USD/JPY

The USD/JPY market initially tried to rally during the course of the session on Wednesday, but turned right back around to fall rather significantly. Although I’m writing this just before the FOMC Statement, the reality is that the market already expects the Federal Reserve to do very little, and as a result I think that’s why this market has dropped a bit from here. However, I think that the 100 level is massively supportive, and that the Bank of Japan will more than likely get involved given enough time. I’m simply waiting for some type of supportive candle or a bounce that I can take advantage of, as I believe that sooner or later the Bank of Japan will get what it wants, mainly because the Federal Reserve is the only central bank in the world that is even remotely looking at raising rates.

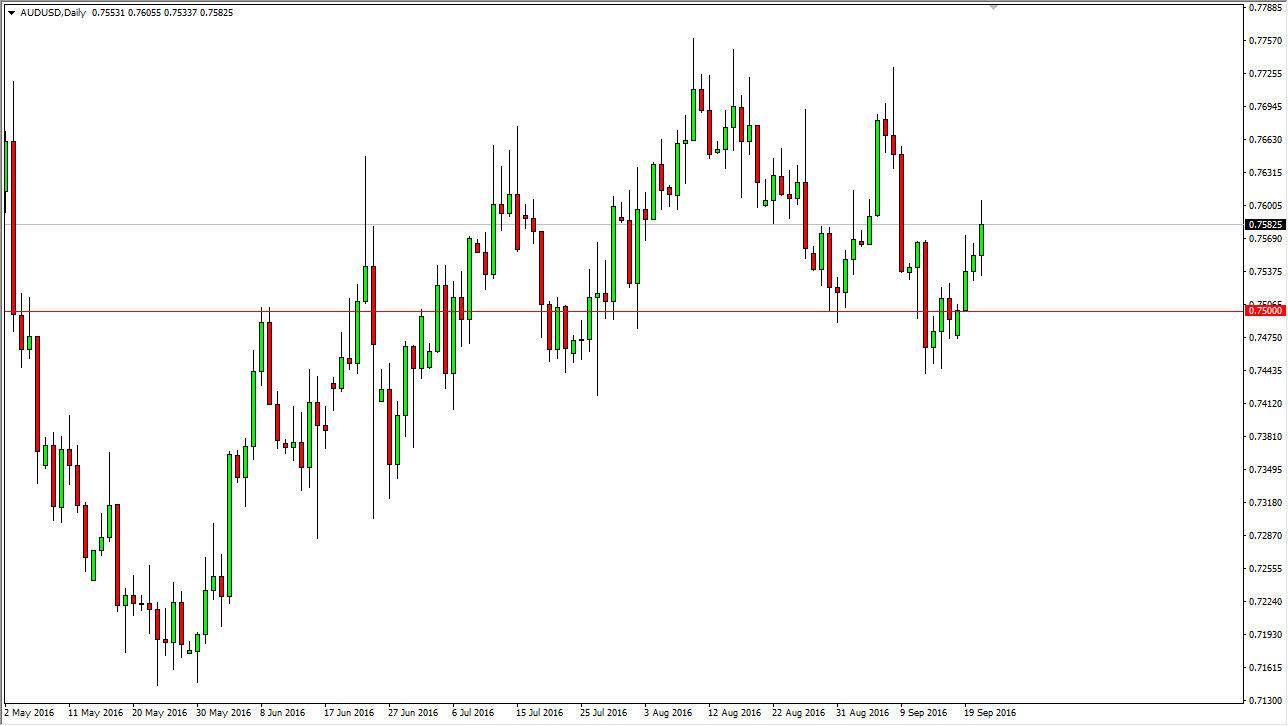

AUD/USD

The Australian dollar initially fell during the course of the session on Wednesday, but found enough support below to turn things back around and form a very bullish sign. A break above the top of the range for the session on Wednesday would be a sign of continuation as we have had such a massive bounce recently. If we pullback from here, the 0.75 level should be supportive as well. In other words, don’t really have any interest whatsoever in selling this market, at least not at this point in time as it seems like we are close to the bottom of the overall consolidation, so it makes sense that we would continue to find buyers here.

At this point in time, I believe that the 0.7750 level will be targeted, that is the top of the recent consolidation. I don’t have any interest in selling at this point in time, at least not until we break down below the 0.74 level. At that point in time I would anticipate that this market goes much lower.