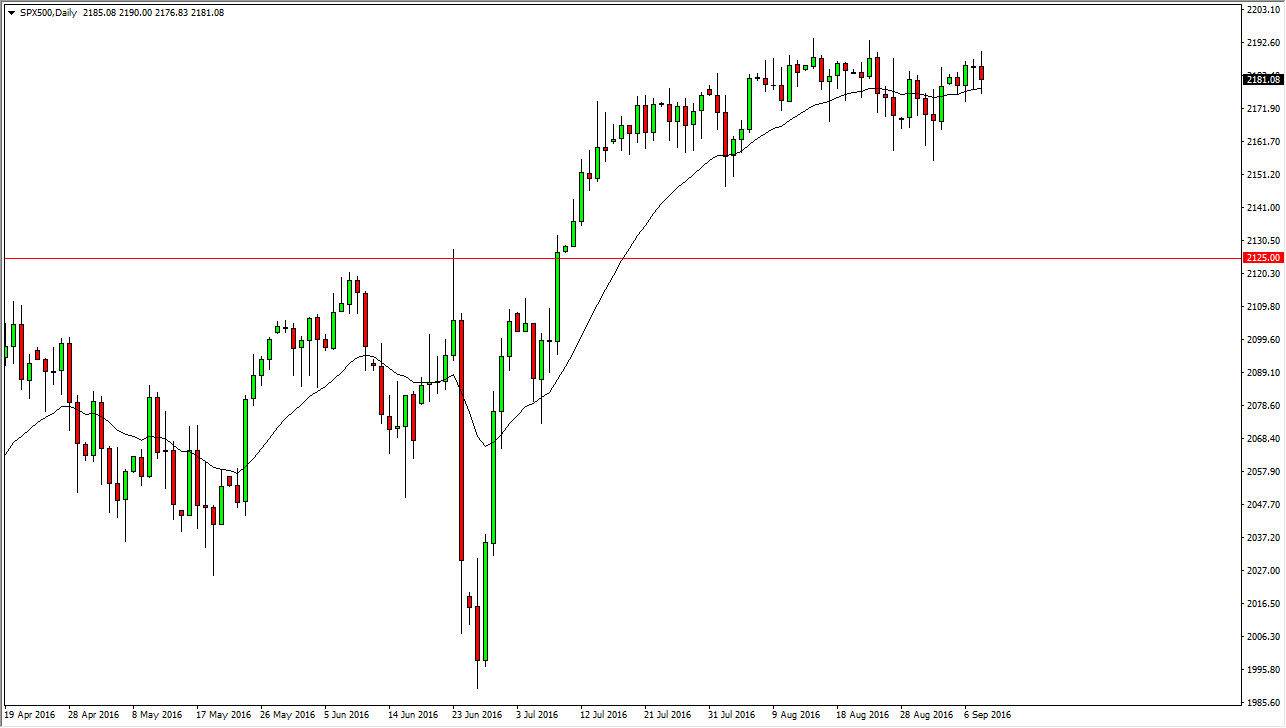

S&P 500

The S&P 500 had a relatively negative day during the session on Thursday, but we are still essentially in the middle of the consolidation area that we’ve been trading in for 2 months now. I do believe that every time we pullback, the market looks at it as potential value and that we will eventually break out to the upside. I think a lot of this comes down to the lack of volume, as a lot of traders are still away at holiday. Ultimately, I believe that this market is probably going to reach towards the 2250 level, but it may take a while to get there. Short-term selling isn’t even a thought at this point, because quite frankly I don’t have any interest in trying to go against what I believe is the longer-term move. With this, I remain bullish but I also recognize that we need to be very careful.

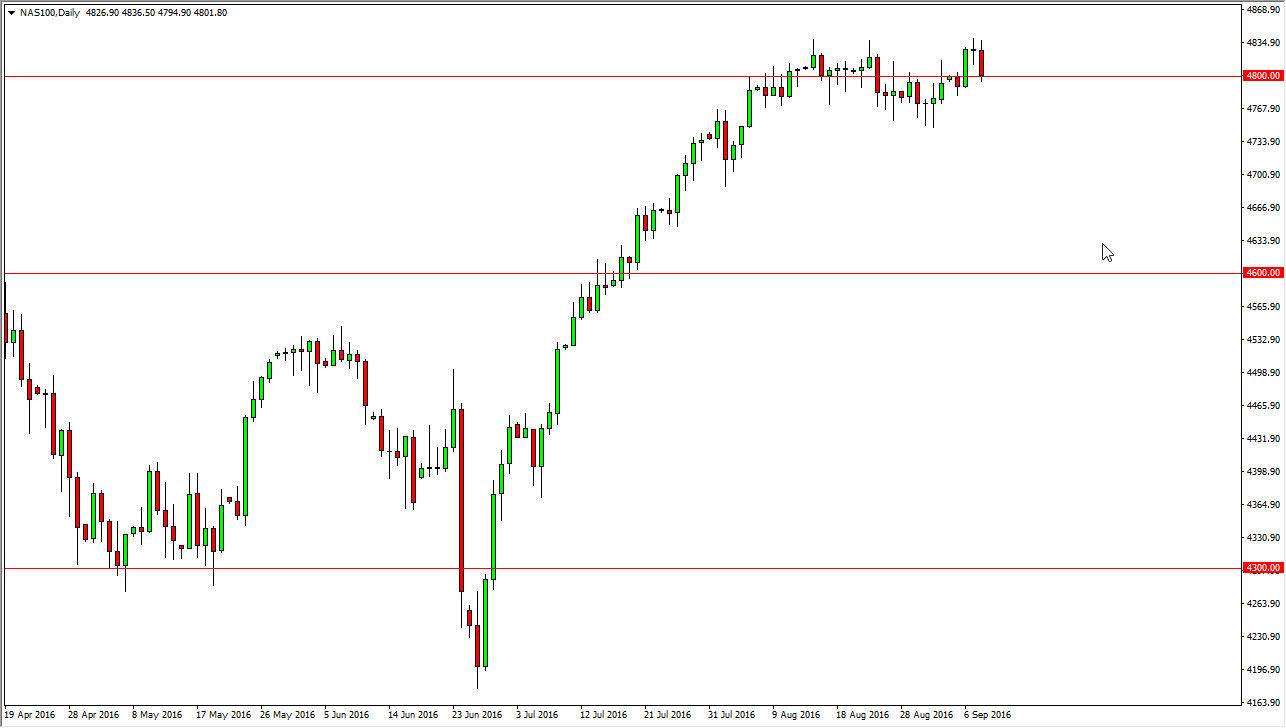

NASDAQ 100

The NASDAQ 100 fell during the course of the day on Thursday, testing the 4800 level. I believe there is a significant amount of support just below though, so having said that I feel that it’s only matter time before we get a supportive candle that we can start buying. Eventually, we will reach towards the 5000 handle, which is the longer-term target that I have had for some time. I also believe that the large, round, psychologically significant number of 5000 makes a perfect place for longer-term traders to be aiming for at the moment.

I don’t have any interest in selling, and I do believe that the 4700 level below is massively supportive. I also recognize the same at the 4600 level and of course the 4500 level. Having said that, I would be very surprised if we reached as far as 4600, but a pullback really isn’t much of a surprise to me in general. I just don’t expect a very large one.