USD/JPY Signal Update

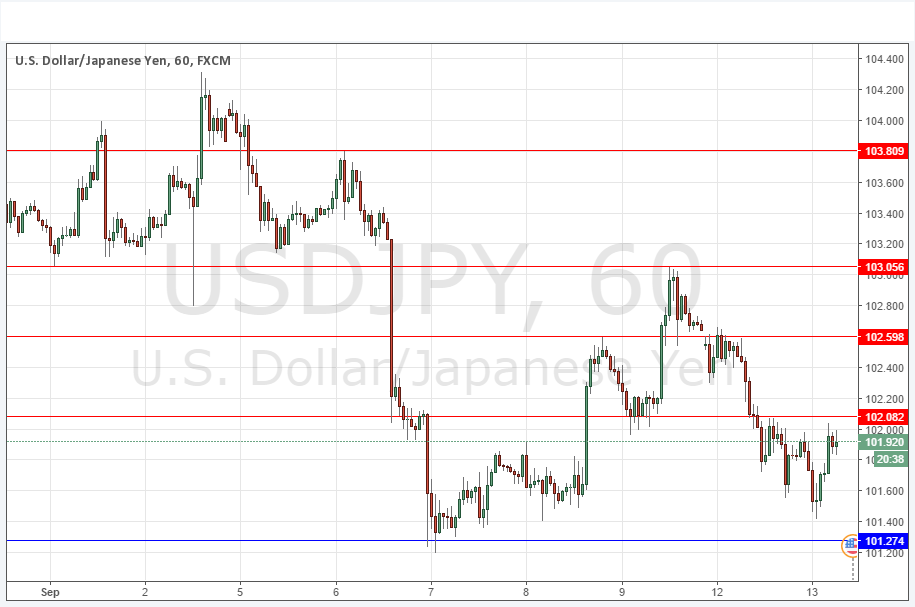

Yesterday’s signals were not triggered as the price was already below the key level of 102.00 by 8am New York time.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period only.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 101.27.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 102.60 or 103.05.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The situation looks interesting. We have made something of a double bottom at 101.40 and of course there is support just below that at 101.27. This suggests bulls are buying and there will be an upwards move. However, not only do we have the second shoulder of a bearish pattern at 102.60 above, we also had a supportive area around 102.00 which has been flipped to become resistance. Bears will defend 102.08 but a break above that will suggest a retest of 102.60 is on the cards.

There is still a long-term bearish trend in force, but we have not made a new low for several weeks, and we do get persistent buying the closer the price gets to 100.00.

There is no high-impact news due today concerning either the JPY or the USD.