USD/CHF Signal Update

Yesterday’s signals produced a profitable long trade off the support level at 0.9707. It should probably be mostly closed by now as we have some kind of a double top at the resistance level of 0.9777.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trades

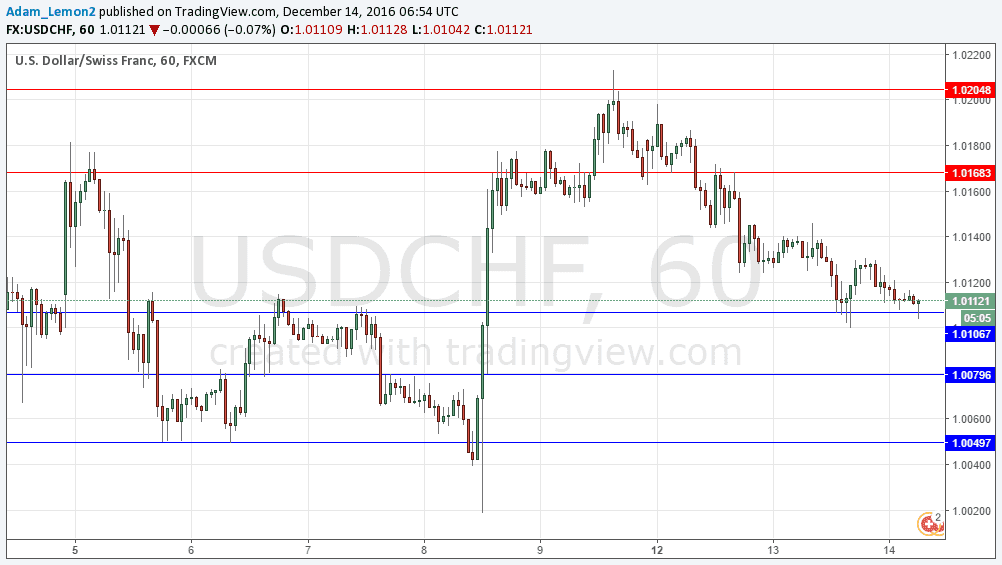

Go long after bullish price action on the H1 time frame following the next touch of 0.9735 or 0.9707.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9777 or 0.9816.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

Ironically having written yesterday that “opportunities today are most likely to found trading other currency pairs”, there was a good long trade opportunity off 0.9707 that produced a profitable trade, although it is true that the movement was better and more profitable on other currency pairs.

Not much changes here: like its sister pair EUR/USD, this pair has no long-term trend. A weekly chart shows it simply continues and in fact tightens its consolidation.

In spite of the clear double top at 0.9777 I am not strongly confident that this level will hold as resistance over the near term.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.