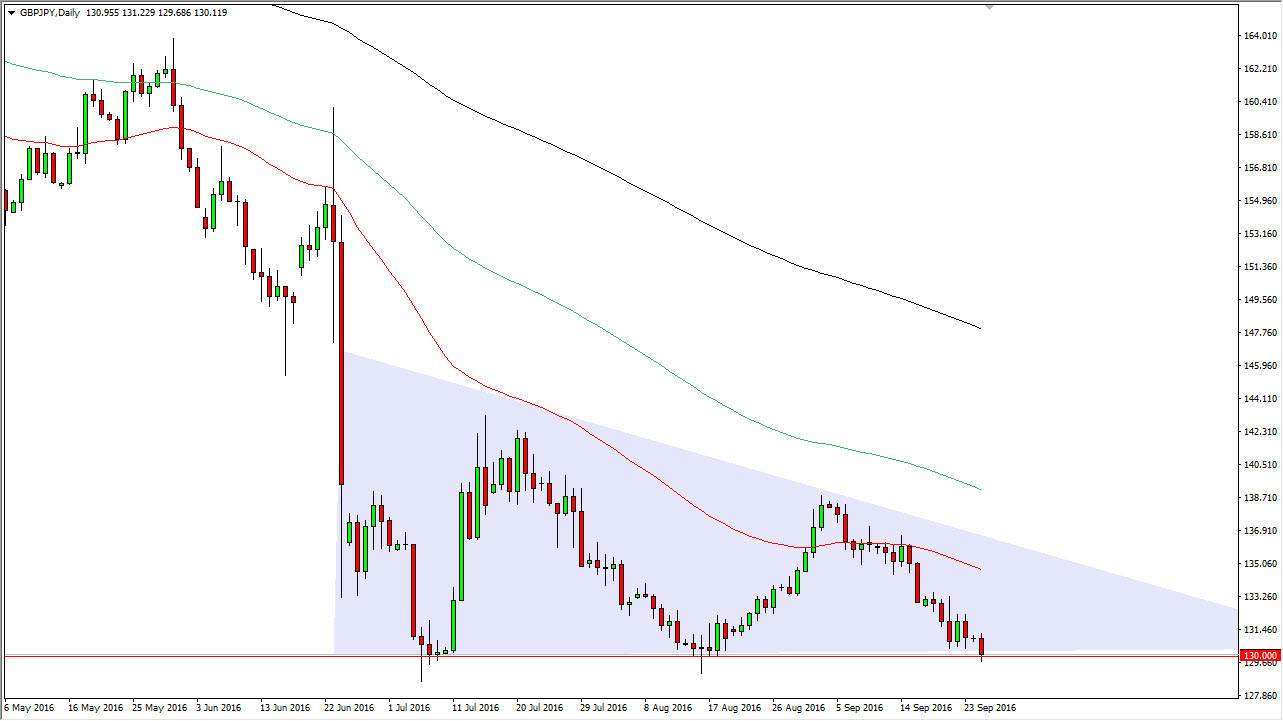

The GBP/JPY pair fell significantly during the day, as we did go below the 130 handle. However, we bounced back above there during the day, showing that the 130 level is going to continue to be very supportive. A break down from here could be a negative sign, and I believe that if we can continue to go lower than the original attempt to break down during the day, we could see this market reach down to the 125 handle. Because of this, I believe that it is only a matter of time before we break down, but we may have to attempt it a couple of different times. Because of this, I believe that rallies offer selling opportunities, especially considering the fact that we been punishing the British pound for the exit vote for some time now.

Risk aversion

I believe that risk aversion will come into this market as well, and that always favors the Japanese yen. However, we have the Bank of Japan looking to turn the situation around, although not necessarily in this particular pair, as the USD/JPY pair tends to be the one that they follow the most. The 100 level is just below current trading in that market, so having said that we could get a little bit of a “pushback” in the short-term. Again though, I believe that’s a nice selling opportunity as we continue to see more and more bearish pressure over the longer term, as this pair has been falling for months.

On the chart, you can see that the red 50-day exponential moving averages well above, so that is more than likely going to be a bit of a dynamic barrier, and as you can see the 100 day and 200 day moving averages above continue to look very negative as well, as we continue to see selling pressure pick up.