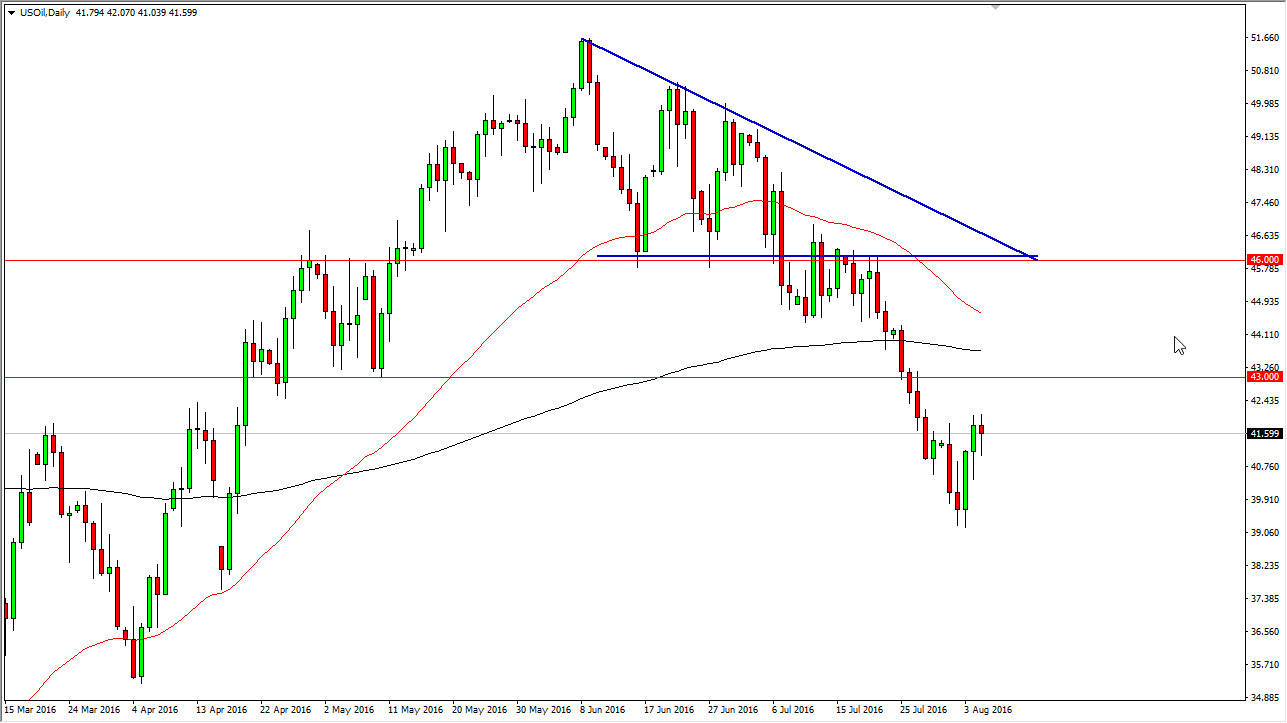

WTI Crude Oil

The WTI Crude Oil market initially fell during the course of the session on Friday, but bounced enough to form a nice-looking hammer. That being the case, looks as if we could go higher from here, but I see a significant amount of resistance just waiting at the $43 level above. With this being the case, an exhaustive candle would be reason enough to start selling. I have the 50-day exponential moving average marked in red on the chart, as well as the 200-day exponential moving average. They look like they are about to cross given enough time, so having said that I think it’s only a matter time before the sellers return to this marketplace and continue the downtrend. On the other hand, a break down below the bottom of the hammer for the session on Friday would also be a nice selling opportunity.

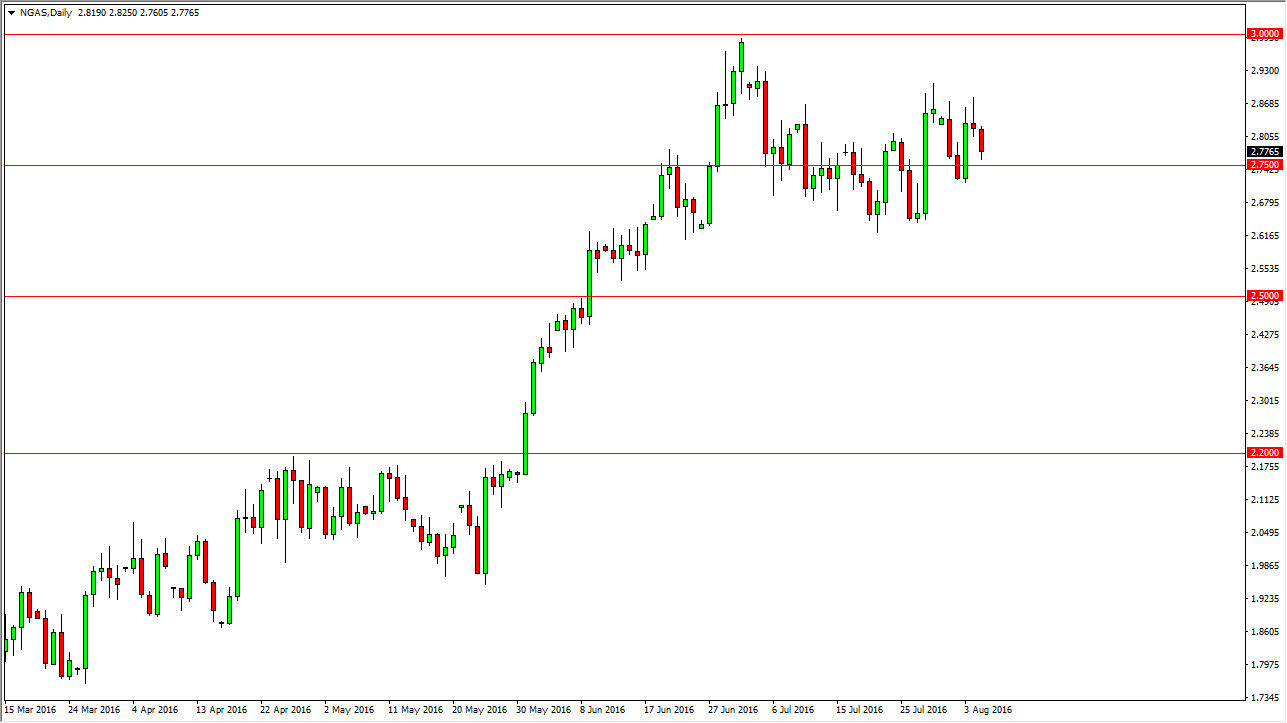

Natural Gas

Natural gas markets fell during the day on Friday, but found the $2.75 level to be supportive enough to cause the market to bounce. I have been saying for a couple of sessions now that this is a market that simply continues to grind back and forth and difficult to hang onto for any real length of time. Because of this, I have no interest in trading this market at the moment, at least not until we break out or break down. With that being the case, it’s likely that short-term traders, if not scalpers will be involved more than anybody else. Ultimately, the $3.00 level above will be targeted, just as it has been previously. However, we are not exactly exploding to the upside so I can’t start buying. I suppose if we break down below the $2.60 level that would be very negative sign, but we are anywhere near doing that either. With this, I feel it is probably safest to simply stay away.