By: DailyForex.com

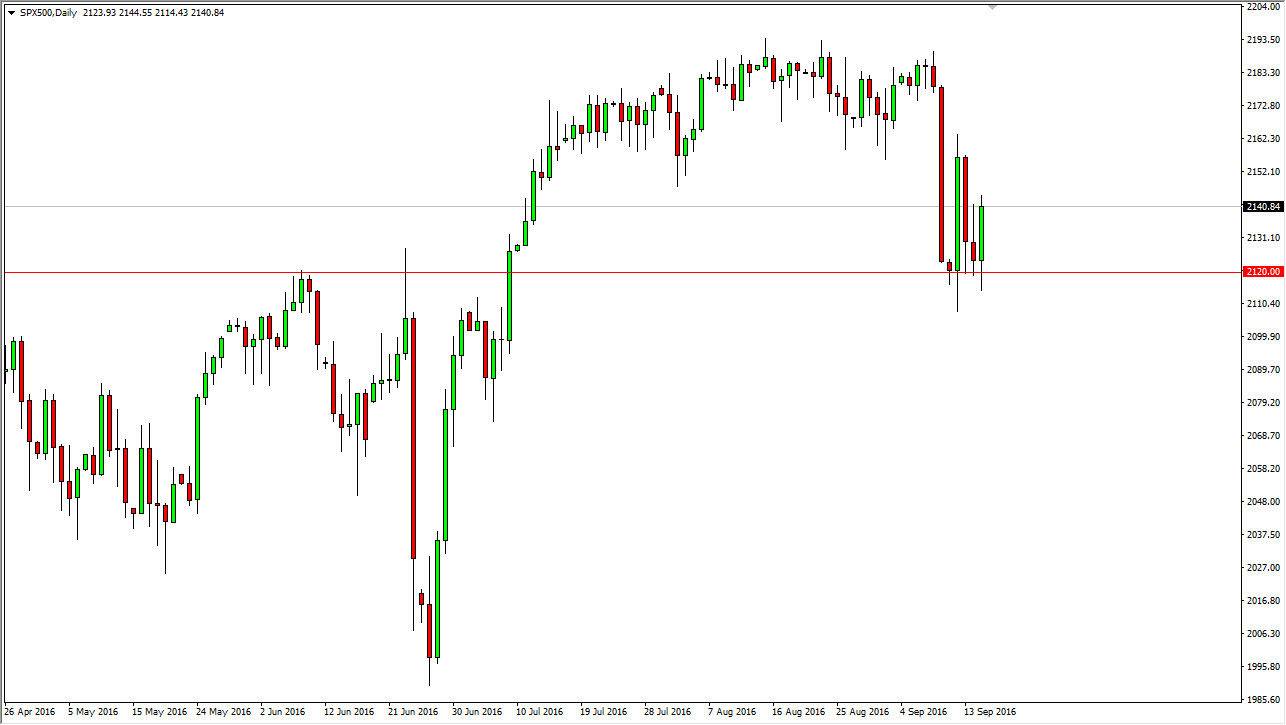

S&P 500

The S&P 500 initially fell during the course of the day on Thursday, but found enough support below the 2120 handle to turn things back around and form a positive candle as we continue to see this market back around this area. Most importantly though, we did break above the shooting star from the session on Wednesday. By doing so, I think we are starting to show real support in this market, and as a result I think we will continue to go much higher. This is a market that should then reach towards the 2200 level, and then possibly higher than that. This is a market that shows a massive amount of support below, and as a result I think that the only thing you can do is buy, but we could continue to see quite a bit of volatility in the short-term.

NASDAQ 100

The NASDAQ 100 initially fell during the course of the day on Thursday, but turned things completely around and ended up forming a very bullish candle. In fact, we tested the 4800 level. I think given enough time every time we pullback the buyers will continue to jump into this marketplace, and perhaps break out above the recent highs. Once we do, I don’t see any reason why will continue to go to the 5000 level which has been so massively attractive to the market recently. After all, we’ve seen a massive shot straight up in the air, and that of course has people looking to the next major big figure.

I think this will continue to be the case, the market will simply grind higher and every time we pullback I think buyers will look at it as an opportunity to pick up a market that will eventually go much higher. Ultimately, this is a market that I think will continue to do well due to the fact that the interest-rate environment is going to stay low for a long time.