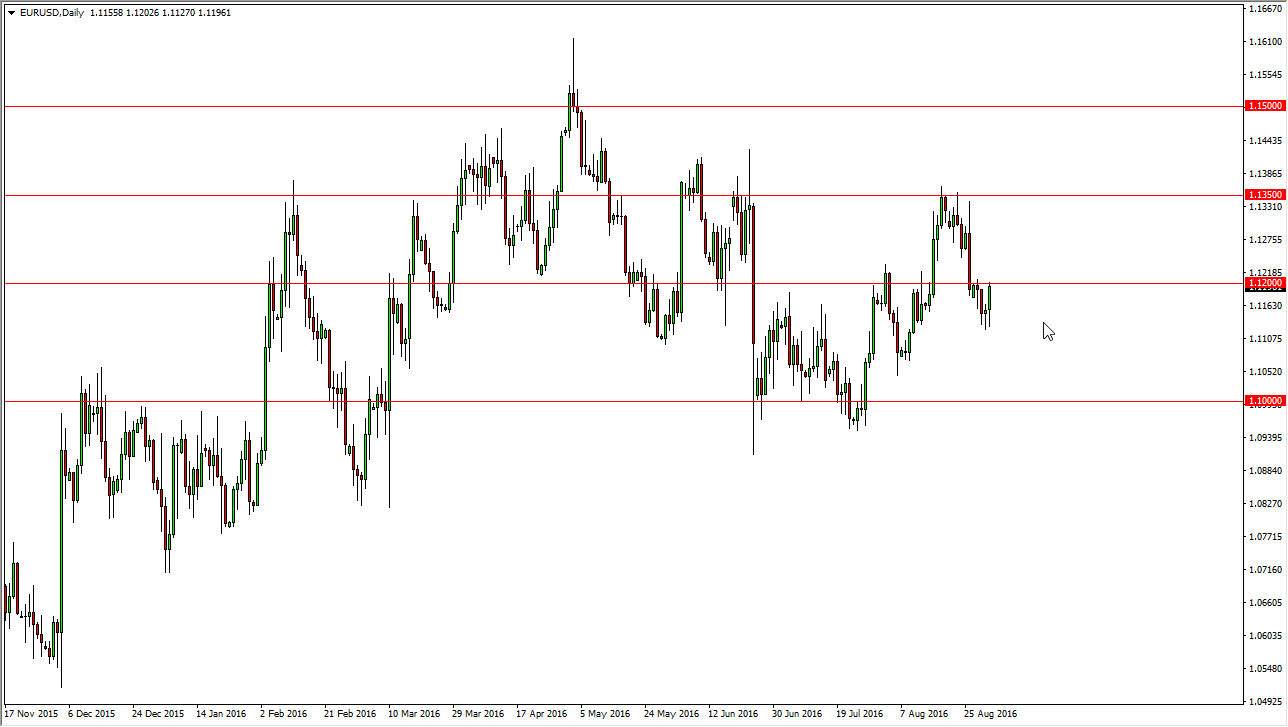

EUR/USD

After forming a hammer on Wednesday, the Euro rallied against the US dollar and slammed into the 1.12 level. This is an area where we have seen resistance and support previously, so it’s not surprising that the market would take a bit of a break here. After all, we get the employment figures coming out of the United States today, and that of course can be very influential on where this pair goes next. I think if we break above the 1.12 level for a significant amount of time, we will probably find yourselves going back towards the 1.1350 level. However, if we managed to break down below the bottom of the hammer for the Wednesday session, we could find yourselves breaking down a bit and reaching towards the 1.10 handle given enough time.

GBP/USD

The British pound rose during the course of the day on Thursday, showing real strength. However, this is a market that has been in a downtrend for quite some time, and quite frankly I think there is a massive amount of resistance above, starting at the 1.34 level and extending all the way to the 1.3650 handle. In other words, I believe that any rally at this point in time will more than likely offer a selling opportunity on signs of exhaustion. You may have to look to short-term charts in order to do so, but I think you will find them given enough time. I think the market will reach down to the 1.30 level at that point, and then perhaps try to break down to the 1.2850 level below there. I have no interest whatsoever in buying this market, and recognize that once the volume comes back into play after the summer break, we very well could see the larger player selling the British pound yet again.