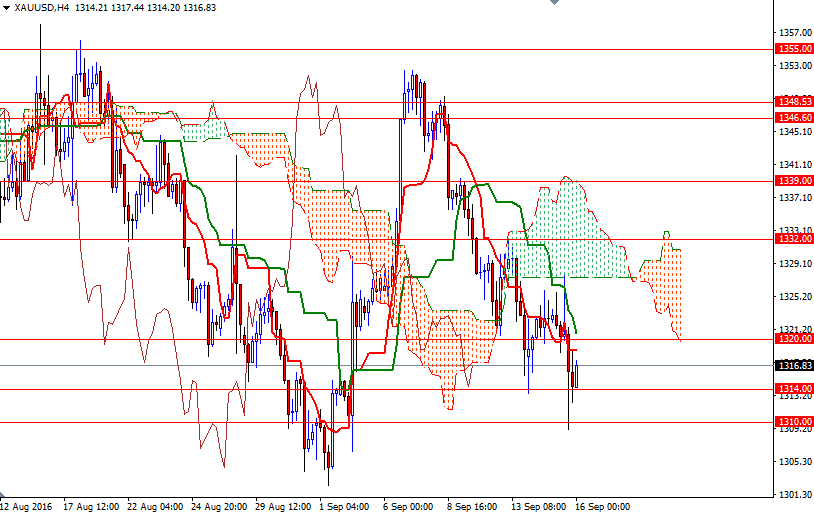

Gold prices fell for the sixth time in seven sessions as gains in U.S. equities reduced the need for insurance against risks. The XAU/USD headed lower and tested the $1310 level after a failed attempt to break through the anticipated resistance in the $1327.40-1326.40 area encouraged sellers. The market is currently trading at $1316.83, slightly higher than the opening price of $1314.21.

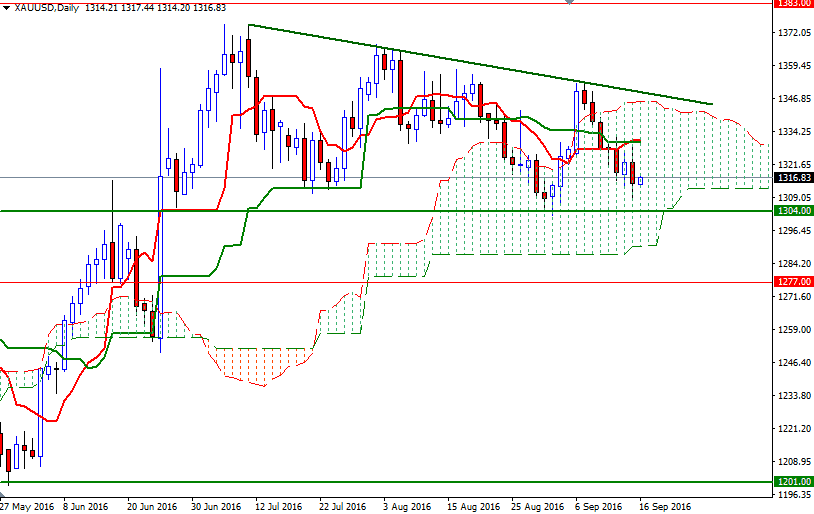

The short-term outlook remains bearish, with the market trading below the Ichimoku clouds on the 4-hour chart. The Chikou span (closing price plotted 26 periods behind, brown line), which dropped below the cloud, also indicates that there is further downside risk. With that in mind, I will be keeping an eye on the 1314/0 area. If this support is broken, the 1304/0 zone could be the next port of call. That area has been supportive in the past so capturing this strategic point is essential for a bearish continuation towards 1297/5.

On the other hand, if the bulls manage to hold the market above the 1314 level, then I wouldn't rule out the possibility of a push up towards the 1322.50-1320 area. The bulls have to convincingly lift prices beyond that barrier so that they can gather some momentum and make an assault on the 1327.40-1326.40 area. Climbing above 1327.40 could signal a run up to 1332.