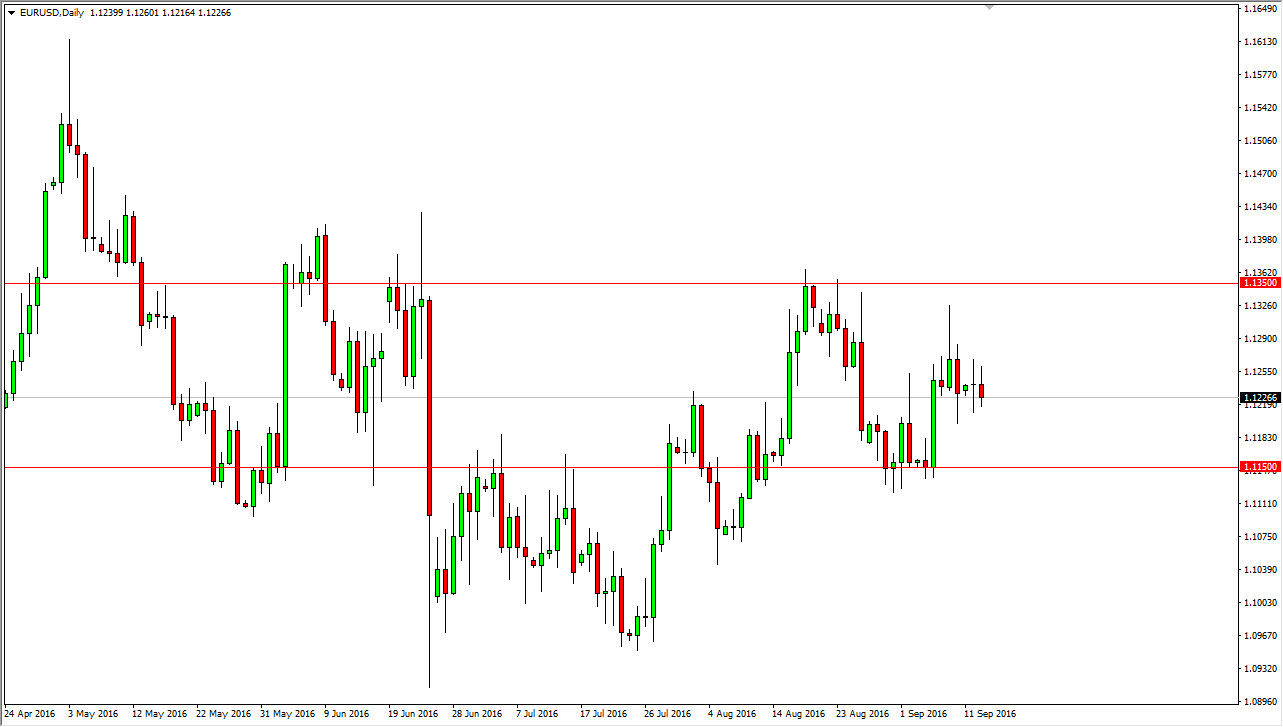

EUR/USD

The EUR/USD pair initially tried to rally during the course of the session on Tuesday, but turn right back around to form a rather negative candle. By doing so, looks as if the market continues the consolidation that we’ve seen for some time now, and quite frankly there isn’t much here to get me too excited. Ultimately, this is a market that I think will continue to consolidate between the 1.1150 level on the bottom, and the 1.1350 level on the top. I need to see some type of impulsive candle in order to get involved, and although we have formed a fairly negative one, there is support just below current levels. With this being the case, I just feel that it’s probably best to leave this market alone at the moment.

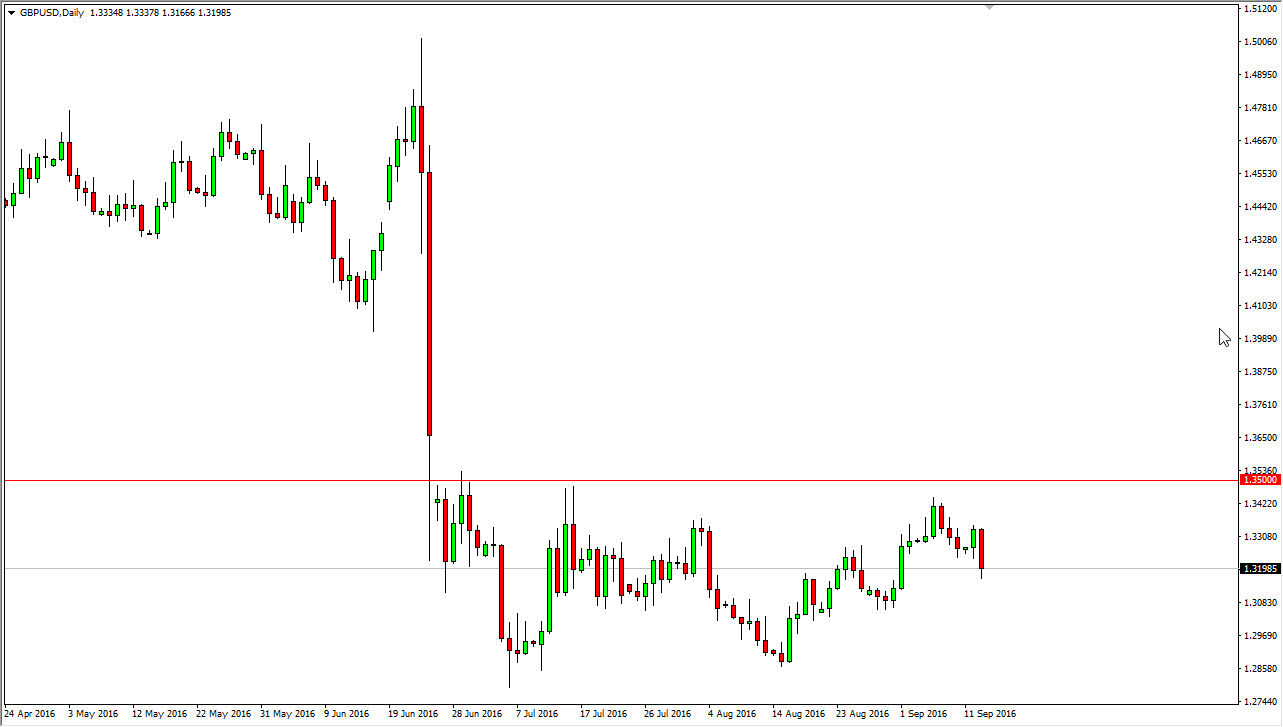

GBP/USD

The British pound fell during the course of the day as the US dollar gained in general. It makes sense in this market though, because quite frankly the British pound has been punished for some time. You can even make an argument for an uptrend line been broken to the downside, and that gives me just another reason to continue selling, as the market should then reach towards the 1.2850 level. I don’t think it’s can be an easy move, I think it will be difficult and probably quite choppy. At the end of the day though, I have no interest in buying and I believe that any rally at this point in time has to be treated with suspicion, and exhaustive candles after those rallies would of course be short-term selling opportunities.

There so much bearish pressure above and volume is starting to pick up so I do believe that eventually we will see a continuation of the downtrend that had been in place. Longer-term, we might be talking about the 1.25 handle, but it isn’t going to happen overnight.