USD/JPY Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at 103.12.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be entered only between 8am New York time and 5pm Tokyo time, over the next 24-hour period.

Long Trade 1

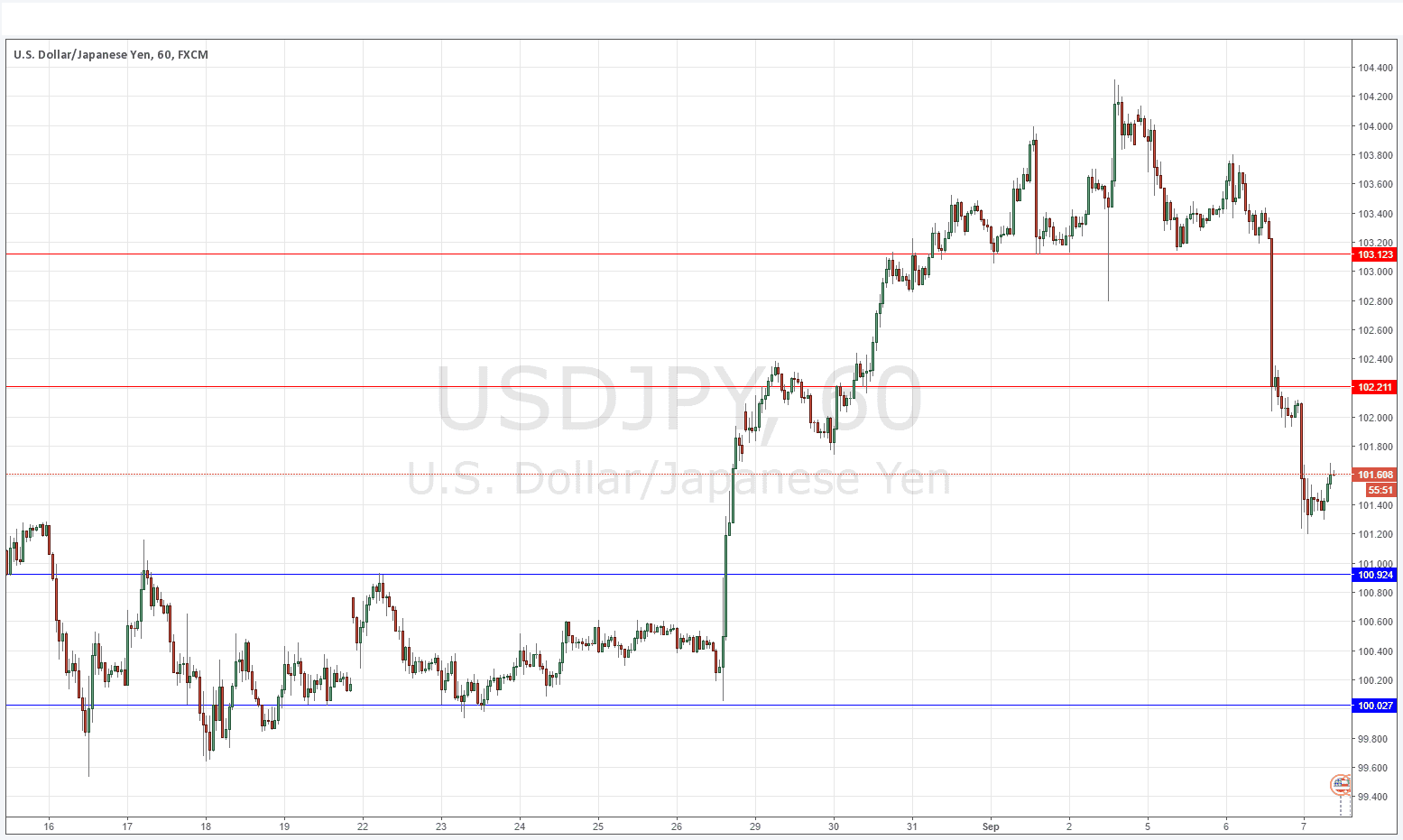

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 100.92.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 102.21.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The price fell strongly and hard yesterday after the poor U.S. data. It was a great short trade to get into. The price was poised to fall as it couldn’t really rise and was just lingering above the increasingly weak-looking support at 103.12. Once it broke below there, it fell very quickly.

The London session so far, as at the time of writing, could not exceed the lows of the Tokyo session, nor do those lows at around 101.20 look as if they are going to be broken today. Therefore, swing traders would probably want to take at least partial profits on any short trade by now.

It looks quite straightforward to just leave the previous support levels as resistance, especially 102.21 where there was something of a bullish reaction.

There is nothing due today concerning the JPY or the USD.