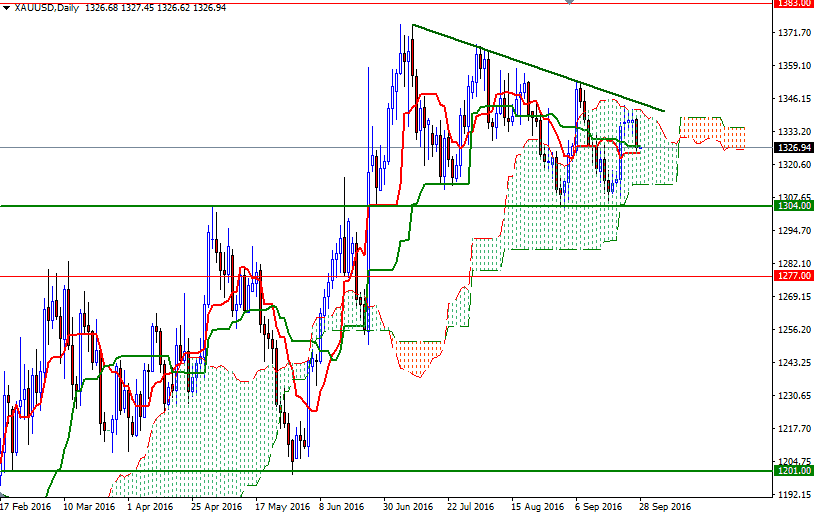

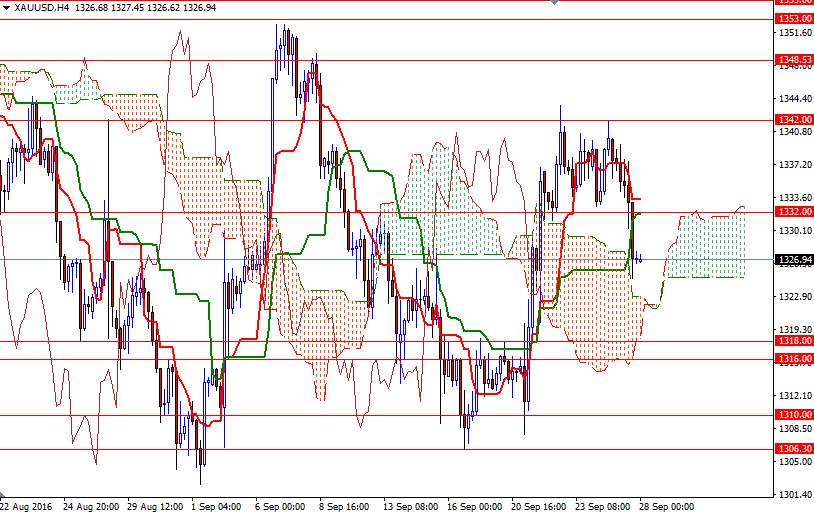

Gold prices fell $10.90 on Tuesday, ending a six-day streak of gains, as a firm dollar and the market’s inability to penetrate the $1342 level prompted investors to book profits from a recent rally to a two-week high. Gold’s surge in recent days was mainly driven by the Fed's cautious approach to future interest rate increases. The XAU/USD pair had attempted to climb above the top of the daily Ichimoku cloud but faced significant resistance. As a result, the market came under pressure quickly as expected and retreated to the 1327.40-1324 area where the daily Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) resided.

Trading within the borders of the Ichimoku cloud on the daily chart suggests there is an intense battle going on and the market will stay range-bound. If XAU/USD falls back below the 4-hourly cloud, then it is likely that the market will head towards the bottom of the daily cloud (1312/0). On its way down, some support can be seen in the 1318/6 zone. A daily close below 1310 would open up the risk of a fall to 1304.

The bulls will have to defend their ground in the 1327.40-1324 area push prices back above the 1334/2 area if they don’t intend to give up. In that case, they could have change to revisit the 1339 and 1342 levels. If the market anchors somewhere above the daily cloud and breaks out through the bearish trend line, the 1348.53-1346 region will probably be the next port of call.