USD/CAD Signal Update

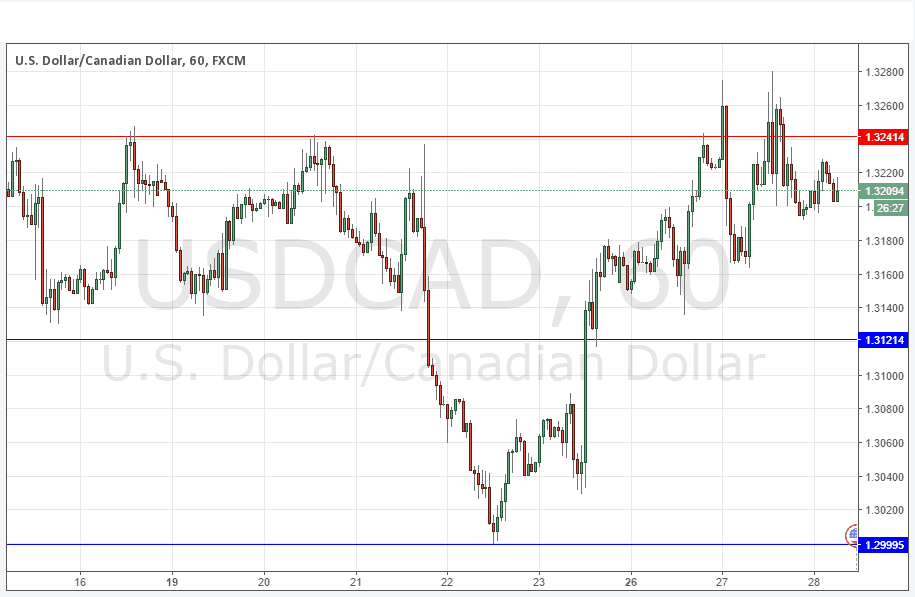

Yesterday’s signals were not triggered as the bearish price action took place a little above the identified resistance level of 1.3241.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered between 8am London time and 5pm New York time today only.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 1.3121 or 1.3000.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 1.3241.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

It was a familiar situation yesterday, with the price trying and failing to get established above the very crucial resistance level at 1.3241.

The level remains worth watching. The longer the price looks fairly bullish not far beneath it, the stronger any eventual bullish breakout should be.

There are no key resistance levels higher up until 1.3400 so there could be a sustained and powerful upwards move there.

There is nothing due regarding the CAD. Concerning the USD, there will be a release of Core Durable Goods Orders at 1:30pm London time followed by testimony from the Chair of the Federal Reserve before Congress at 3pm and Crude Oil Inventories data at 3:30pm.