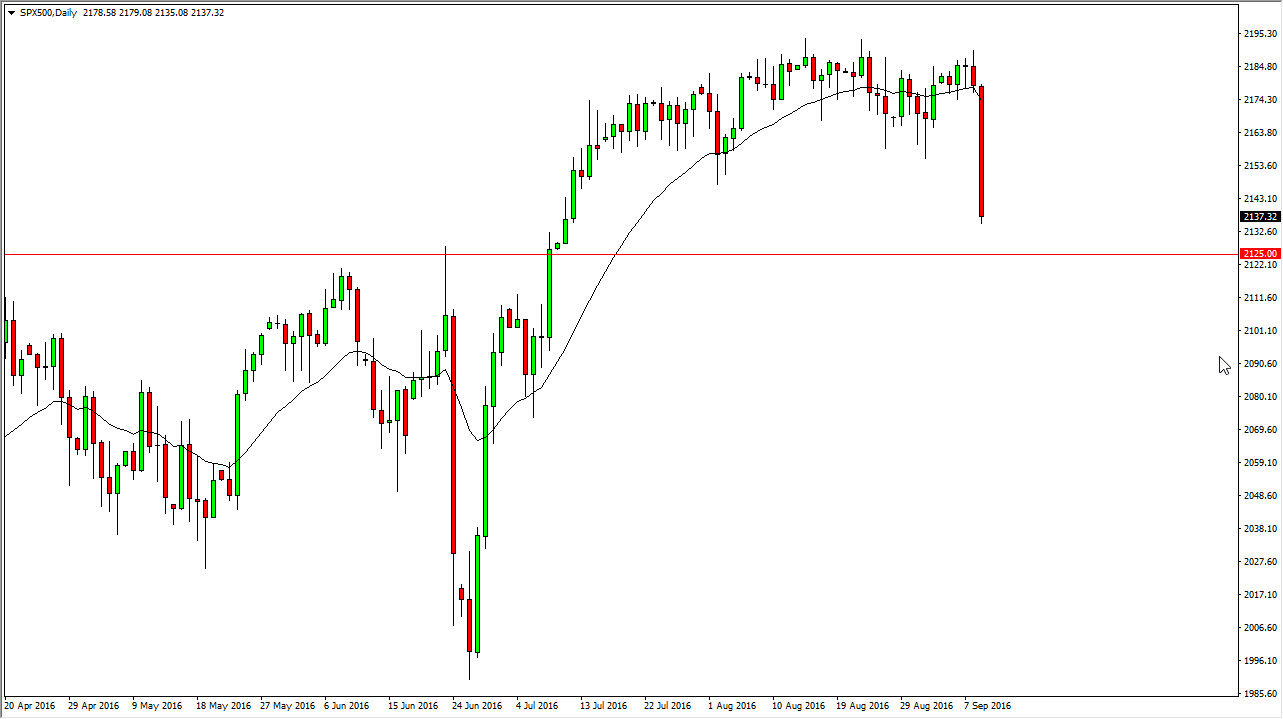

S&P 500

The S&P 500 had a very tough day on Friday as traders are starting to worry about whether or not central banks can continue to list the markets. After all, quantitative easing has had very little effect economically. With this being the case, the markets fell apart and it now looks like we’re going to have to go down and test the 2125 handle. This is a horrifically negative candle, and as a result I feel that this market probably will continue to go lower in the short-term. A bounce though would be reason enough to start buying, just as a supportive candle would be. At this point in time, we are still very much in a strong uptrend, so having said that I believe that the market will continue to go higher over the longer term. However, if we do break down below the 2100 level, we really have to start to become concerned.

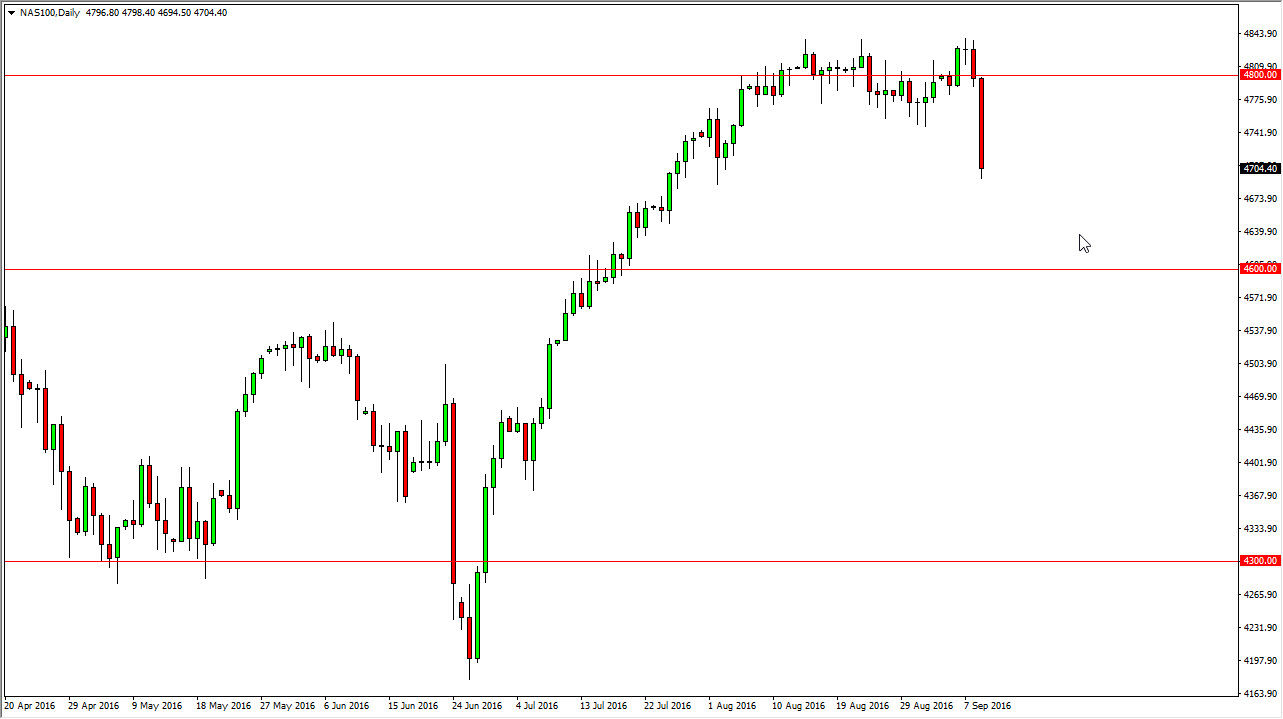

NASDAQ 100

The NASDAQ 100 broke down significantly as well, testing the 4700 level. This being the case, it looks as if the market is going to continue to go lower at this point in time, but it’s only a matter of time before the buyers get involved. I think that the 4600 level below is going to be massively supportive as well, so somewhere between this area and that number I expect to see a supportive candle that you can start buying based upon value. This value of course will be difficult to deal with, but it is still very much within the uptrend that we have been in for some time, so having said that I feel that the market is one that you simply have to wait long enough to get the opportunity to go long.

I think a lot of this knee-jerk reaction might have been automated selling as well, as the volume is still a little bit on the light side. However, I think sooner or later cooler heads prevail and offer a nice longer-term buying opportunity.