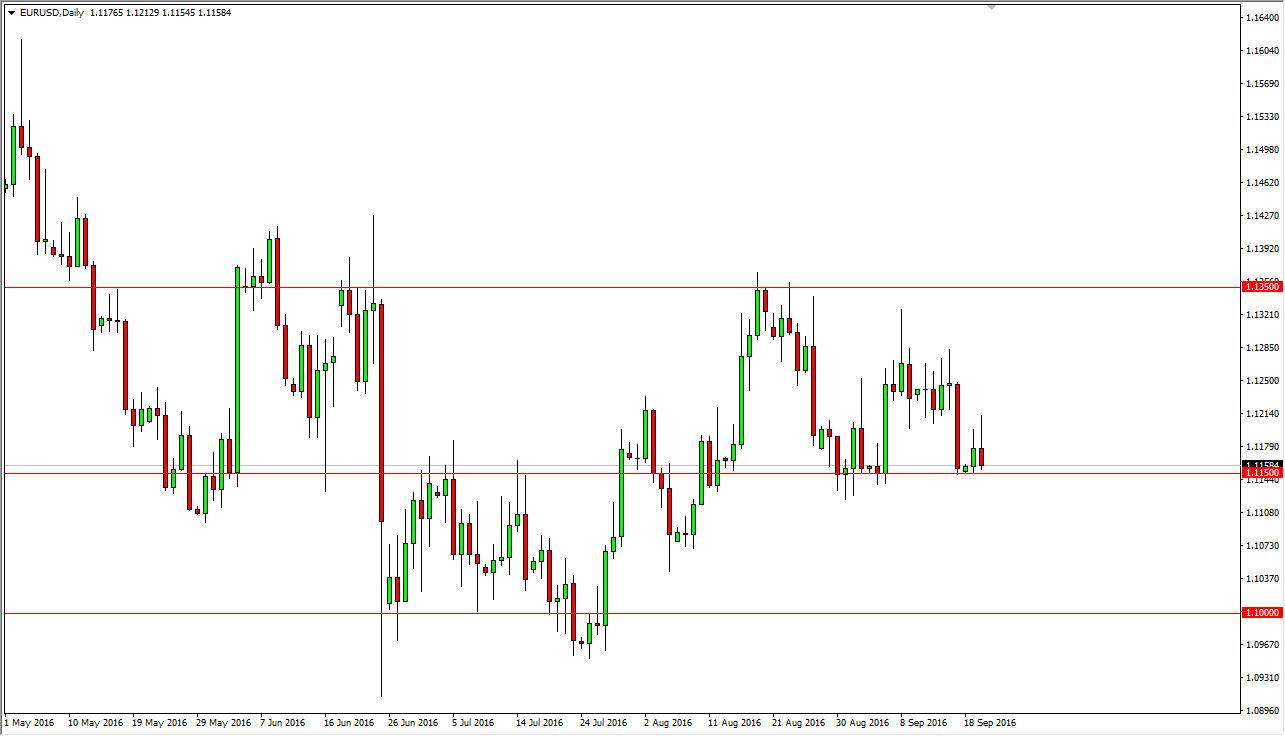

EUR/USD

The EUR/USD pair initially tried to rally on Tuesday, but found enough resistance above to turn things back around. In the end, we formed a shooting star, and it now looking like we are trying to break down below the 1.1150 support level. This is a level that has been important time and time again, so I think it makes sense that we have to test it. Given enough time, I think that the level will give way, and as a result I think that we will eventually try to reach the 1.10 level below. I think that level will be we much more supportive, so that fight will take more energy. Any rally at this point in time should find sellers above, and as a result I would look for exhaustive candles in order to sell.

GBP/USD

The GBP/USD pair fell on Tuesday, as the US Dollar strengthened a little bit overall. The British pound is still being punished for the “Brexit” vote, so I believe we are going lower. By doing so, I think we will continue down to the 1.2850 level, now that we have broken below the 1.30 level during the day. The 1.30 level is essentially a psychological level more than anything else, as we have broken down below there a couple of times during this consolidation.

I believe that given enough time we will break below the 1.2850 level and reach down to the 1.25 handle, which of course is my longer-term target. I’m not seen is going to be easy, but I think that the remainder of the year is essentially going to be all about punishing the British pound, and of course maybe a little bit of a run to safety in the US dollar. On top of that, the Federal Reserve could very well do another interest-rate hike between now and the end of the year.