USD/JPY

The USD/JPY pair initially tried to rally during the course of the session on Thursday, but turned around to form a very long shooting star. However, I still think that the 100 level below is massively supportive, so with that being the case I think it’s only matter time before the buyers return. The Bank of Japan continues to paying quite a bit of attention at the 100 level, so I have notched in shorting and believe that it simply a matter of time before you can go long. On the other hand, we can break above the top of the shooting star and that would be very bullish as well. At that point time, I would anticipate that the market would reach towards the 103 handle.

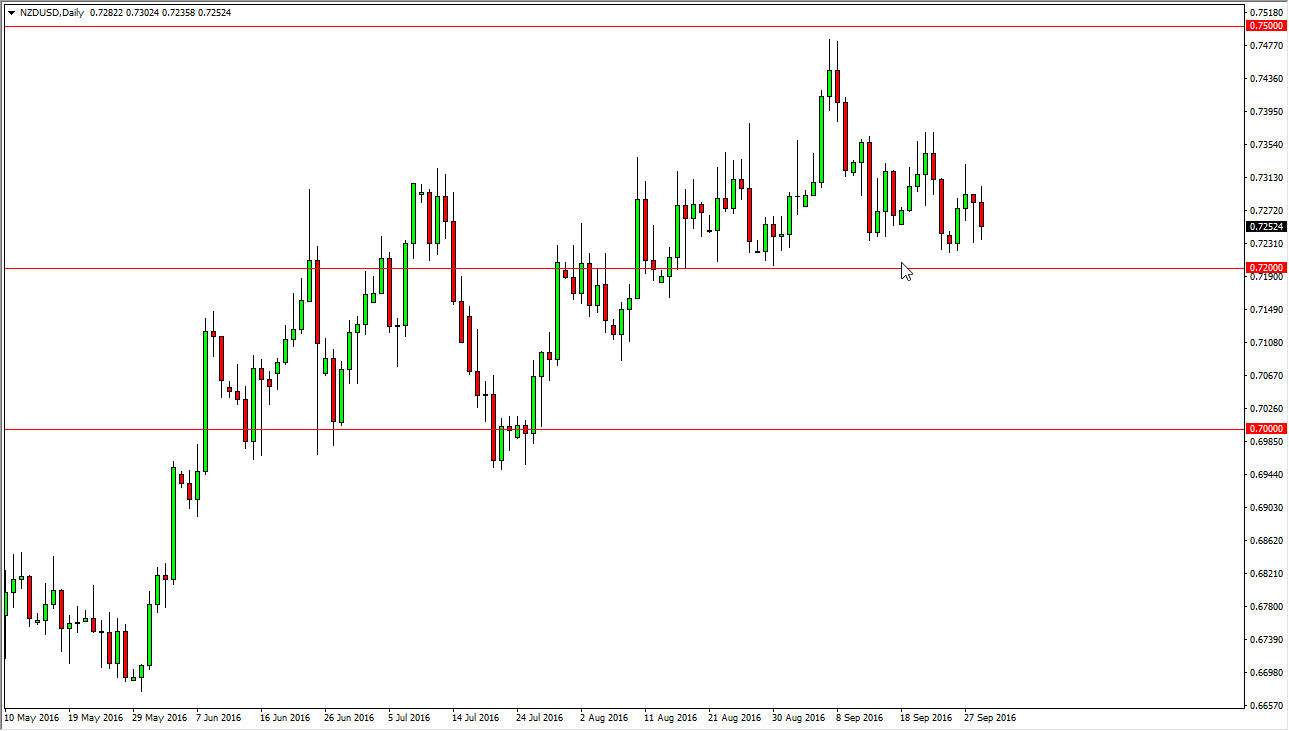

NZD/USD

The New Zealand dollar is highly leveraged to commodities, and that of course makes a bit of a “risk currency.” However, at this point in time I don’t see anything risky about this pair, just consolidation. I believe that the 0.72 level below is massively supportive, just as the 0.7350 level above is massively resistive. In other words, I think that you can continue to play this market back and forth, but I personally feel much more comfortable buying this market on pullbacks as we have broken out to the upside at one point in time.

Ultimately, a break down below the 0.72 level would be a very negative sign, perhaps reaching down to the 0.70 level after that. I recognize that one of the biggest reasons why this market has been going higher is the fact that there is a positive swap at this point in time, and with that being the case it’s likely that the market will continue to benefit from that alone, as there are simply no benefits to owning anything that pays interest beyond perhaps dividend paying stocks, and of course currencies such as the Kiwi.