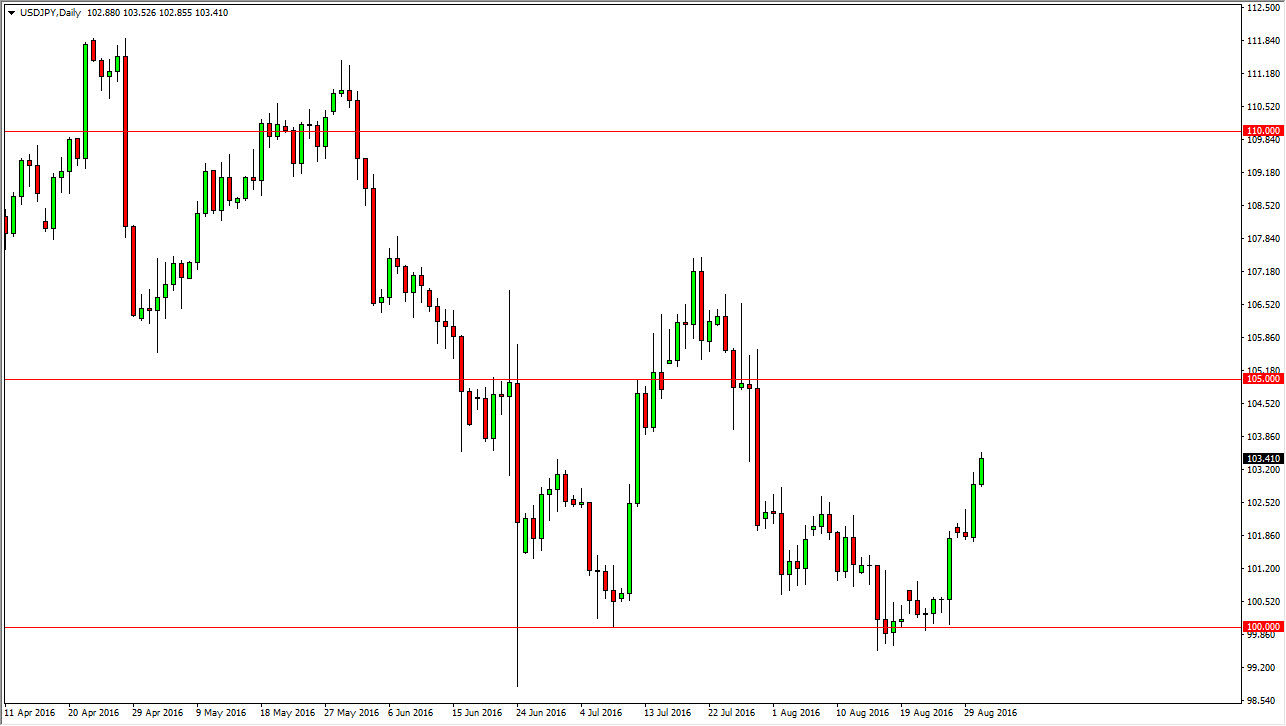

USD/JPY

The US dollar rose against the Japanese yen during the day on Wednesday, as we continue to see bullish pressure. We are now above the 103 level, which was a barrier that was going to be fairly significant. Having said that, it’s very likely that the market could continue to reach towards the 105 level, but I also recognize that there is a lot of influence that can come into this marketplace due to the jobs number on Friday. I believe that pullbacks at this point in time will more than likely offer buying opportunities, so I am a short-term buyer but I do recognize that Friday is going to be monumental as far as the direction in this pair more than likely as the Bank of Japan has decided to trying to weaken the Japanese yen, while the Federal Reserve is suggesting that perhaps rate hikes art out of the question in September.

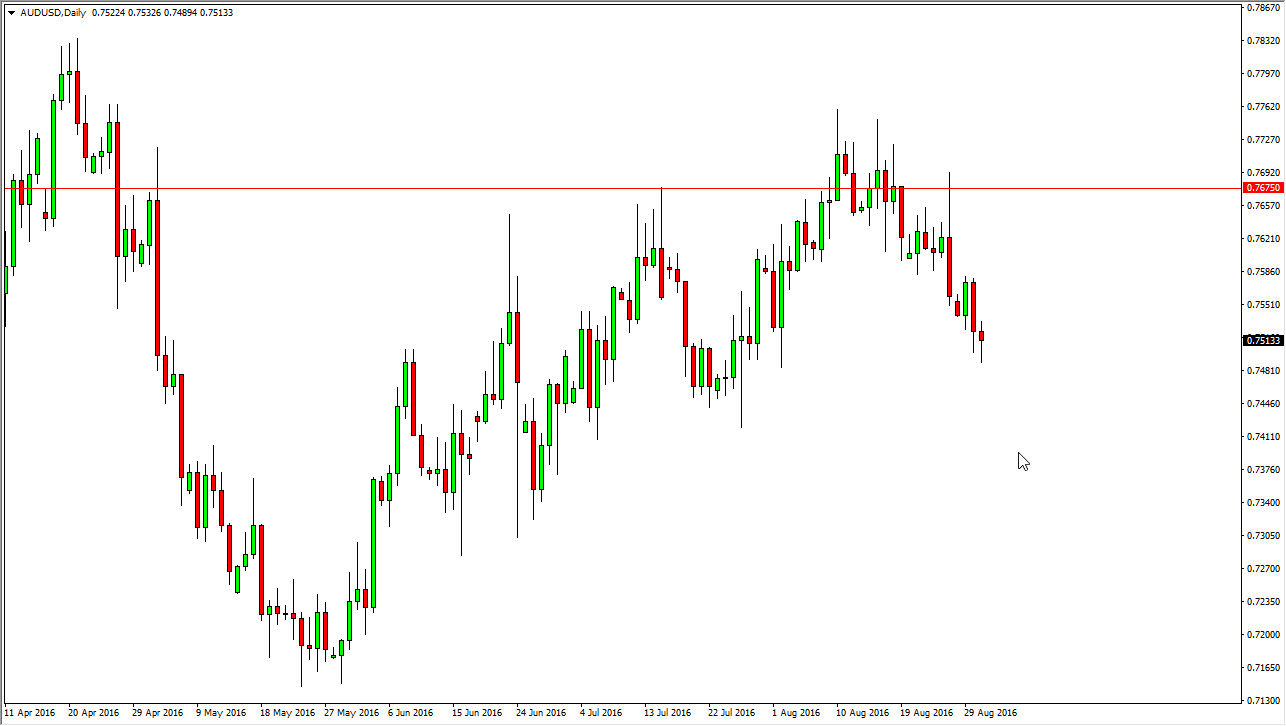

AUD/USD

The Australian dollar fell initially during the day on Wednesday but found enough support to bounce and turn things back around to form a hammer. The hammer of course is a very bullish sign, and if we can break above the top of it it’s likely that we will try to reach towards the 0.76 level next. After that, I believe that the gold markets will have quite a bit of an influence on this market as well.

I don’t expect any type of major move between now and the Friday jobs announcement, so at this point in time I think that any move higher is probably going to be short-lived, at least until we get the announcement. Ultimately though, I would not be surprised at all to see this market rise a little bit just due to exhaustion from all of the selling that had occurred over the last several sessions.