This week we’ll begin with our monthly and weekly forecasts of the currency pairs worth watching. The first part of our forecast is based upon our research of the past 11 years of Forex prices, which show that the following methodologies have all produced profitable results:

Trading the two currencies that are trending the most strongly over the past 3 months.

Assuming that trends are usually ready to reverse after 12 months.

Trading against very strong counter-trend movements by currency pairs made during the previous week.

Buying currencies with high interest rates and selling currencies with low interest rates.

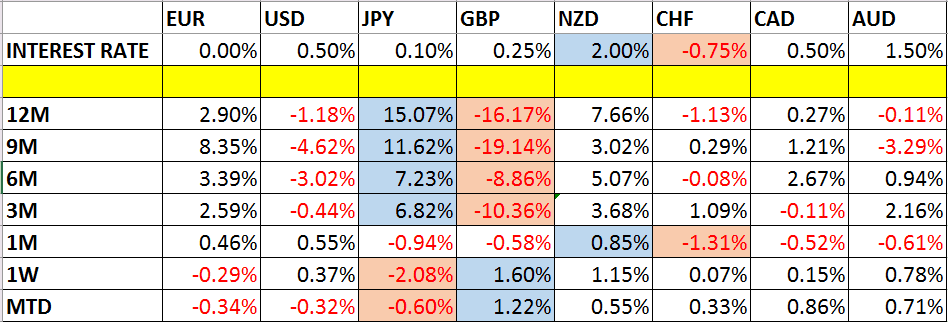

Let’s take a look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast September 2016

This month we forecast that the highest-probability trade will be long NZD/USD.

Weekly Forecast 4th September 2016

Last week, we made no forecast.

This week, we make no forecast, as although there were strong counter-trend moves, we have no confidence that they will reverse.

This week has again been dominated by strength in the British Pound, and weakness in the Japanese Yen.

Volatility was very greater than it was during the previous week, with slightly more than half of the major and minor currency pairs changing in value by more than 1%. Volatility is likely to be about the same over this coming week, which will likely be dominated by central bank actions from the European Central Bank and the Reserve Bank of Australia.

You can trade our forecasts in a real or demo Forex brokerage account.

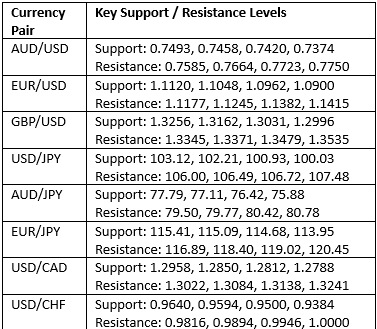

Key Support/Resistance Levels for Popular Pairs

We teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that should be watched on the more popular currency pairs this week, which might result in either reversals or breakouts:

Let’s see how trading two of these key pairs last week off key support and resistance levels could have worked out:

EUR/USD

We had expected the level at 1.1245 might act as resistance, as it had acted previously as both support and resistance. Note how these “flipping” levels can work really well. The H1 chart below shows the how the price initially hit this level just after the NFP release last Friday, reversing immediately with a bearish inside doji candle. Admittedly, this would have been hard to trade: sometimes when there is a big news event you really have to switch to much shorter time frames to exploit the opportunities which arise.

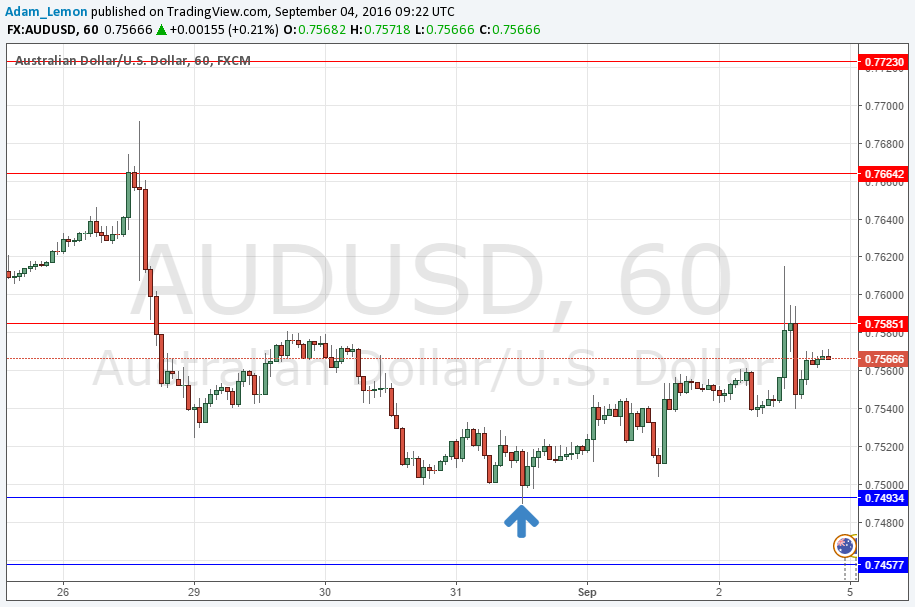

AUD/USD

We had expected the level at 0.7493might act as support, as it had acted previously as both support and resistance. Note how these “flipping” levels can work really well. The H1 chart below shows the how the price initially hit this level around the New York open, reversing immediately with a bullish inside candle. This was the low price of the week. This long trade gave a maximum reward to risk ratio of almost 3 to 1 so far, if the stop had been placed just below the swing low.

You can trade our forecasts in a real or demo Forex brokerage account to test the strategies and strengthen your self-confidence before investing real funds.