Gold prices ended the month down 2.95% as a strong run in major equity markets around the globe and renewed confidence in the U.S. economy led investors to reduce their safe-haven positions. The greenback benefitted from stronger-than-forecast economic data, which boosted bets the Federal Reserve may raise rates before the end of the year. While the minutes from the Federal Open Market Committee’s last policy meeting showed voting members divided over whether to tighten monetary policy soon, Fed chief Janet Yellen said “Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.”

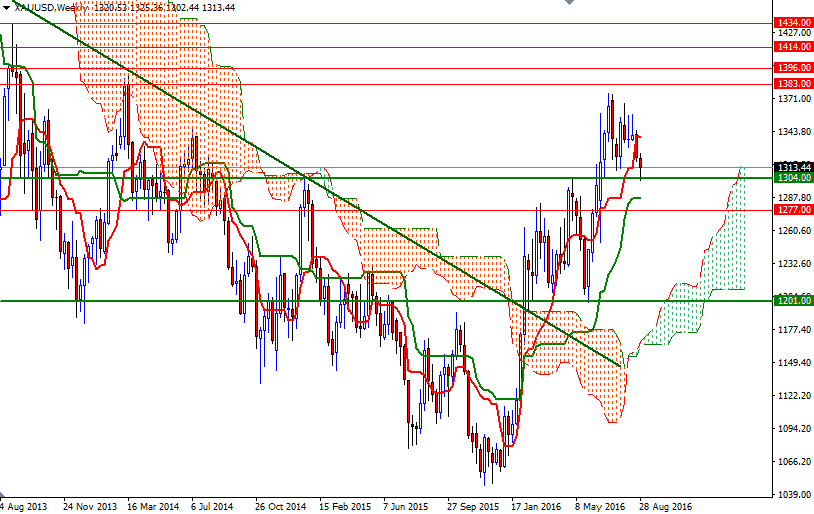

However, their decision on rates hinges on the strength of upcoming data, so therefore investors will weigh August's jobs report carefully. Apparently, the market will remain under pressure if fresh data surprise on the upside but the Fed finally making its move this year may not be so bearish for gold (as it means that they will probably have to wait another year to take another step). From a technical point of view, I think the XAU/USD pair is at a crossroads that will determine the next price movement in the short-term. The support at around the 1304 level had acted as both support and resistance in the past (breaking the ascending trend-line eventually dragged prices to this strategic camp as anticipated) and because of that it will play a crucial role.

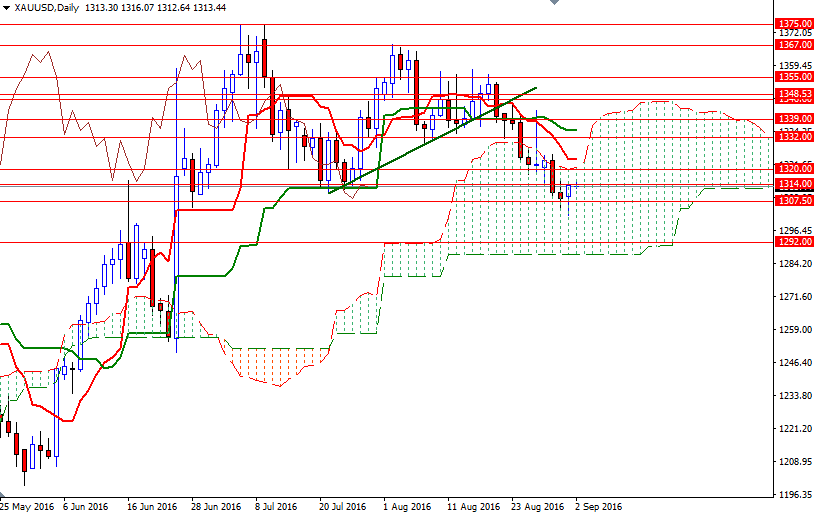

Although the medium term outlook remains positive, with the market trading above the weekly Ichimoku cloud, prices are below the 4-hourly cloud. In addition to that, XAU/USD is residing within the borders of the daily cloud. With these in mind, unless we get a strong reaction from the jobs report, expect market to spend some time inside the daily cloud. If we drop through 1304, then it is likely that XAU/USD will test the 1297 afterwards. Once below that, the market will be marching towards the bottom of the daily cloud. In that case, keep an eye on the 1292-1287.40 region. A sustained close back below the daily cloud means the market will be aiming for 1277 and 1266. The initial resistance to the upside stands at 1314, followed by 1323.56-1320. If the bulls capture this camp where the top of the daily cloud and Tenkan-Sen (nine-period moving average, red line) converge, they might have a chance to march towards the first significant resistance at 1332. A close above 1332 on a weekly basis would prolong the bullish momentum and clear the path towards 1348.53-1346.60.