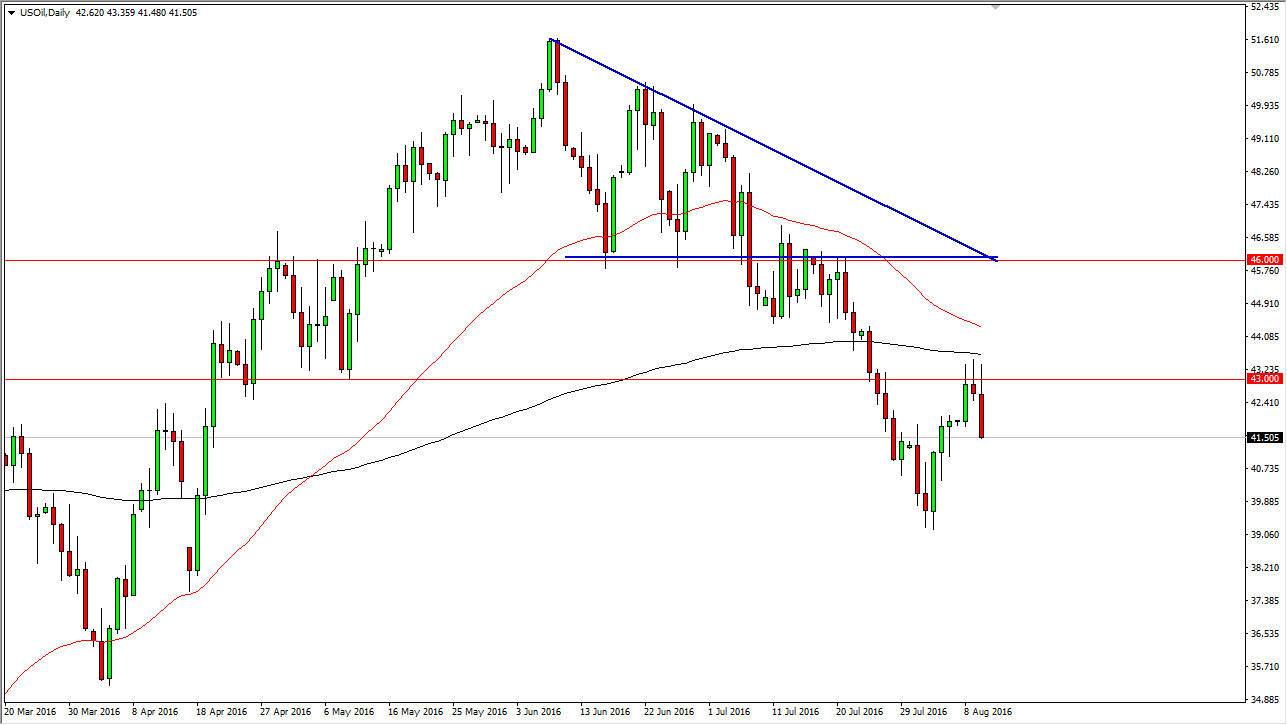

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Wednesday, but turned right back around to form a very bearish candle after forming the shooting star on Tuesday. By doing so, it looks as if the oil markets are getting ready to roll over significantly, and I am short of this market already. We should continue to see this market reach towards the $39 level, and at this point in time I believe that short-term rallies are simply going to be nice selling opportunities. I think that the $43 level will continue to be very resistive, just as the 200-day exponential moving average, pictured in black, and as a result I am “sell only.”

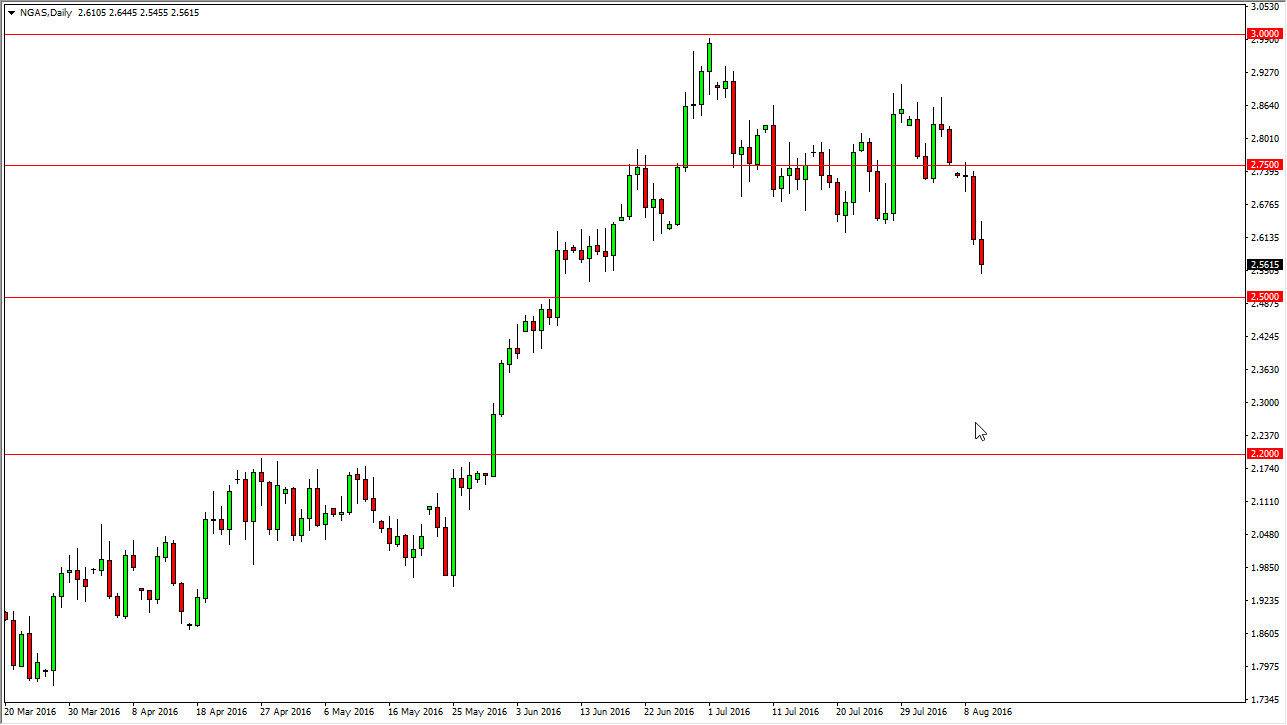

Natural Gas

The natural gas markets initially tried to rally during the course of the day on Wednesday, but as you can see fell and ended up forming a fairly negative candle. By doing so, looks as if we are grinding away to the downside and it now looks very likely that we are going to continue to see sellers enter this market. I’d previously suggests that perhaps we were going to see support just below, and we very well could still, but I think it’s going to be temporary at best. We are starting to see weakness in energy markets overall, and as a result I feel that we are starting to see a roll over and perhaps have already “top-down” in this market. I had initially thought that the $3 level would be attacked, but at this point in time we are clearly starting to see serious bearish pressure in this market.

Once we do break down below the $2.50 level, I believe it will open the floodgates going forward and we will then reach towards the $2.20 level below.