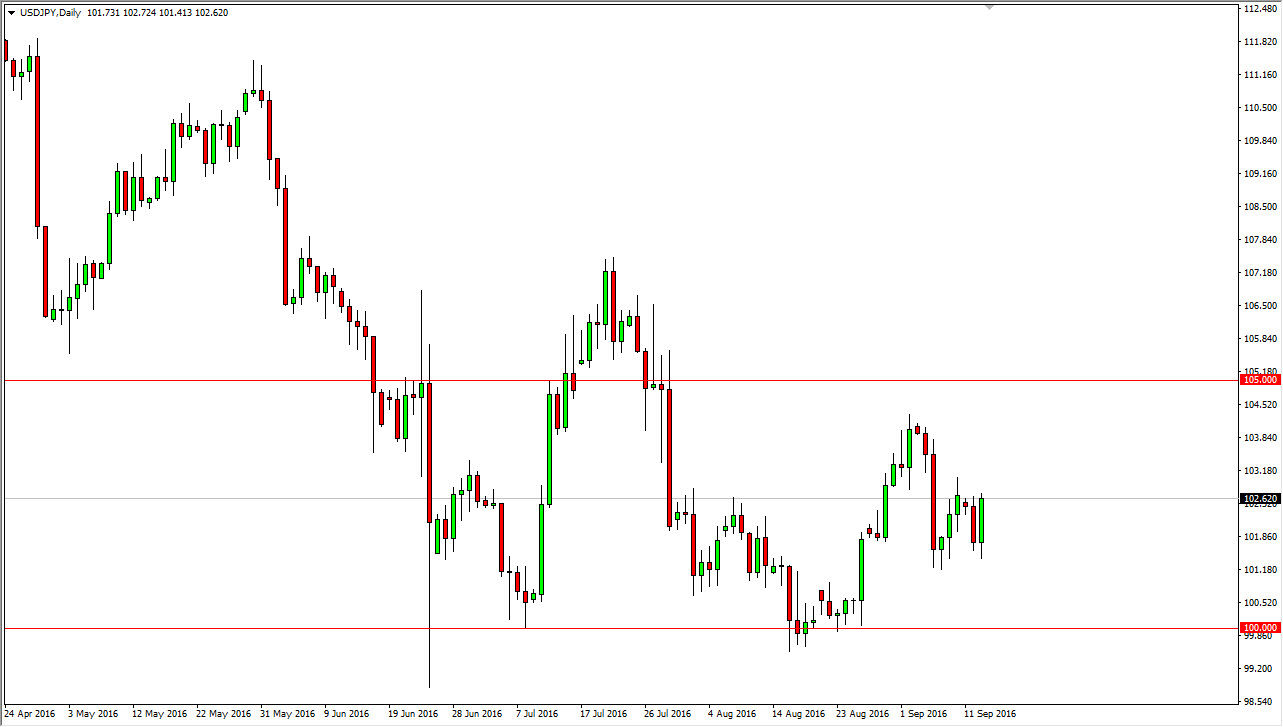

USD/JPY

The USD/JPY pair initially fell during the course of the session on Monday, but turned right back around to form a bullish candle. By doing so, the market turned around and show signs of strength as the market continues to find buyers at lower levels. Ultimately, this is a market that will probably try to reach towards the 105 handle. It will be choppy, but at the end of the day it’s likely that it will be a difficult market to hang onto as this pair tends to be volatile under the best of conditions. I believe that the 100 level below is essentially the “floor” in this pair, as the Bank of Japan looks to be very supportive and is working against the value of the Japanese yen itself.

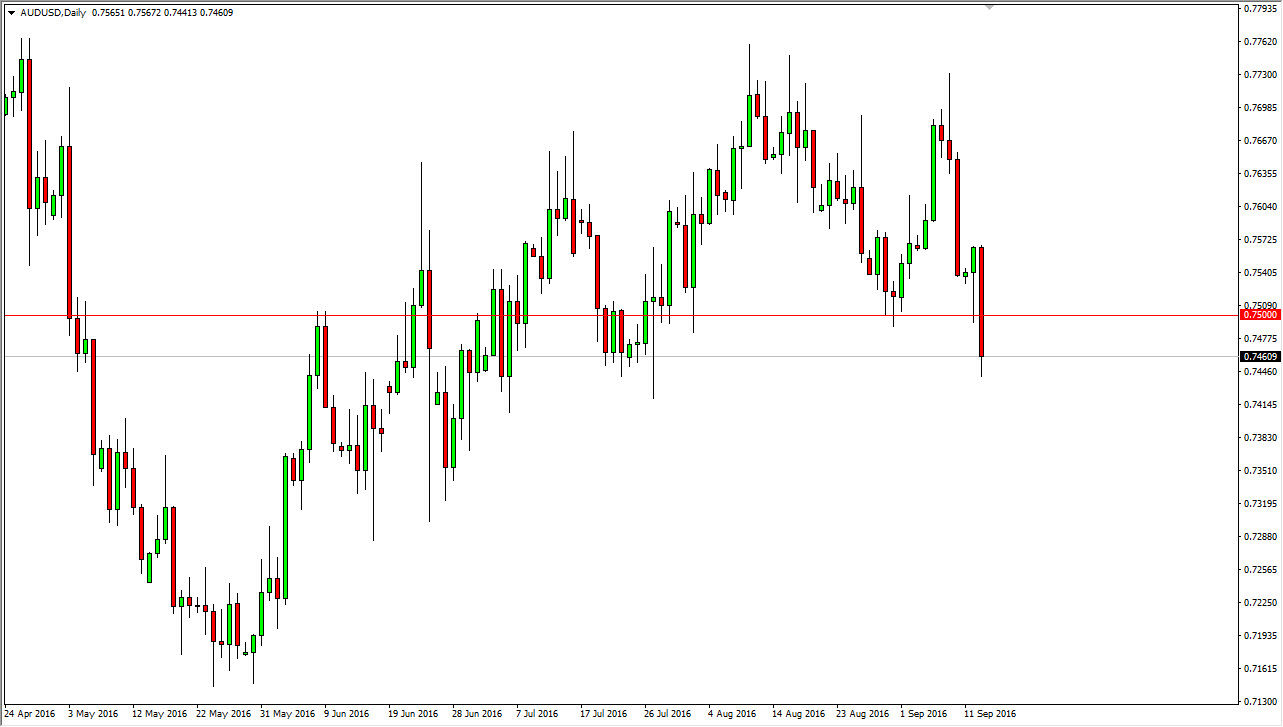

AUD/USD

The Australian dollar broke down rather significantly during the course of the session on Tuesday, slicing through the back half of the hammer that had formed on Monday. By doing so, it shows a significant amount of bearish pressure, and as a result it’s likely that the market will continue to go lower from here. However, I do recognize it’s likely that we will have quite a bit of volatility on the way down. This would be accelerated if we can break down below the 0.74 level, and beyond that I believe that a rally from here could be a selling opportunity at the first signs of exhaustion.

I would be a buyer. A break above the top of the candle from the Tuesday session, as it would show quite a bit of bullish pressure. However, it’s unlikely that we are going to do that based upon the extreme bearish pressure that we have seen during the course of the session. If we do break out to the upside though, we could reach towards the 0.77 handle. Pay attention to gold, it tends to have an influence on the Austrian dollar as level.