USD/CHF Signal Update

Yesterday’s signals were not triggered as none of the key levels were reached.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Long Trades

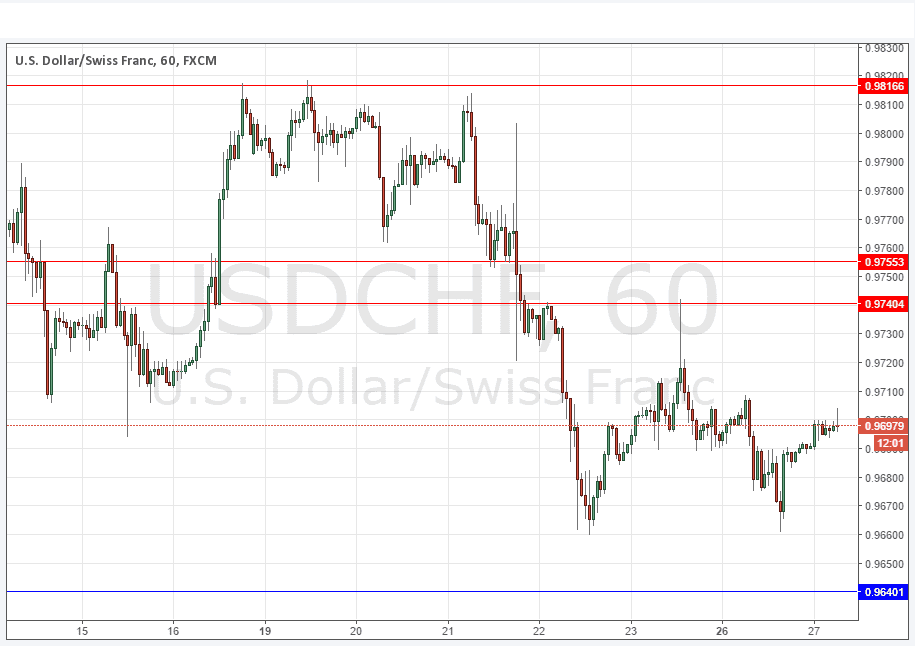

Long entry after bullish price action on the H1 time frame following the next touch of 0.9640 or 0.9593.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry after bearish price action on the H1 time frame following the next touch of 0.9740/0.9755 or 0.9816.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

It can still be said that there is no long-term trend, so short-term targets are probably the most sensible opportunities to focus on.

We have something of a double bottom below at about 0.9760 which could become a triple bottom if the price gets down there again. Of course, the area around 0.9750 is always likely to produce a reaction especially in this trendless environment, so it is probably more a case of that level acting a little early.

There is nothing due regarding the CHF. Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time.