USD/JPY

The US dollar fell during the course of the session on Monday, testing the 101.50 level. There is a lot of consolidative pressure in this market, so having said that I believe that we’re going to see quite a bit of choppiness. If we break down below the 101.50 level, I believe that there is a massive amount of support at the 100 level. This is what I believe is essentially the “line in the sand” when it comes to the Bank of Japan, as they are starting to lose there sends the humor when it comes to the value of the Japanese yen at the moment. With this being the case, sooner or later we should get some type of supportive candle or an impulsive candle to the upside that we can buy. In the meantime, I think that buying short-term pullbacks and show signs of support might be the way to go going forward.

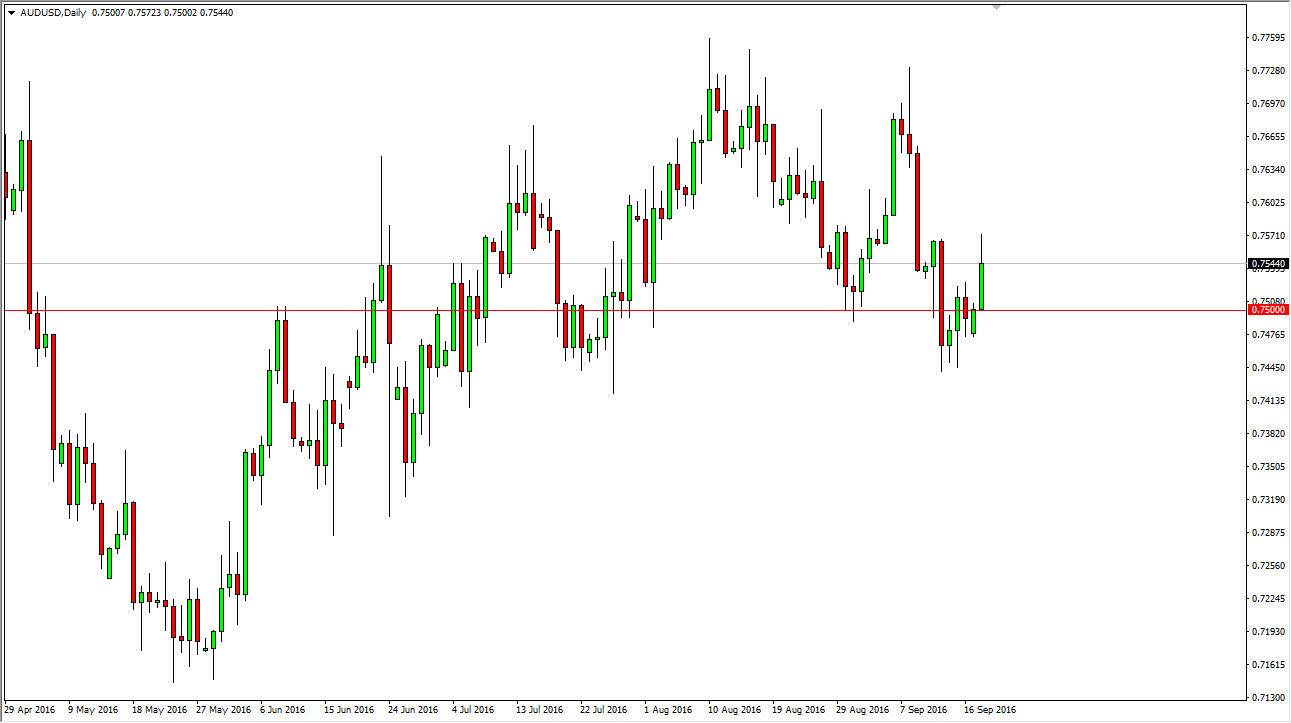

AUD/USD

The AUD/USD pair broke higher during the course of the session on Monday, testing the 0.7550 level for resistance. We did pullback a little bit from there, but I believe if we can break above the top of the range for the session on Monday, we should then reach towards the 0.77 handle. I think that there are a lot of buyers below, so if we drop from here, I think that sooner or later we would find plenty of buyers given enough time. I have no interest whatsoever in selling until we get below the 0.74 level, but if we do I feel that the market should continue to go down to the 0.72 level, and then down to the 0.70 level. Ultimately, this is a market that should continue to show quite a bit of choppiness, as we continue to find a lot of volatility. Do not forget that the gold market can have an influence on the Australian dollar as well.