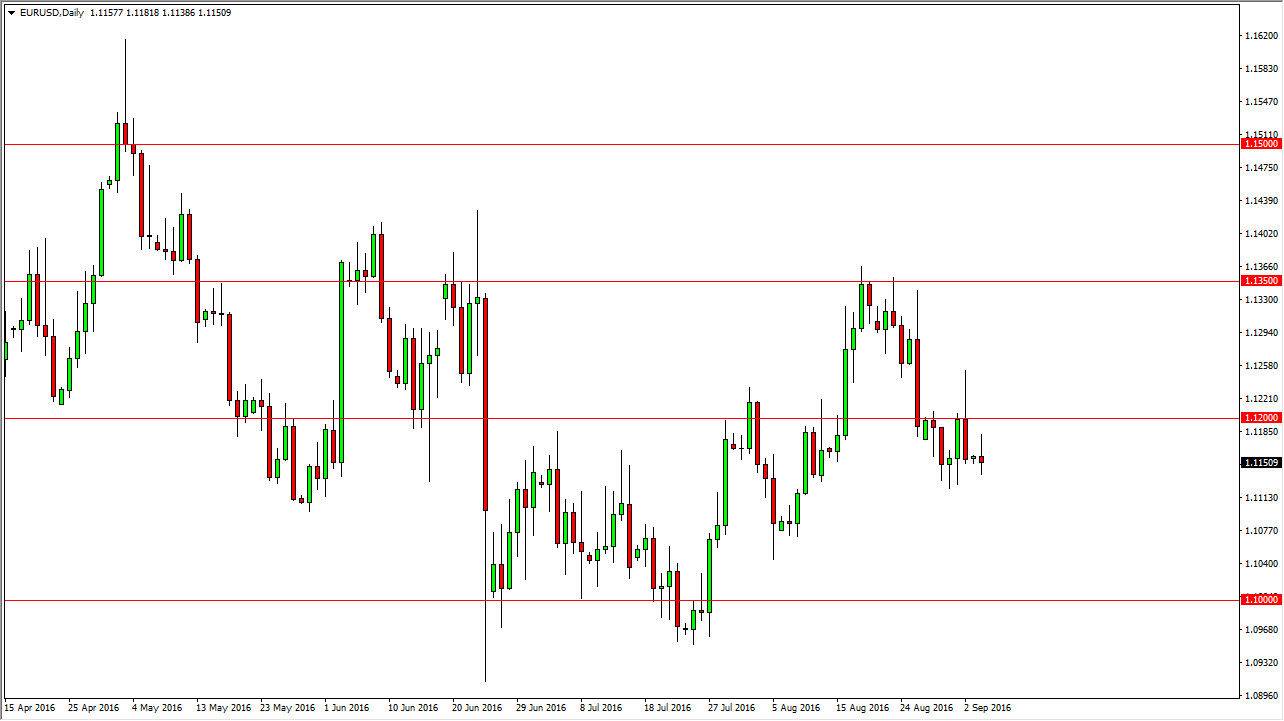

EUR/USD

The EUR/USD pair rose a bit during the course of the day initially on Monday, but as you can see we turn right back around to form of the shooting star. Quite frankly, the liquidity would’ve been an issue anyways due to the fact that the Europeans are the only ones working. The Americans and Canadians were celebrating Labor Day, and as a result I don’t read too much into this candle other than we are still in the same consolidation range we have been in for several sessions. Because of this, it’s likely that the market will continue to chop back and forth and therefore I don’t really have a trade in mind. If we can break down below the 1.11 level, we may drift down to the 1.1050 level, but at this point in time that’s about the only thing I see.

GBP/USD

The British pound of course tried to rally during the day as well but turn right back around to form a shooting star. Having said that, what I find interesting is that it is the exact same candle that form for Friday, and it is right where you would anticipate seeing quite a bit of resistance. Because of that, I believe that if we break down below the bottom of the range for the Monday session, the market will probably try to reach down to the 1.3050 region again. This is a market that continues to chop around sideways but I think ultimately there’s quite a bit of negativity in the British pound and quite frankly one of the reasons it has remained somewhat sideways is the fact that it is summertime, and the volume is probably a bit suspect at this point in time.

Even if we break above the top of the shooting star, I believe there is a massive amount of resistance all the way to the 1.3650 level, based upon the gap that had formed previously. Because of this, I am essentially “sell only”, but I also recognize that the market will be fairly choppy.