The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 4th September 2016

Last week I predicted that the best trade for this week was likely to be short GBP/USD. The result of this trade was not good, producing a loss of 1.37% thanks to the relatively strong performance by the British Pound over the week.

The market is difficult to forecast at the two strongest long-term trends appear to be flattening/ending or even turning, with both GBP/USD and USD/JPY rising with very strong impulse moves.

It is very difficult to pick a good trade this week, I can only forecast that if there are no major adverse releases or announcements changing sentiment on the GBP and JPY, then GBP/JPY or at least USD/JPY should continue to gain.

The GBP/USD pair has reached an area of key resistance and may find it hard to rise much further.

Fundamental Analysis & Market Sentiment

Fundamental analysis is again showing some usefulness in analyzing the current state of the Forex market.

The British Pound has been strengthening on the back of much better than expected British economic data releases.

Elsewhere, sentiment factors remain the key drivers, with the Bank of Japan expected to announce an additional easing of monetary policy in its monthly release due soon. This expectation has led to a strong decrease in the value of the Japanese Yen across the board.

The recent U.S. economic data releases have been poorer than expected, but the USD has held firm and continued to appreciate against most currencies. This may be due to an expectation of another rate hike to be implemented by the Federal Reserve this month, or simply due to the fact that the U.S. economy is in superior health as regards to its major competitors.

Technical Analysis

USDX

The U.S. Dollar technically has no trend, being in between its historical prices from 13 and 26 weeks ago. A glance at the chart below will show that it sits right in the middle of its range that has been established ever since the end of the first quarter of 2015. This week’s candle is an indecisive doji. For these reasons, the next move by the U.S. Dollar is extremely hard to forecast.

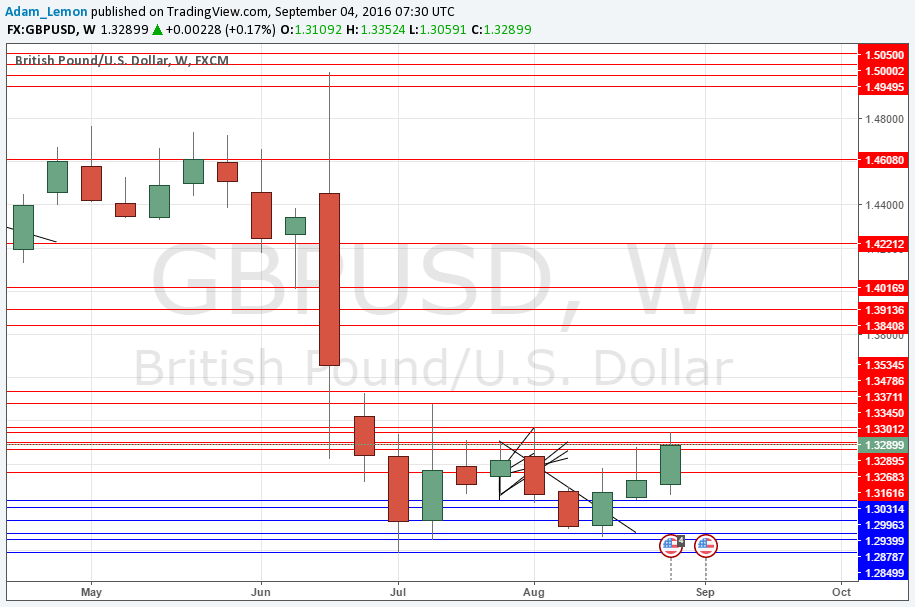

GBP/USD

The chart below shows that this pair rose convincingly last week, printing a bullish candle. There is a long-term downwards trend but new lows have not been made for several weeks, and we have almost ten weeks of consolidation. There is a real bid in the Pound, but caution should be exercised as we approach the major resistance zone sitting at around 1.3300.

USD/JPY

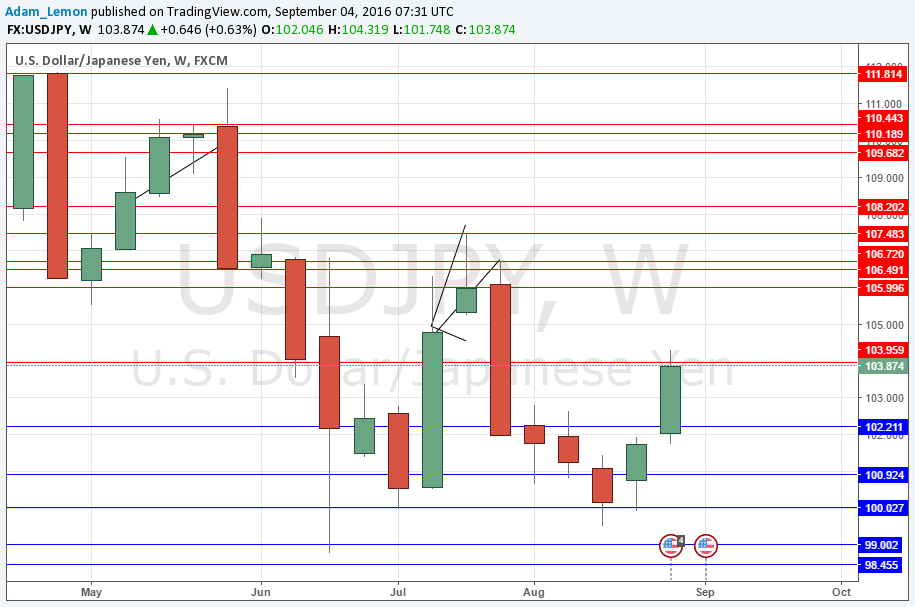

The chart below shows that this pair rose convincingly last week, printing a bullish candle. There is a long-term downwards trend but new lows have not been made for ten weeks. Furthermore, we have a real double bottom formation rejecting the psychologically key area of 100.00 which is a very bullish sign, and there is strong bullish momentum.

At the moment the price is bumping up against resistance at 104.00, but if this can be broken, the price can have a clear run up to the 106.00 area at least.

Conclusion

Bearish on the JPY, bullish on the USD and GBP to a lesser extent.