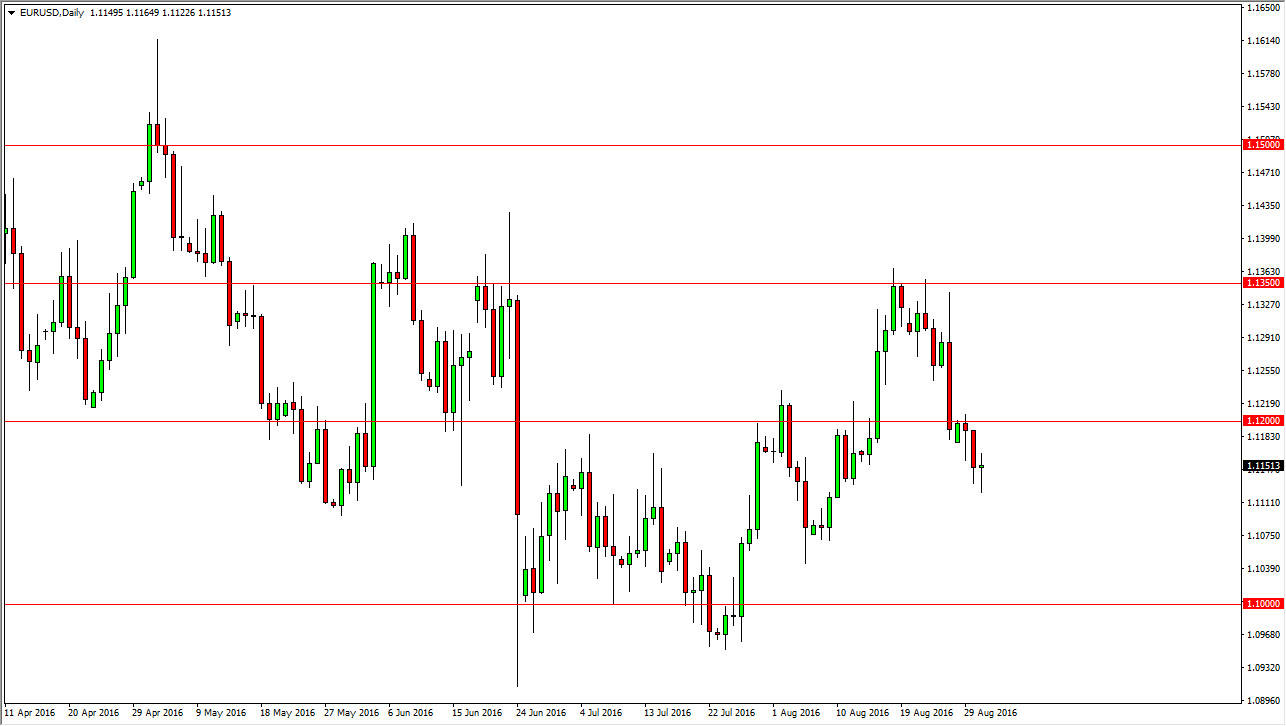

EUR/USD

The Euro initially fell during the course of the session on Wednesday, but turned back around form a hammer. That being the case, it looks as if the market is trying to find a bit of supportive action here, and as a result it should send this market looking for the 1.12 level above. We can break above there; we should continue higher. However, I also recognize that if we break down below the bottom of the hammer, it’s likely that the market will fall from there. Nonetheless, the Nonfarm Payroll numbers come out during the session on Friday, and could have a massive effect on the US dollar and of course the overall action of the Forex markets for the next several sessions. Between now and then, I would anticipate that we should have a fairly quiet market.

GBP/USD

The British pound rallied a bit during the course of the day on Wednesday, as the area near the 1.30 level continues offer quite a bit of support. I believe sooner or later though we will find sellers above, and an exhaustive candle should be reason enough to start selling, as we have seen quite a bit of bearish pressure in the British pound due to the vote to leave the European Union. If we can break down below the 1.30 level below, I think the market can drop down to the 1.2850 level given enough time.

Ultimately, the jobs number will have a massive amount of influence on where the Forex markets in general go, and that will probably be the case here in this pair as a strong jobs number will increase the likelihood of an interest-rate hike by the Federal Reserve, which of course will drive up pressure for the US dollar in general as it will become even more in favor by traders.