Gold prices rose $20.63 on Wednesday to settle at their highest level since September 9 after the Bank of Japan decided to scrap its focus on monetary base and set targets for long-term rates and the Federal Reserve left monetary policy unchanged. The Federal Reserve cut the number of rate increases expected in 2017 and 2018 but signaled it could hike rates by year-end. Fed Chair Janet Yellen, speaking after the central bank's latest policy statement, said “We judged that the case for an increase has strengthened but decided for the time being to wait.” The XAU/USD pair traded as high as $1336.95 an ounce before pulling back to the current levels.

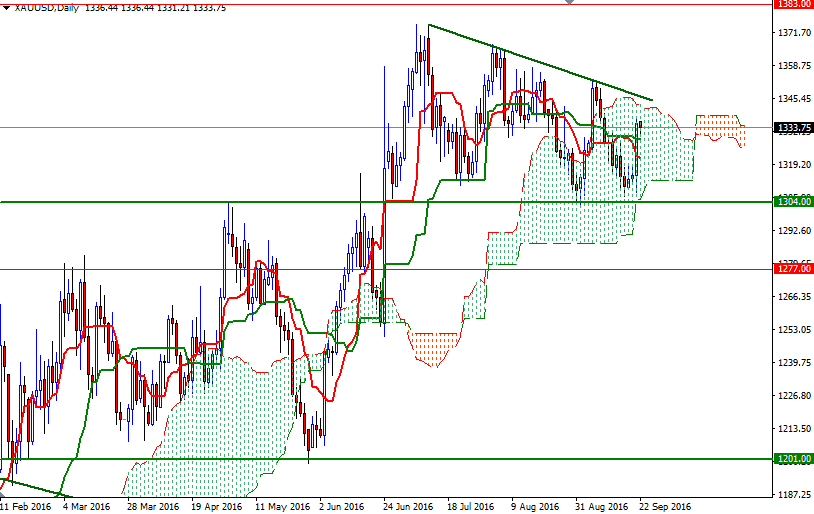

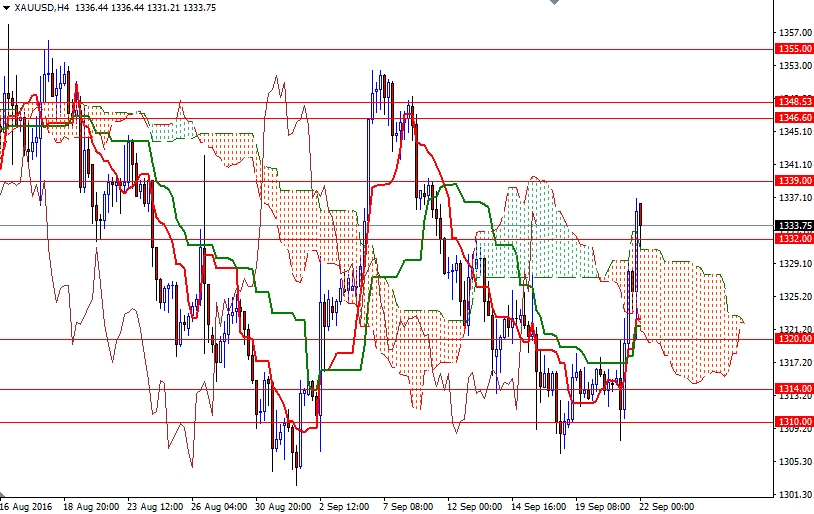

From a technical perspective, there are two things catch my attention at first glance. First of all, yesterday's rally pushed prices above the Ichimoku clouds on the 4-hour time frame, indicating that the short-term technical outlook for the XAU/USD pair has shifted to the upside. However, trading inside the daily Ichimoku cloud suggests that the market is not out of the woods yet.

If the bulls can maintain the control, the market is most likely headed for the 1348.53-1346.60 region over the next days. We have a confluence of horizontal resistance and a short-term bearish trend line there, so it will play an important role going forward. Of course, there are some barriers on the road -such as 1339 and 1342- for the buyers to break through. To the downside, keep an eye on the 1332/0 support zone. If XAU/USD breaks down below that, it could return to 1327.40-1326.40 area. The bears have to capture that camp so that they can gain some momentum and make an assault on the 1321.60-1320 zone.