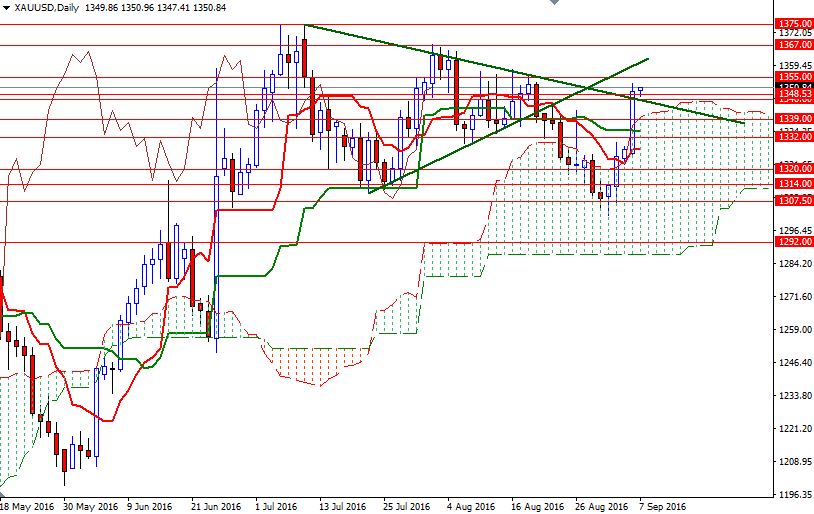

Gold prices ended Tuesday's session up $23.74, extending gains to a fourth straight session, as weak economic data reinforced market expectations that the U.S. Federal Reserve will push off a rate increase until December. The Institute for Supply Management reported that its non-manufacturing index fell to 51.4% last month, the lowest since February 2010, from 55.5% in July. Technical buying was also behind gold's 1.8% jump on Tuesday. Penetrating the $1332/0 resistance triggered a fresh round of buying as expected and pushed prices beyond the $1348.53-1346.60 region.

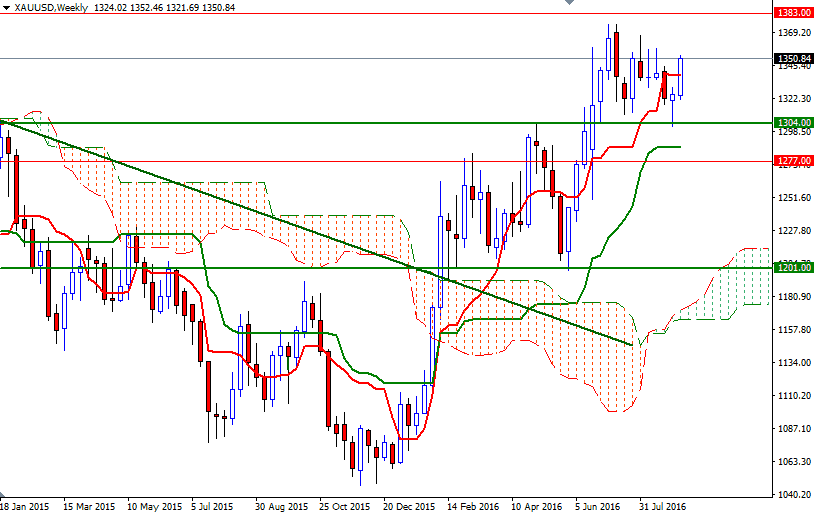

The XAU/USD is currently trading at $1350.84 an ounce, slightly lower than the opening price of $1349.86. Speaking strictly based on the charts, climbing back above the Ichimoku cloud on the 4-hour chart improves the technical picture as it realign short-term charts with longer-term bullish inclinations. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself.

Closing above 1348.53 is a positive signal that has opened a path to 1358/5, though further upside is likely to be limited until this resistance is convincingly broken. If the bulls pass through 1358/5, then the 1362/0 and 1367 levels could be the next possible targets. However, if the bears increase the pressure and XAU/USD starts to fall, a retreat to the broken trend line at 1346 wouldn't be so surprising. The bears have to drag prices back below 1346 so that they can gather some momentum and make an assault on the 1341/39 zone where the top of the daily Ichimoku cloud currently sits.