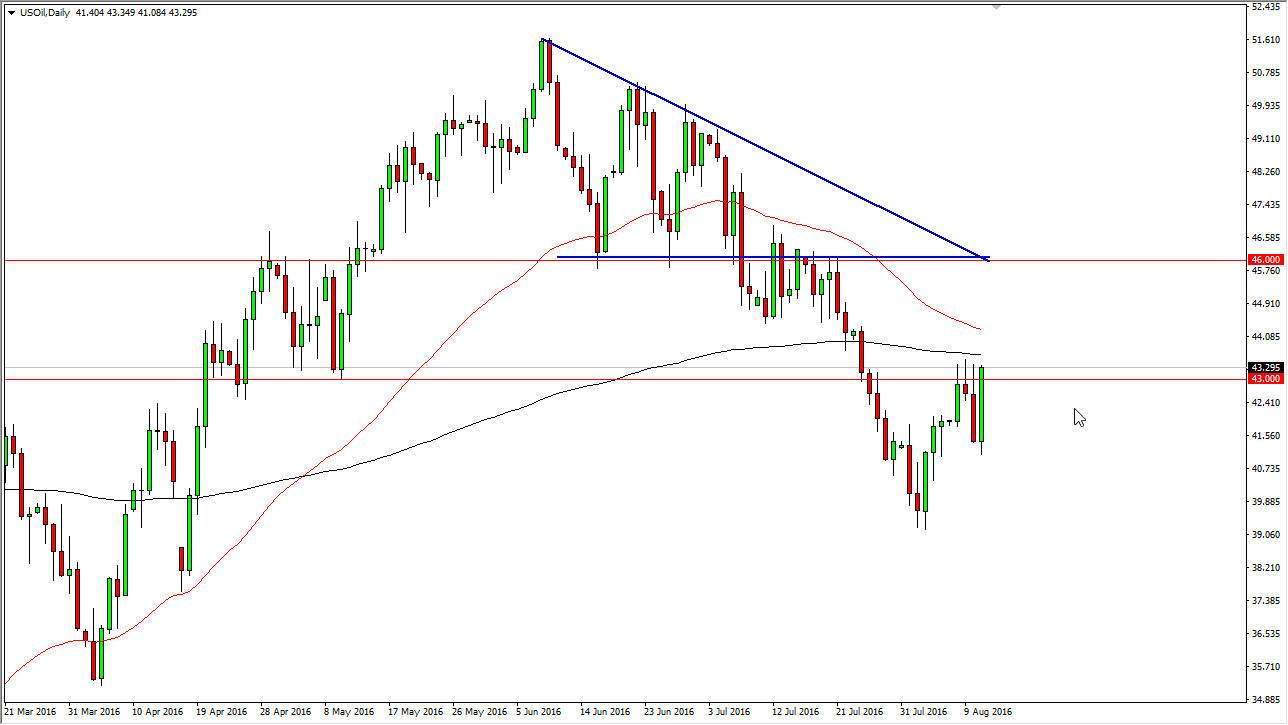

WTI Crude Oil

The WTI Crude Oil market had an explosive session during the day on Thursday, flying in the face of the resistance that we’ve seen recently. However, I would be very cautious about going long here, simply because the 200-day exponential moving average is just above, pictured in black. Also, the 50-day exponential moving averages just above there and looks likely to try to cross. This being said, the IEA has released a report that suggests crude oil production may fall and 2017, which of course makes sense because we have had lower prices. Ultimately though, I think this candles jumping the gun a bit, and therefore I’m still looking for exhaustion to sell at this point in time.

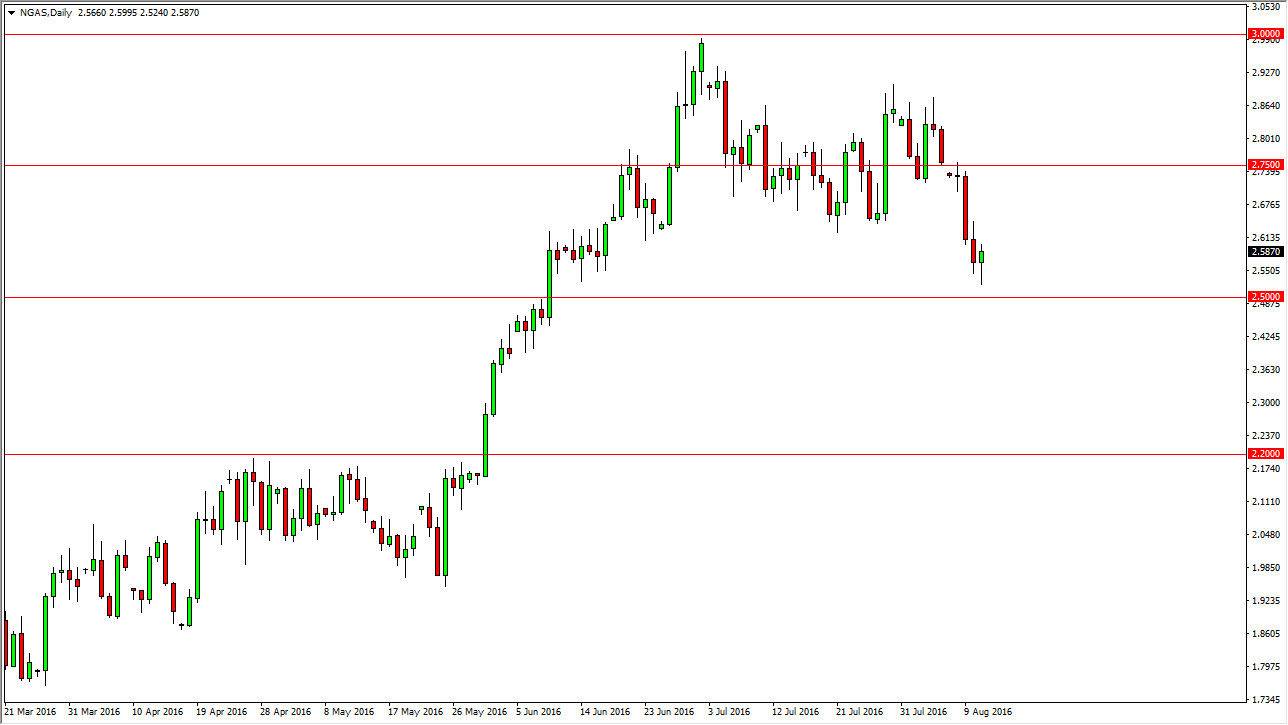

Natural Gas

Natural gas markets fell significantly during the course of the day, but found support near the $2.50 level, an area that has been supportive in the past and I see as the signal that we’re changing trends to the downside for the longer term. The fact that we bounce from there is a positive sign, but I still believe that eventually we will see sellers above that will continue to punish this market. Because of this, I’m simply waiting to see whether or not we get the exhaustive candle that I can start selling. On the other hand, if we break down below the $2.50 level, I would start selling there as well as it would not only be a break down below a significant large round number, but also the bottom of a hammer. Ultimately, I think that the natural gas markets will fall the longer-term, because the demand simply isn’t going to be there. At this point in time, I am going to ignore any signals to start buying and I will start looking for exhaustion that I can start selling and believe it to be coming very soon.