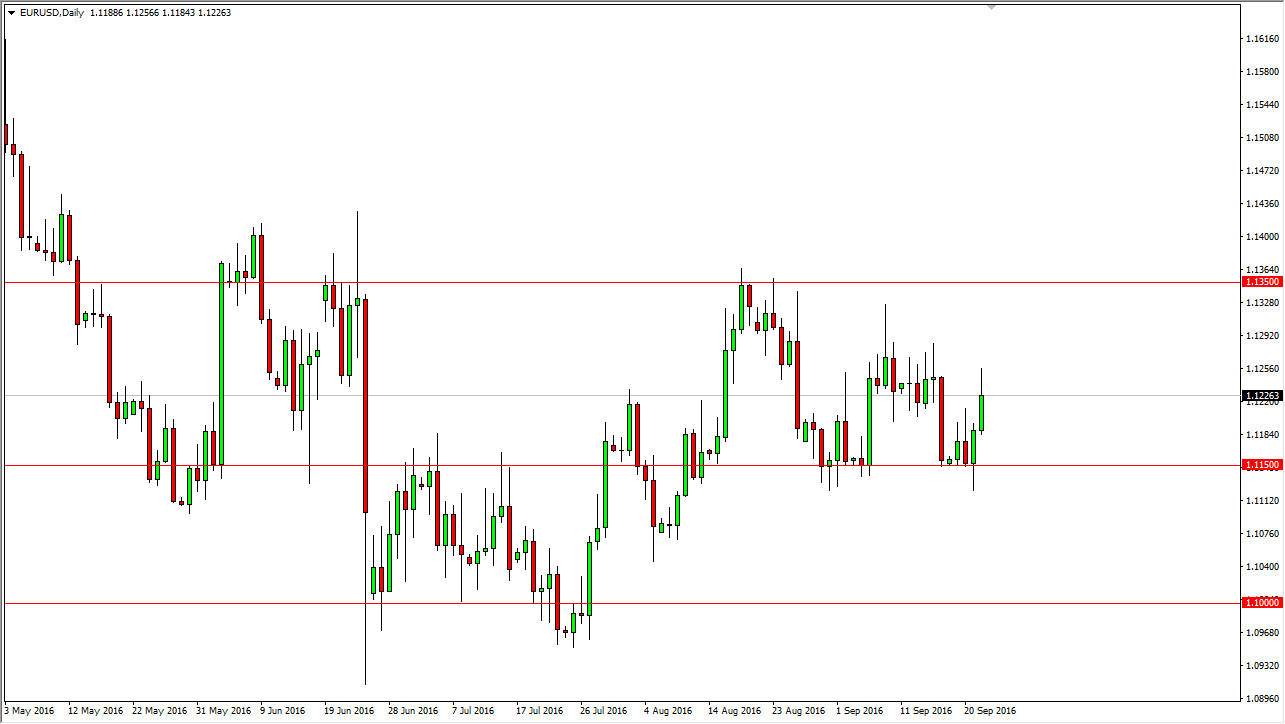

EUR/USD

The EUR/USD pair initially rallied during the session on Thursday, and then found resistance to turn the thing back around. The market has been making lower highs over the longer term, so I believe that we are eventually going to build up enough momentum to finally break down below the 1.1150 level. Once we do, I am a seller and I think that the market then reaches down towards the 1.10 level below. I have no interest in buying rallies, as we continue to see bearish pressure again and again.

Although the Federal Reserve set still with interest rates during the decision yesterday, the reality is that the Federal Reserve is the only central bank that is currently even debating raising interest rates, so having said this the US dollar should continue to be favored over the Euro longer term.

GBP/USD

The British pound rallied a bit during the course of the session on Thursday, so having said that we could very well continue to grind its way to the upside, perhaps reaching towards the 1.33 level above, but I think it’s only a matter time before the sellers jump back into this market. After all, the British pound will continue to be punished for the vote to leave the European Union, and as a result I am looking at rallies and show signs of exhaustion as potential selling opportunities.

I believe that the 1.2850 level below is the bottom of the consolidation area, and once we do break below there we continue to see this pair fall away down to the 1.25 handle. The 1.35 level above is massively resistive, because of the recent reaction of the market and of course the gap above. Either way, I think we are not only consolidating, but I think we are having this market offer more and more selling opportunities as time goes on.