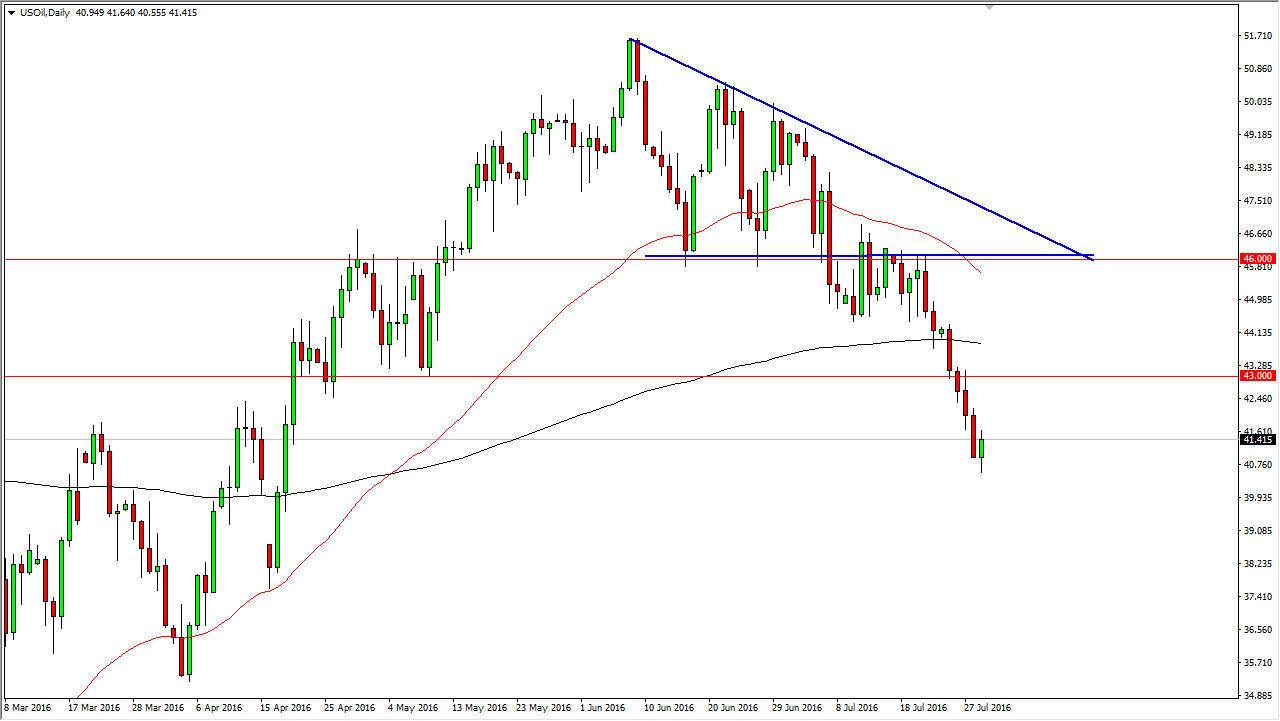

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Friday, but turned around to bounce and form a slightly positive candle. Nonetheless, there is quite a bit of negativity in this market and it seems very likely that we will continue to go to the downside. Because of this, I’m waiting to see signs of exhaustion that I can take advantage of, and start selling yet again. I believe that the $43 level above is going to be a bit of a ceiling, and it’s only a matter of time before sellers get involved between here and there. I believe that the market will try to break down below the $40 level, but it may take a couple of attempts as it is a large, round, psychologically significant number.

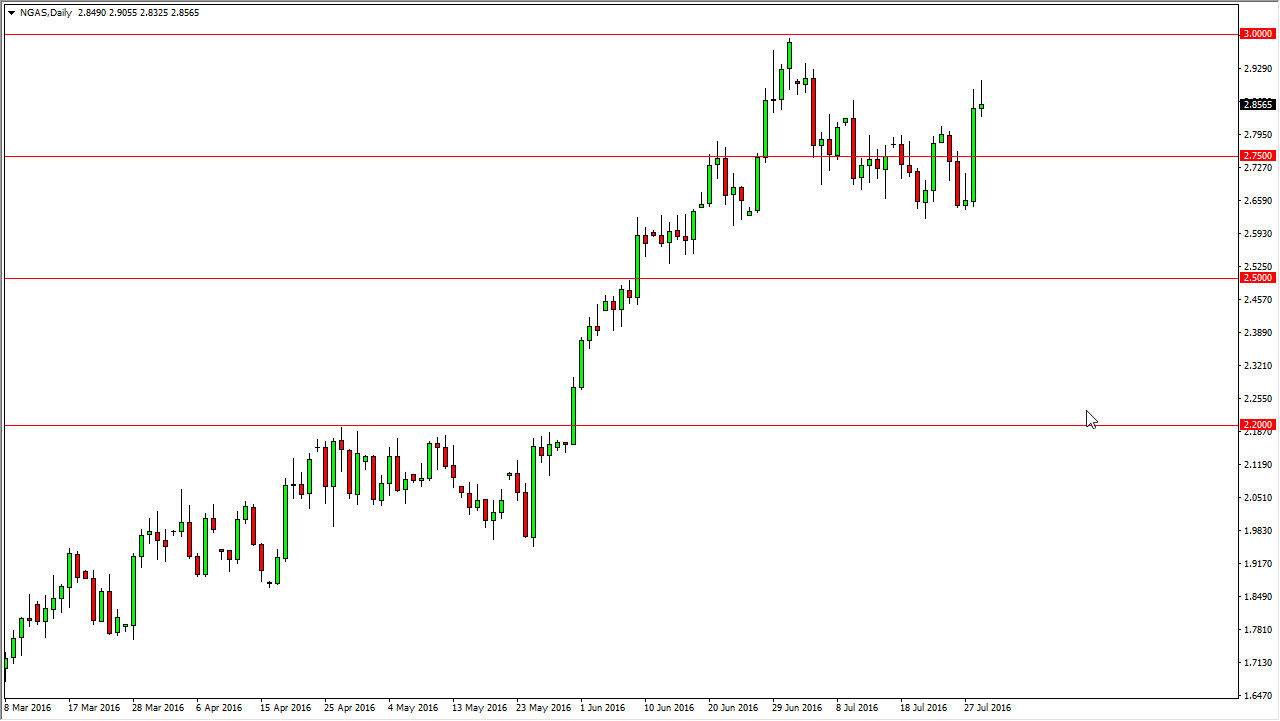

Natural Gas

The natural gas markets rallied during the day on Friday, but turned right back around to form a shooting star. By doing so, looks like the market is going to continue to struggle with the volatility but should continue to be a market that finds buyers on pullbacks. With that being the case, I feel that it is only a matter time before he can go long. I would wait for a supportive candle after this potential pullback, or a break above the top of the shooting star would also signify that we should continue to go higher as the market will reach towards the $3.00 level.

That is of course a very large number, so having said that I feel that the market will have to fight in order to break above there, and I believe that it could take quite a bit of effort to finally make the breakout. Because of this, it will probably chop around quite a bit and offer several different attempts and opportunities to trade. At this point, I still believe that we are going to reach towards $3 at the very least.