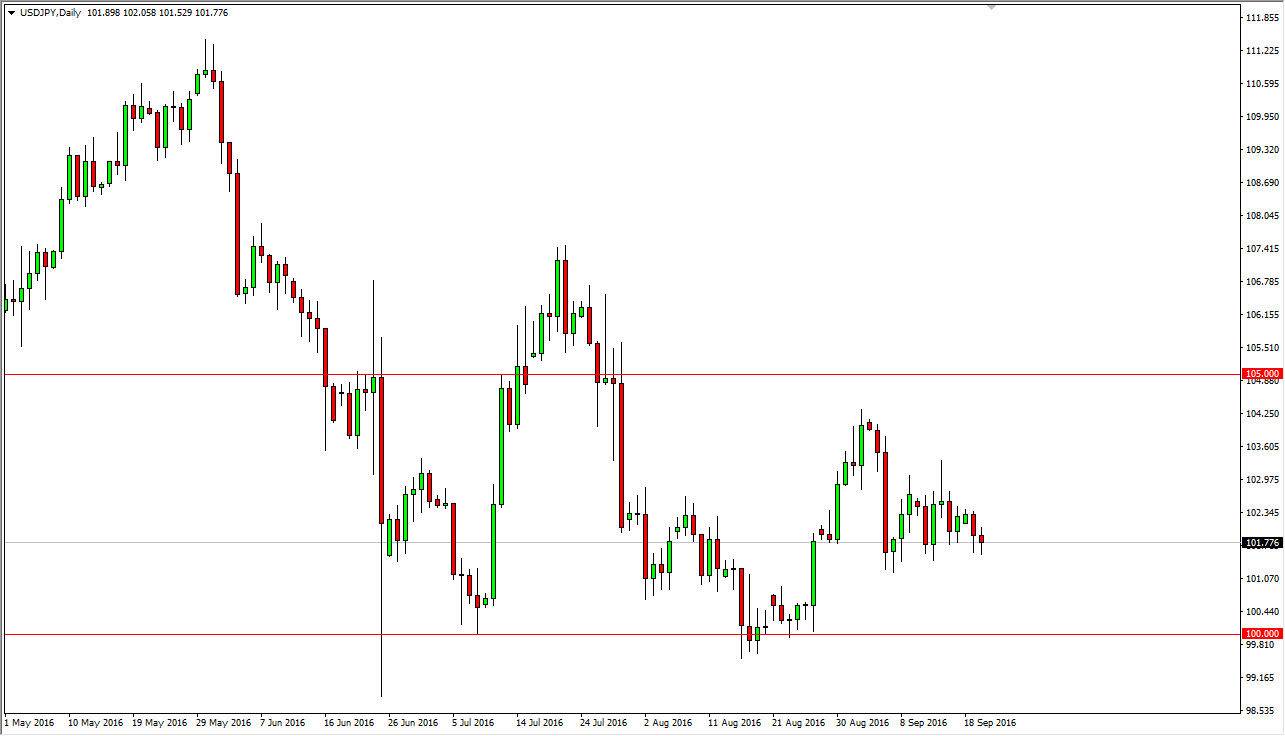

USD/JPY

The USD/JPY pair fell slightly during the session on Tuesday, but found a bit of support in a very quiet market. I believe that this market continues to consolidate, and therefore I am not looking to put a lot of money into it. However, I think that the Bank of Japan has drawn a ‘line in the sand’ at the 100 level, and therefore I have no interest in selling this pair. I think that sooner or later the Bank of Japan is going to get its way. Because of this, the market is one that I buy on dips, but that’s about it. I have no real interest in selling, and therefore continue to ignore sell signals, unless of course if we see one near the massive resistance at the 105 level. This level being broken to the upside would signal a trend change in my opinion.

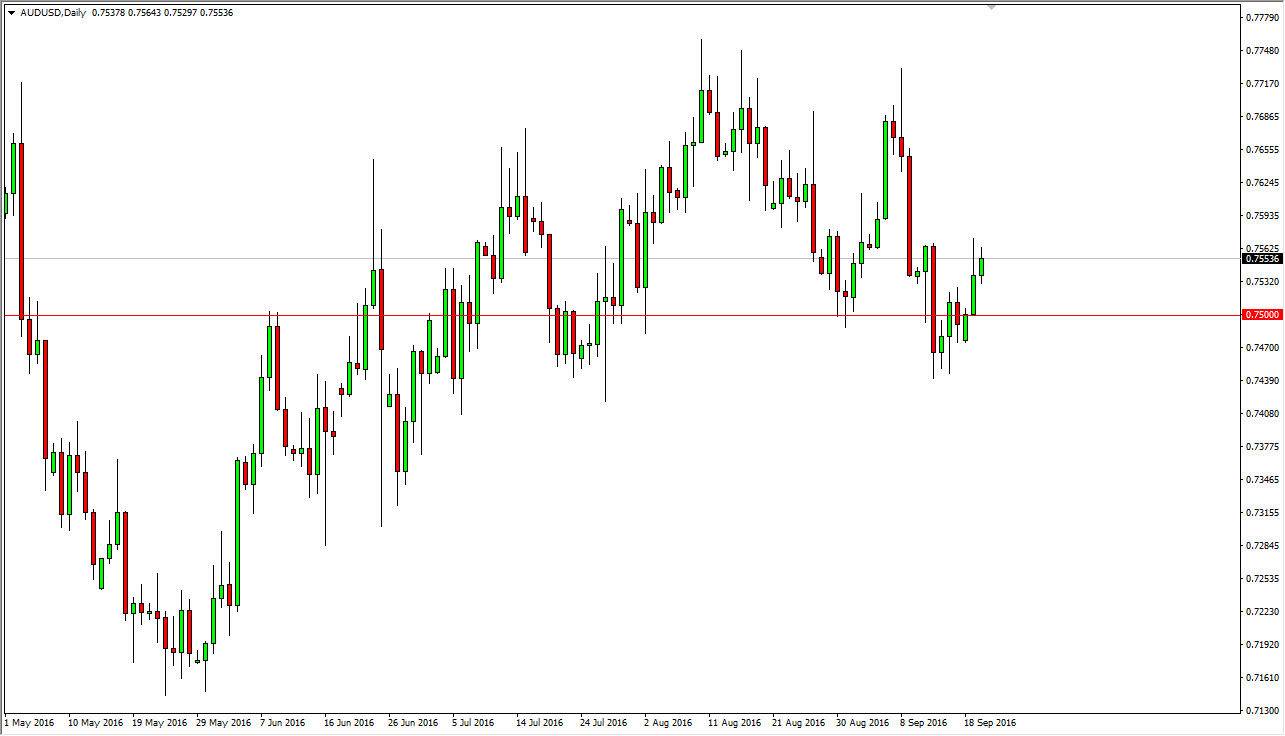

AUD/USD

The AUD/USD pair rose slightly during the session on Tuesday, and as a result I think that the markets will continue to find buyers, but at the end of the day I believe that volatility will be the mainstay of this pair. The markets will also be influenced by the gold markets as it tends to drive the Aussie longer-term. The Federal Reserve will also take the spotlight during the day, so there could be a bit of back and forth trading today.

The market breaking above the 0.7575 level would send this pair looking for the 0.77 level above, which has been resistance in the past. With this being the case, I think any rise in the pair will be only somewhat temporary when it comes to this. The market continues to be one that is a bit tight, meaning that the markets will be choppy and probably a market that short-term traders are attracted to.