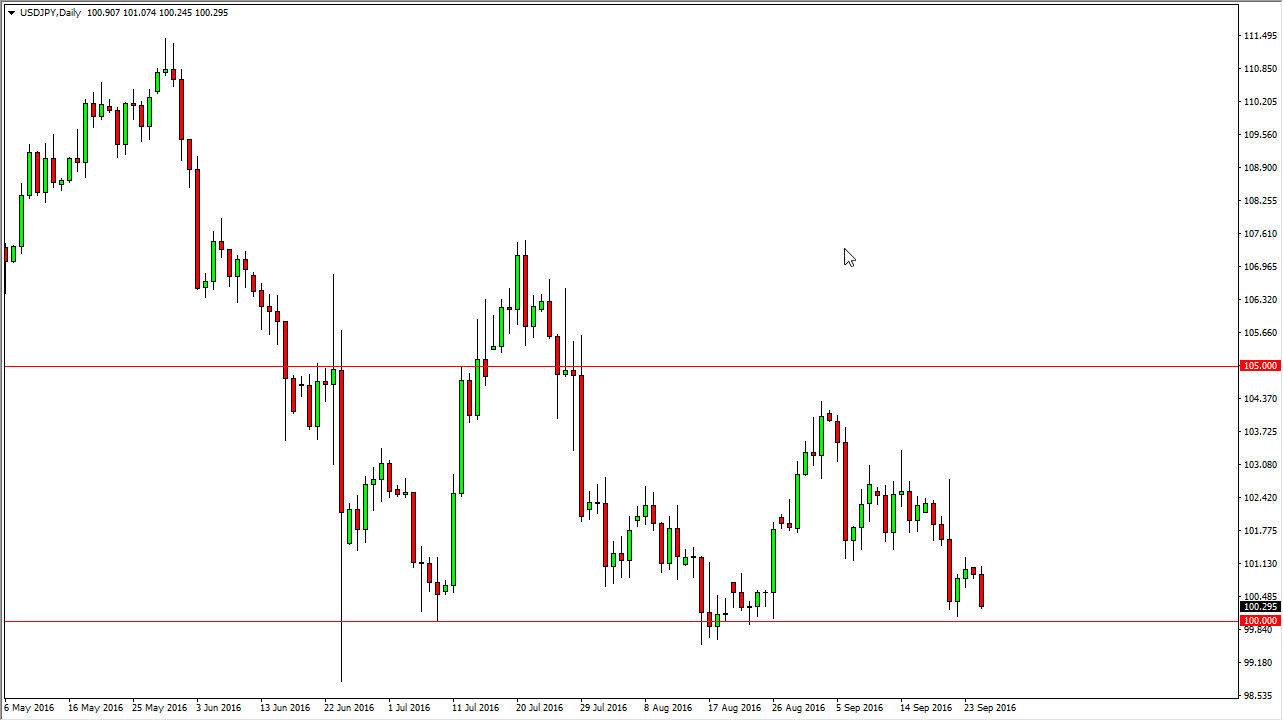

USD/JPY

The US dollar fell against the Japanese yen during the course of the day on Monday, as we continue to grind our way towards the 100 level below. If we can break down below there, it’s likely that we would continue to go much lower, at least until the Bank of Japan got involved. I do think it will get involved given enough time, so be aware the fact that it’s dangerous to start shorting this market below. If we do rally from here, I think that it will be very choppy, and you will have to be able to hang onto quite a bit of volatility to take advantage of what I think is a bit of a “backstop” by the Bank of Japan. With this, I am bullish but I also recognize that it isn’t going to be easy.

AUD/USD

The Australian dollar rally during the course of the session on Monday, reaching above the 0.76 level. Ultimately, I believe that the shooting star from last week will continue to be very resistive, and with that being the case, it’s going to be very difficult to go much higher from here, and I cannot help but notice that the highs continue to get lower and lower, so that of course is a very negative sign and I think at this point in time we are more than likely continue to grind down to the 0.75 handle below.

I also recognize that there is a lot of support in that general vicinity, so even if we do drop down to that area I think it’s only a matter of time before the buyers get involved to form a supportive candle in this region so we can start buying. With this being the case, it’s likely that the market will fall for a while, only to find buyers yet again.