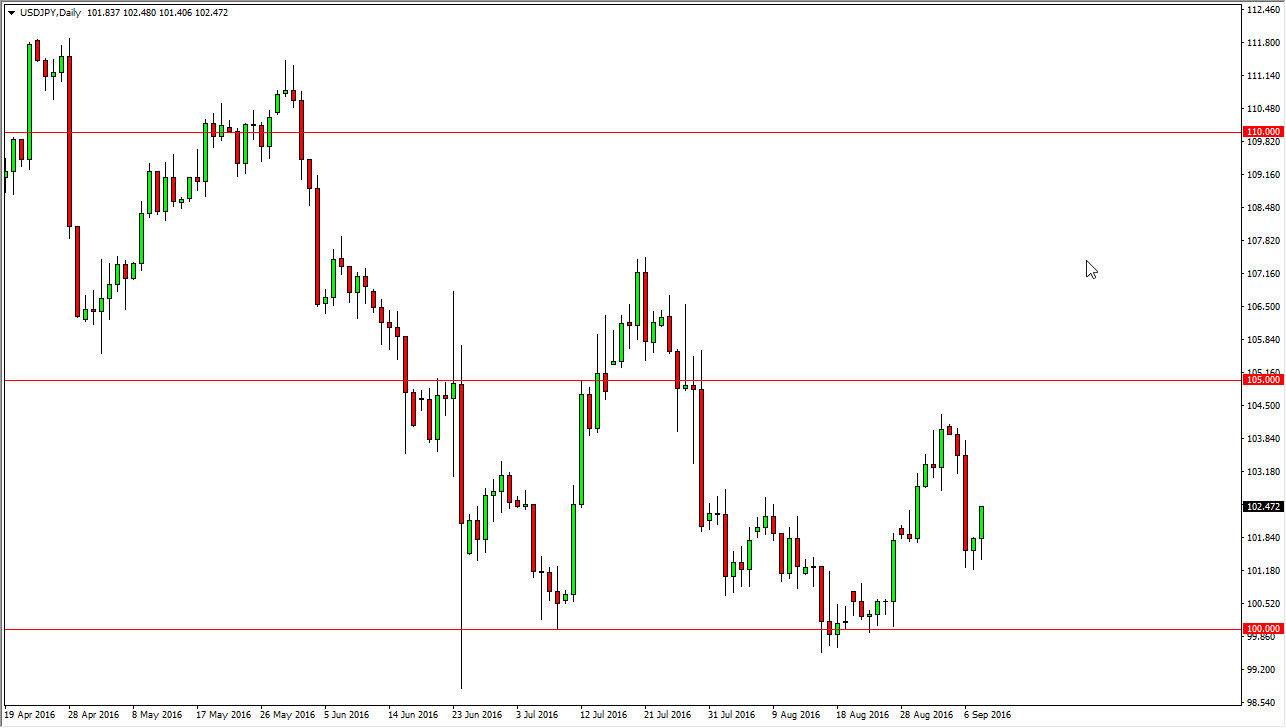

USD/JPY

The USD/JPY pair initially fell during the day on Thursday, but turned right back around to form a fairly positive candle. As the US dollar continues to climb, I believe that eventually we will break out and reach towards the 104 level yet again. I think that the real barrier extends all the way from there to the 105 level, so I do expect a fight. However, I also believe that this market has a hard bottom in it, supplied by the Bank of Japan of the psychologically significant 100 level. Every time this market pulls back, I’m starting to think about buying a small position and just simply adding to what I already have going on. Once we break above the 105 level, I’m targeting the 107 level after that.

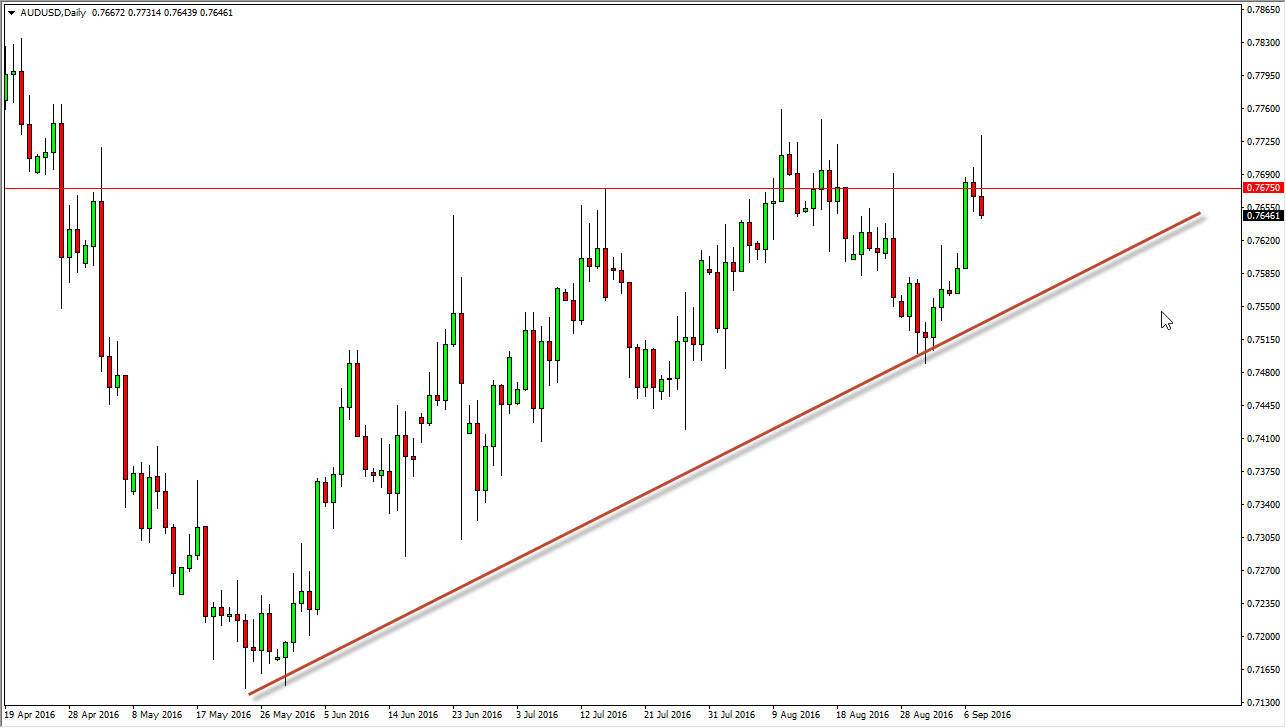

AUD/USD

The Australian dollar initially tried to rally during the day on Thursday but found the area above the 0.7675 level far too resistive yet again. Because of this, we ended up forming a shooting star in the shooting star of course is a negative sign. Now that we have formed this candle, I believe that we are going to pull back but I also recognize that you could make an argument for a bit of an uptrend line below. Because of this, I believe that this is going to be more or less a short-term selling opportunity more than anything else. I think it is an attempt to find enough momentum to finally break out to the upside.

On the other hand, if we do break down below the 0.75 handle, then I would consider this a market that should go much lower, albeit in a very choppy manner as we have quite a bit of volatility and noise just below. With this being the case, I think you can have to deal with volatility in either direction, but right now it looks like at least a short-term momentum is heading down.