Gold prices rose 0.35% on Wednesday, snapping a five-day losing streak, and settled at $1322.55 an ounce as a softer dollar lured investors back into the market. The XAU/USD pair initially headed lower but the anticipated support at the $1314 level kicked in and pushed prices higher. The precious metal has been facing constant pressure due to expectations of an interest rate hike by the U.S. Federal Reserve some time this year.

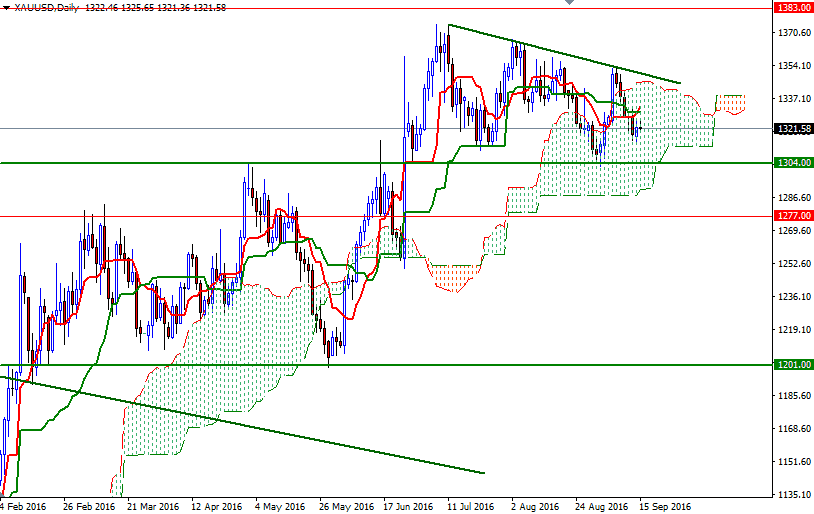

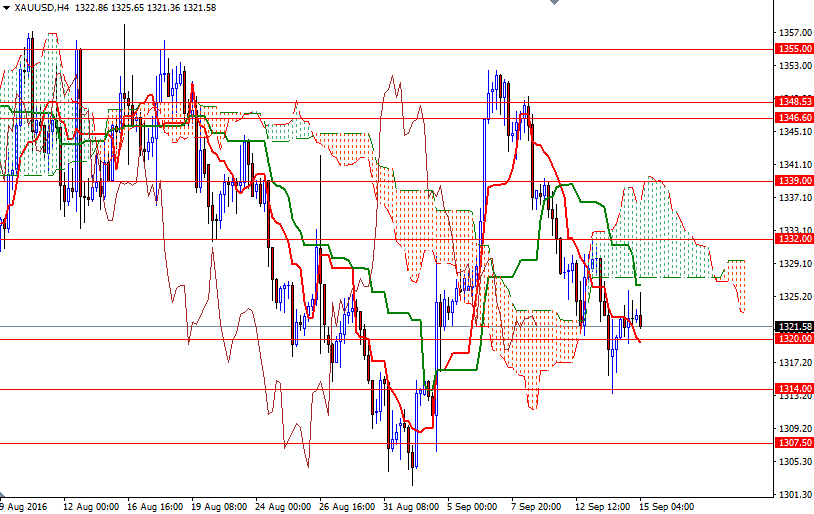

Currently the technical outlook is mixed as the weekly, daily and 4-hour charts points to different directions. The XAU/USD pair is trading above the weekly Ichimoku cloud but on the daily time frame we are moving inside the cloud and the 4-hourly cloud right on top of us is creating some extra pressure. Unless the markets climbs back above the cloud on the H4 chart, prices will have a tendency to visit the critical support in the 1304/0 area. But in order to get there, the bears will have to drag prices below the 1310 level first.

From an intra-day perspective, the initial resistance level now stands in the 1327.40-1326.40 area. A break up above 1326.40 would give the bulls the extra power they need to reach the 1332 level. Since the cloud on the H4 chart occupies this area all the way up to the 1339 level, we might see significant resistance. If the market closes beyond 1339, that would a bullish sign, suggesting a move towards the 1348.50-1346.60 area.