USD/JPY

The US dollar bounced off of the 100 level against the Japanese yen during the session on Thursday, as this area continues to be a bit of a “line in the sand” when it comes to the Bank of Japan. With that being the case, I feel that the market is going to continue to grind higher from here, but the key word here will be “grind”, as it is a very choppy market, and it appears that we are trying to change the overall trend. The Bank of Japan will get what it wants, but is going to take quite some time. With that being the case, I believe that you can either buying this pair for short-term moves higher, or perhaps think of it more or less as an investment and just simply hang onto this market for some time.

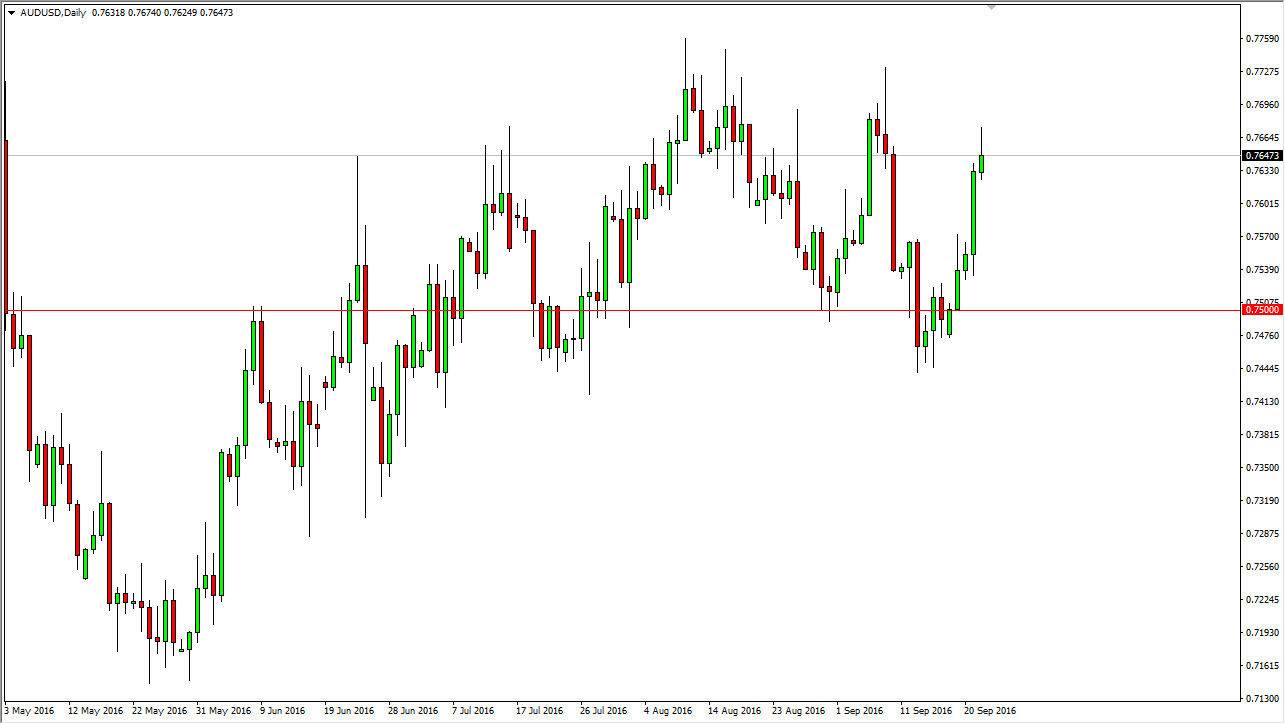

AUD/USD

The Australian dollar initially rallied during the day on Thursday, but turn right back around to form a bit of a shooting star. The shooting star of course is a very negative candle, and if we can break down below the bottom of a negative candle, we should then drop down to the 0.7550 region, perhaps even the 0.75 level. Ultimately, that would be a short-term trade more than anything else, because I do not expect the bottom to fall out.

Alternately, we could break above the top of the shooting star which would be a very bullish sign. However, I think that there is more than enough noise above that it would be a very difficult long to take as there is so much in the way of choppiness waiting to happen. I am not saying that we can’t go higher, but the move higher is a bit overextended at this point. I think that we will need to build up more momentum in order to that – so having said that I think that the market needs this breather.