EUR/USD

The EUR/USD pair fell rather dramatically during the session on Friday, crashing into the 1.11 level. By doing so, we are challenging a fairly significant support level, but I think we will eventually break down below it. In the meantime, you have to assume that a bounce is likely, but I’m not willing to buy that bounce as the candle was so negative on Friday. With this being the case, I think that rallies will have to be looked at as potential selling opportunities on signs of exhaustion going forward. Because of this, I am essentially in a “sell only” mode. I think that given enough time we will reach down towards the 1.10 level, but it may take a while to get down there.

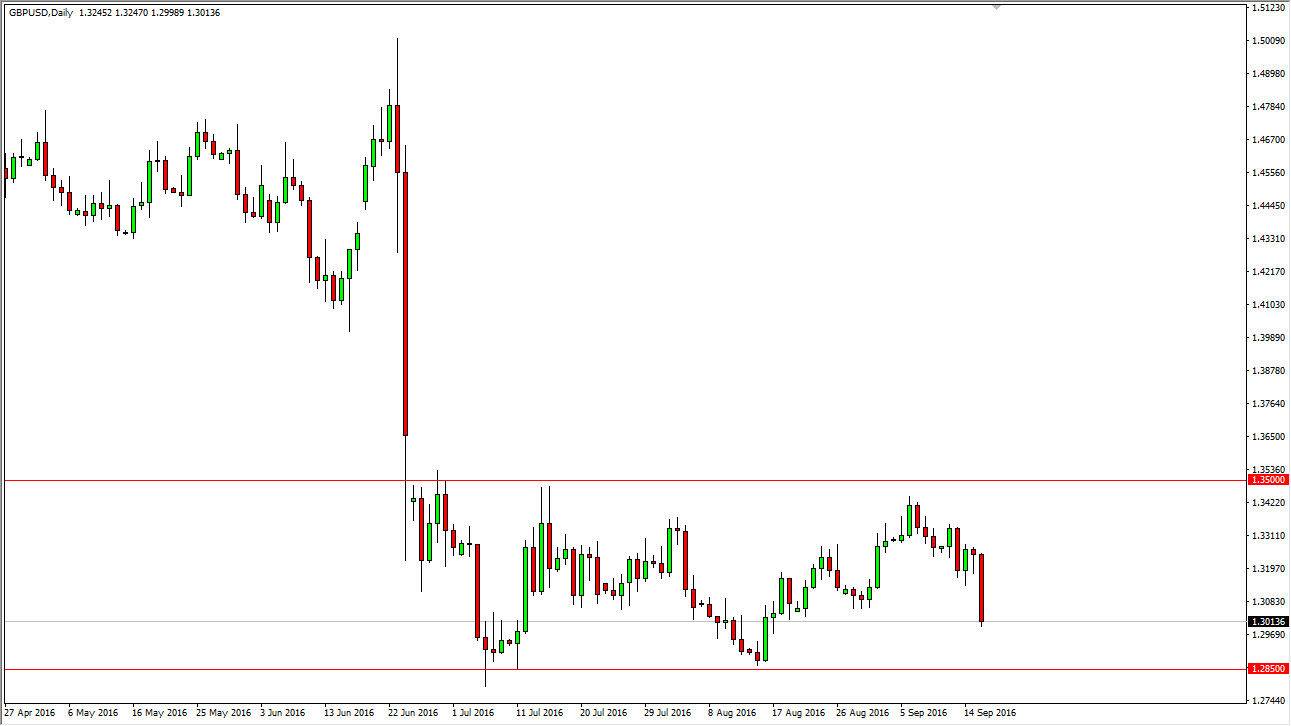

GBP/USD

The British pound had a rough day during the session on Friday, testing the 1.30 level. This of course is a large, round, psychologically significant number, so having said that it’s likely that the sellers will return after any type of bounce because although the number is a large, round, psychologically significant number, the reality is that the real support is all the way down to the 1.2850 handle. With this being the case, I think that the market will offer selling opportunities again and again, but you’re going to have to find exhaustion in order to start selling again. I believe that the market will ultimately try not only to test the 1.2850 level, given enough time I believe that this market will reach down to the 1.25 handle. After all, we are just now starting to see the volume come back to the marketplace, after the summer break. With this being the case, think that we’re going to see more and more traders come in and try to punish the British pound for the exit vote and momentum should start to pick up. Perhaps Friday was the beginning of this.