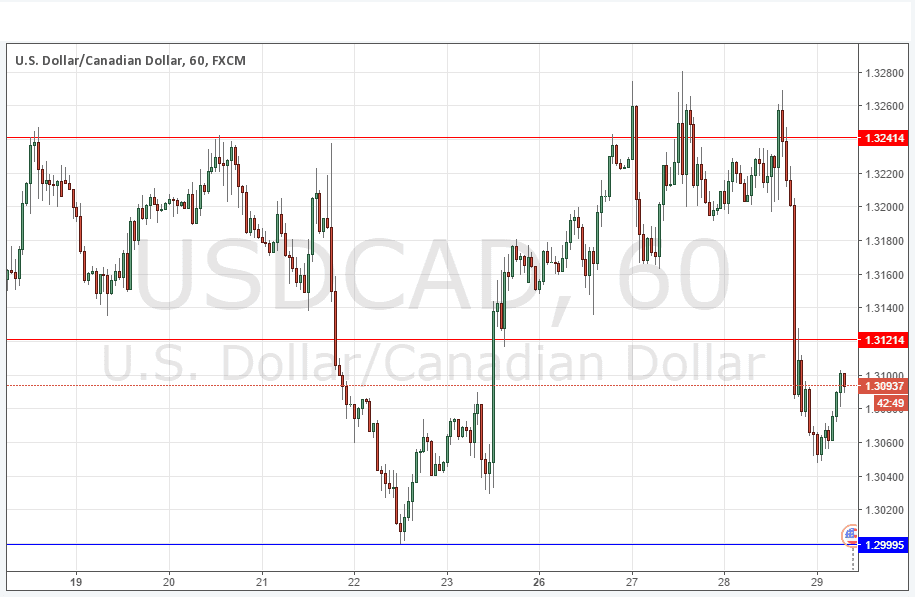

USD/CAD Signal Update

Yesterday’s signals were not exactly triggered as the bearish price action took place a little way above the key resistance level identified at 1.3241.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken from 8am London time until 5pm New York time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame following the next touch of 1.3000.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 1.3241.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

I have been writing for several days running about how significant the level at 1.3241 is, predicting either a strong decisive bullish break – which I had thought more likely – or failure. This level is a real “pivotal point”.

Yesterday, we got a strong failure, and a dramatic drop from that price area, with the price breaking well below a support level and even getting to a low only 50 pips or so from the big support level at 1.3000.

This means it is probably correct now to take more of a bearish bias, at least as long as 1.3121 proves itself as flipped support to resistance. If the price breaks up above that level quickly, it would suggest a more bullish picture.

The big round number at 1.3000 remains an attractive place to look for longs.

There is nothing due today regarding the CAD. Concerning the USD, there will be a release of Final GDP and Unemployment Claims data at 1:30pm London time followed by words from the Chair of the Federal Reserve at 9pm.