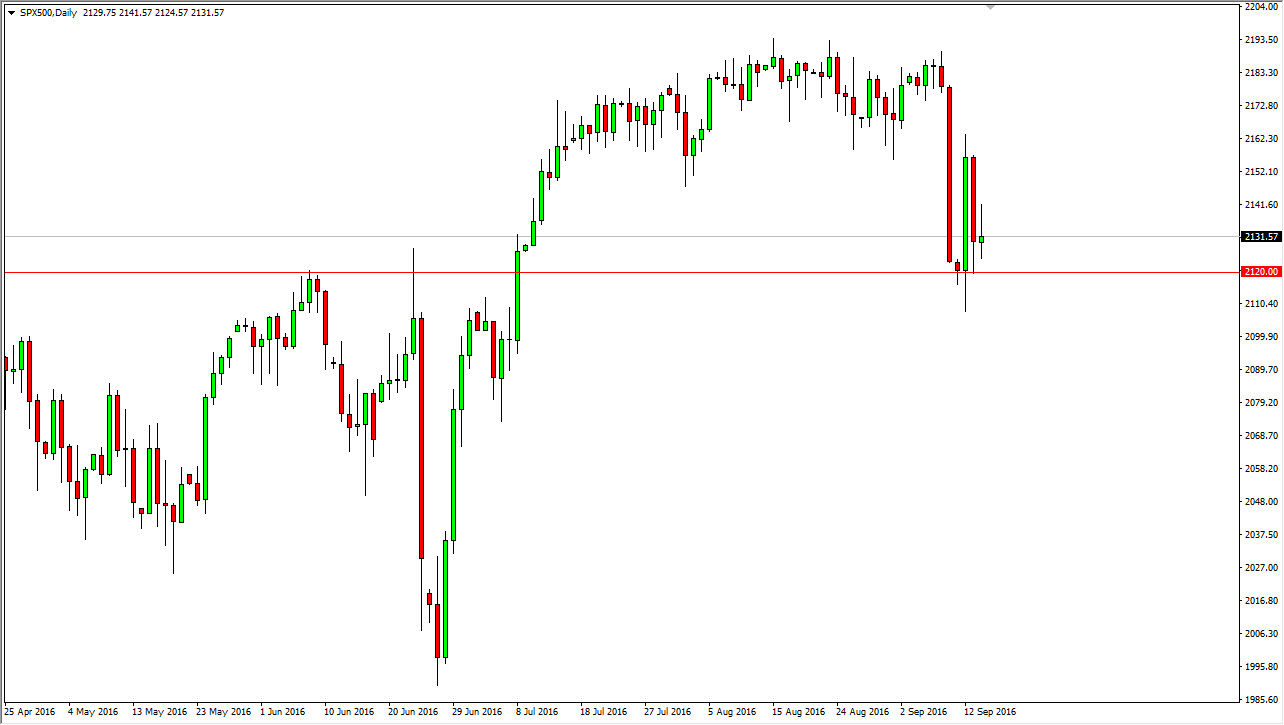

S&P 500

The S&P 500 had a very volatile session on Wednesday, as we went back and forth and ended up forming a shooting star like candle. However, I do think that there is a significant amount of support at the 2120 handle, as denoted by the horizontal line on my chart. With this being the case, I believe that this market will continue to find buyers in this lower area, and once we see a bit of support, I’m not concerned about buying this market. Quite frankly, I believe that even though we’ve seen a lot of volatility here recently, but the reality is that the market is still very much in an uptrend. Because of this, I don’t really have any interest in selling at the moment, and believe that even below the 2120 handle, there is a massive amount of support extending all the way down to the 2100 level.

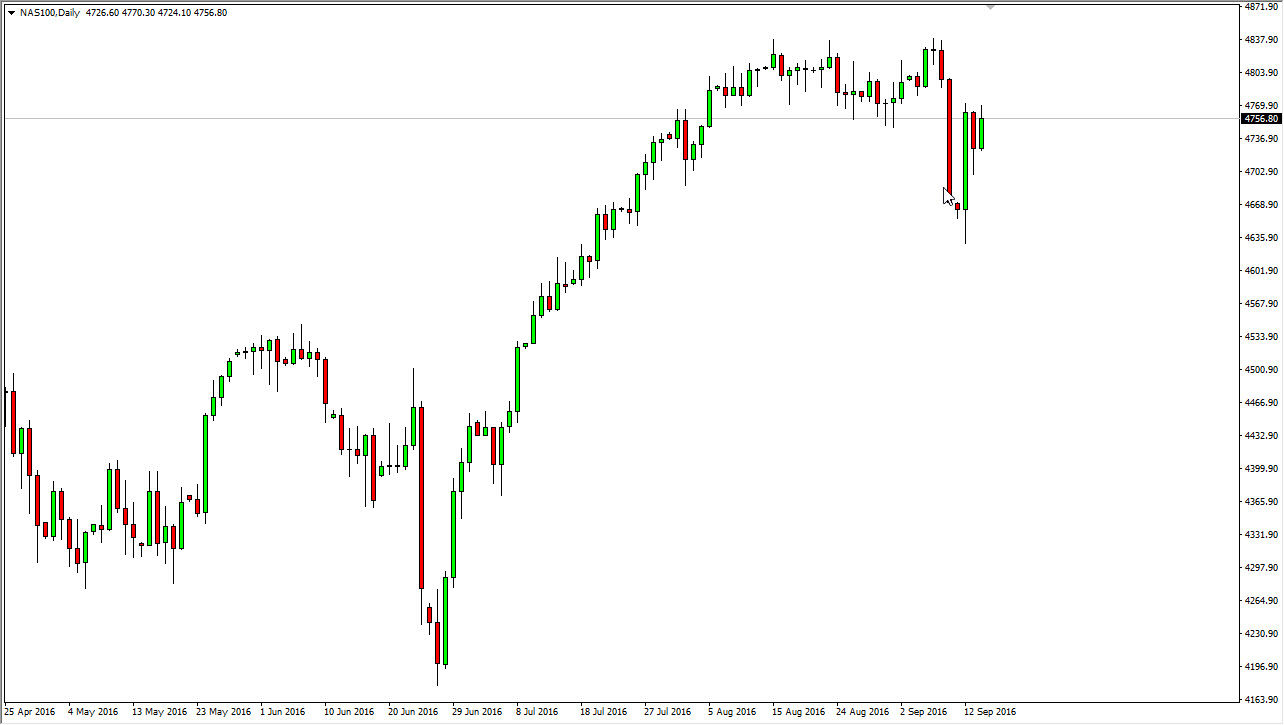

NASDAQ 100

The NASDAQ 100 rose slightly during the course of the session on Wednesday, slamming into the 4760 handle. This is the beginning of a cluster of orders that have caused quite a bit of consolidation recently. I believe that we will eventually break to the upside and perhaps reach towards the 4840 handle again, and a break above that should lead to the 5000 level. However, between here and there I expect to see quite a bit of volatility, and that should offer the opportunity to pick up a little bit of value based upon pullbacks. With fact, I am essentially “buy only” when it comes to the NASDAQ 100 but I do recognize that timing will be important, and of course you will probably have to deal with a bit of volatility going forward.

Ultimately, the interest-rate situation in the United States remains extraordinarily low, so therefore I feel that money will be forced into the stock markets in the United States, and of course the NASDAQ 100 will be any different.