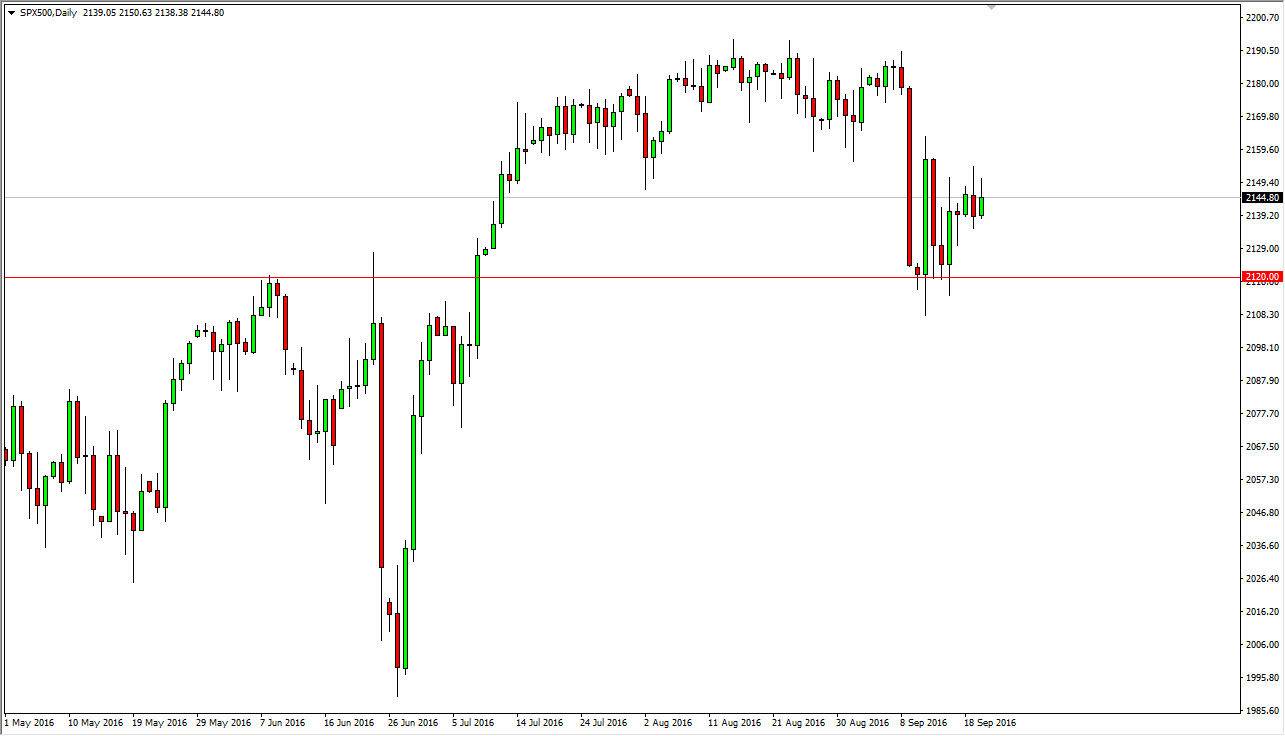

S&P 500

The S&P 500 initially tried to rally during the course of the day on Tuesday, but Turn right back around at the 2150 handle. Because of this, we did up forming a bit of shooting star and it now looks as if the market is simply trying to figure out what to do next. This makes sense though, because today we get the FOMC Statement. After all, interest rates are expected to stay fairly flat, but the wording of the statement will be particularly interesting for stock traders. Given enough time, the market will more than likely try to parse future expectations out of the central bank, and as a result there could be quite a bit of volatility in this general vicinity. Regardless though, I do believe that the 2120 level below will act as a “floor”, and with that I think it’s only a matter of time before we go higher.

NASDAQ 100

The NASDAQ 100 and rally during the course of the session on Tuesday, as we continue to try to break out to the upside. This is a market that will be paying a lot of attention to the Federal Reserve, as await to see what the central bank sees as the likelihood of an interest rate hike, which will determine the reaction in the band markets. With so little being offered in the way of interest, stocks have been getting a nice boost, and this statement could tell us as to whether or not rate hikes are coming anytime soon. Quite frankly, I would be very surprised if we get any number of hikes with certainty. I think that the markets will continue to go higher over time, and with this I think that a pullback will only offer short-term buying opportunities, and with this I would like to buy supportive candles below. Either way, I am still looking for 5000 to be tested over the longer-term.