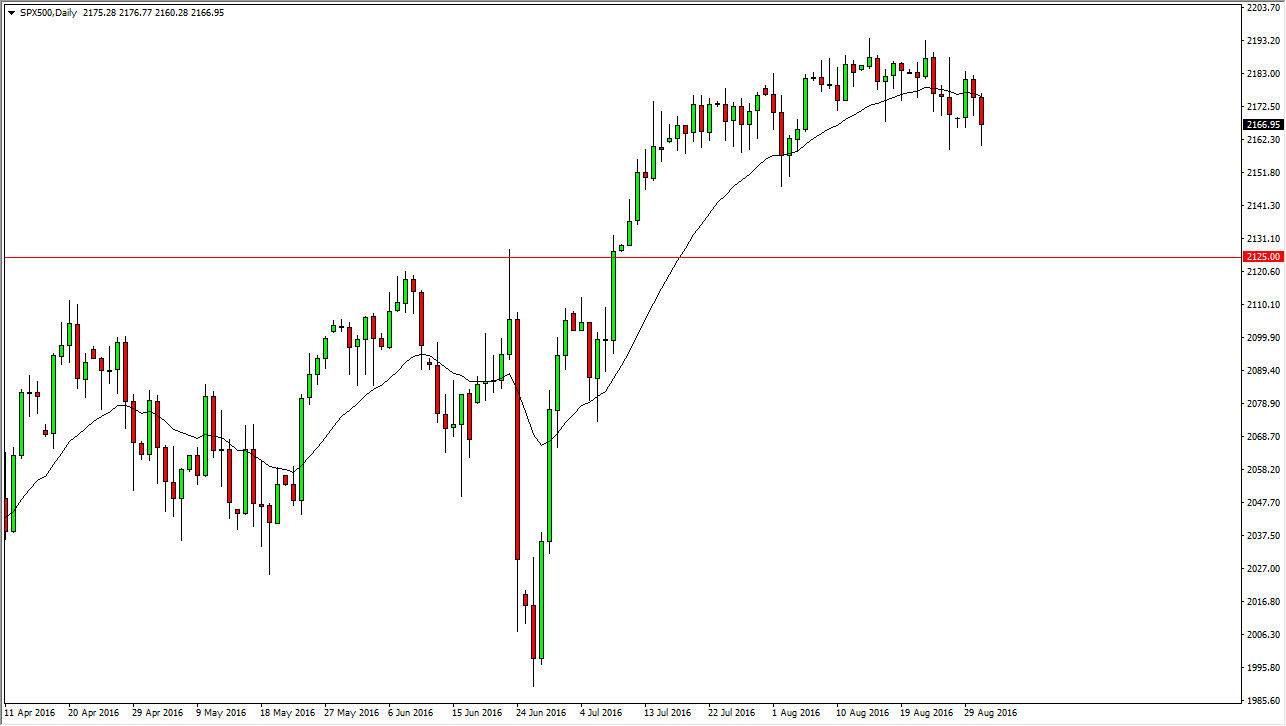

S&P 500

The S&P 500 fell significantly during the course of the day on Wednesday initially, but we did get a little bit of a bounce towards the end of the day. Because of this, it looks as if we are trying to stay within the consolidation area that we have been stuck in recently. Because of this, it’s probably only a matter of time before we rally, but having said that it’s likely that the market will continue to bounce around, and perhaps reach towards the top of the consolidation. But with the jobs number coming out tomorrow, it makes a lot of sense that we may have to wait until after that announcement before we get the volatility and momentum necessary to continue going higher.

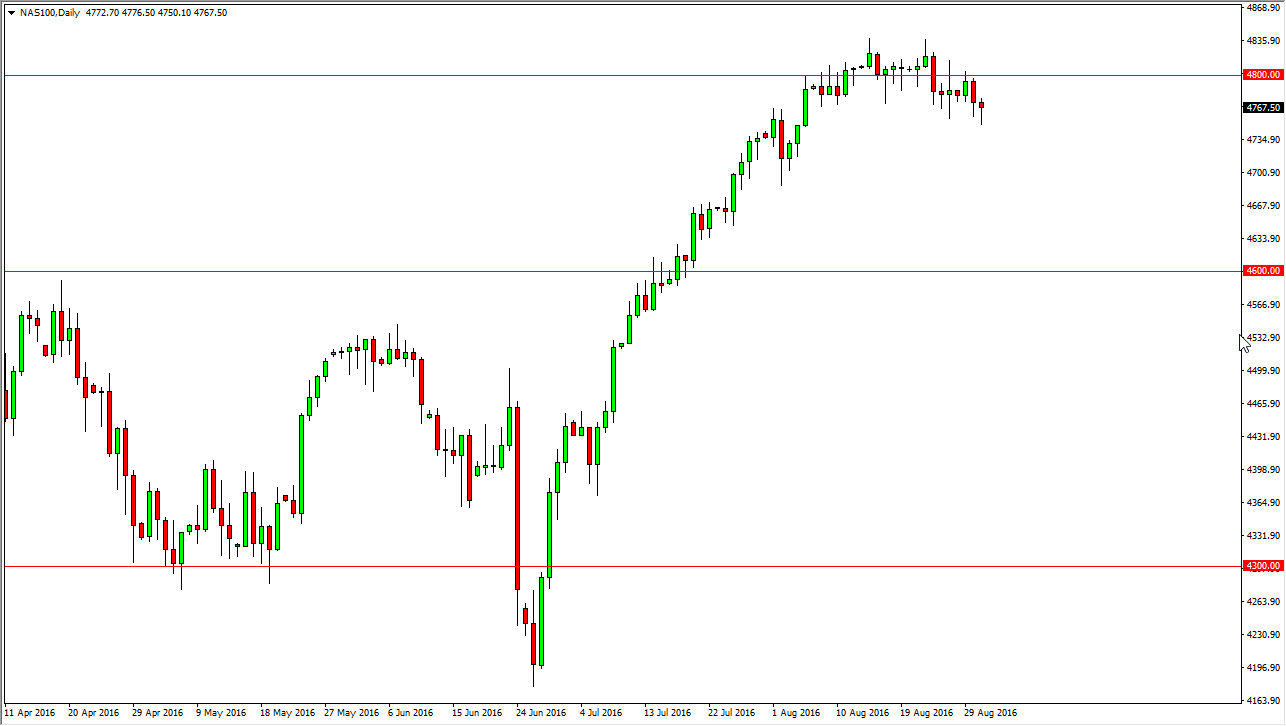

NASDAQ 100

During the course of the session on Wednesday, the market fell initially, but turned right back around to form a hammer. The hammer of course is a bullish sign, so we can break above the top of the hammer, it’s likely that we will continue the consolidation. However, just as in the S&P 500, we have a significant amount of concern placed upon the jobs market and we of course need to see the announcement come out first.

The market continues to try to strengthen, but we also have a concern about volume as we are still in the middle of the holiday season. Because of this, it’s likely that we will struggle to go higher until we not only the jobs number, but until we get more volume due to the traders coming back from summer break. Ultimately, I still have a target of 5000, but I recognize that it can to take a while to get there, as the market will pull back from time to time as we have quite a bit of bullish pressure underneath, and as a result I believe that this will be a “buy on the dips” trade waiting to happen.