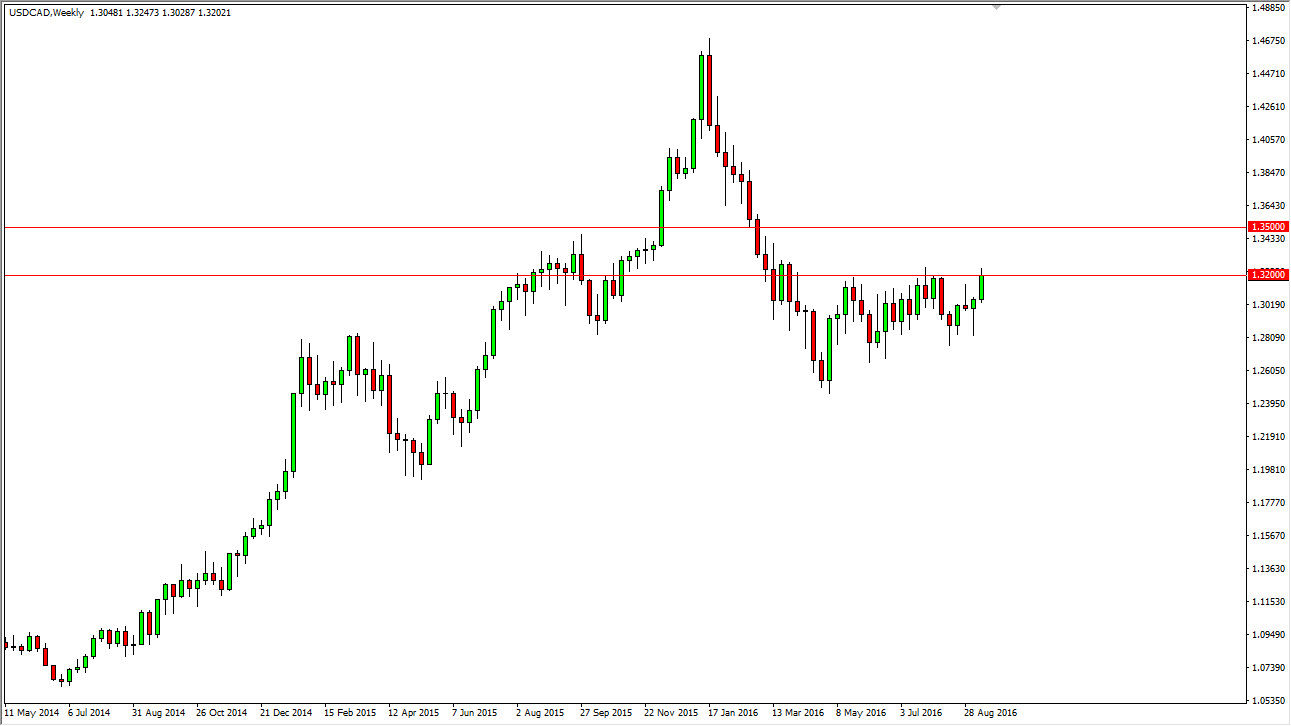

USD/CAD

The US dollar rose during the course of the week, crashing into the 1.32 level against the Canadian dollar. This was due to several different factors, not the least of which was a really poor Canadian manufacturing report. Oil markets look a bit soft at the moment, so having said that I feel that eventually we do break out. A move above the 1.3250 level should send this market looking for the 1.35 handle.

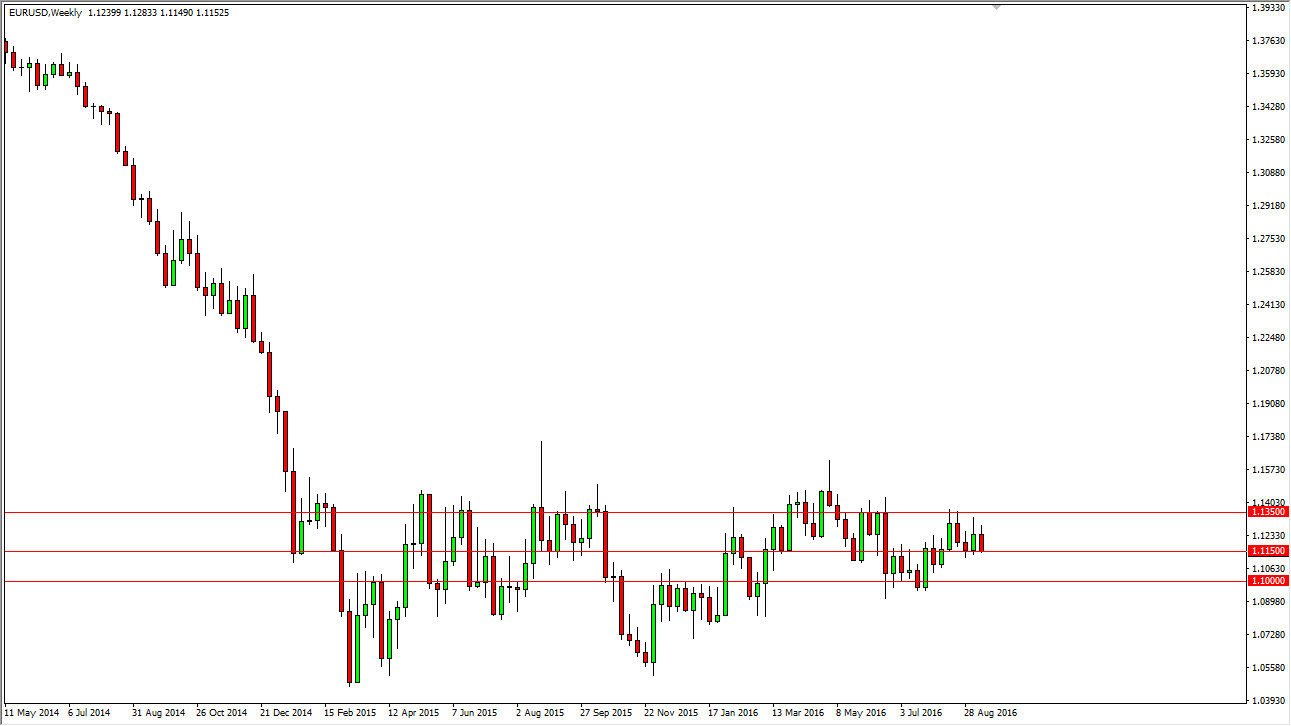

EUR/USD

The Euro initially tried to rally during the week but then turned back around to crash into the 1.1150 level on Friday. Quite frankly, I feel that this is a market that if we can get a little bit of downward momentum should go fishing for the 1.10 handle below. I would be suspicious of any rally at this point in time, but overall I believe the consolidation is still the name of the game in this market.

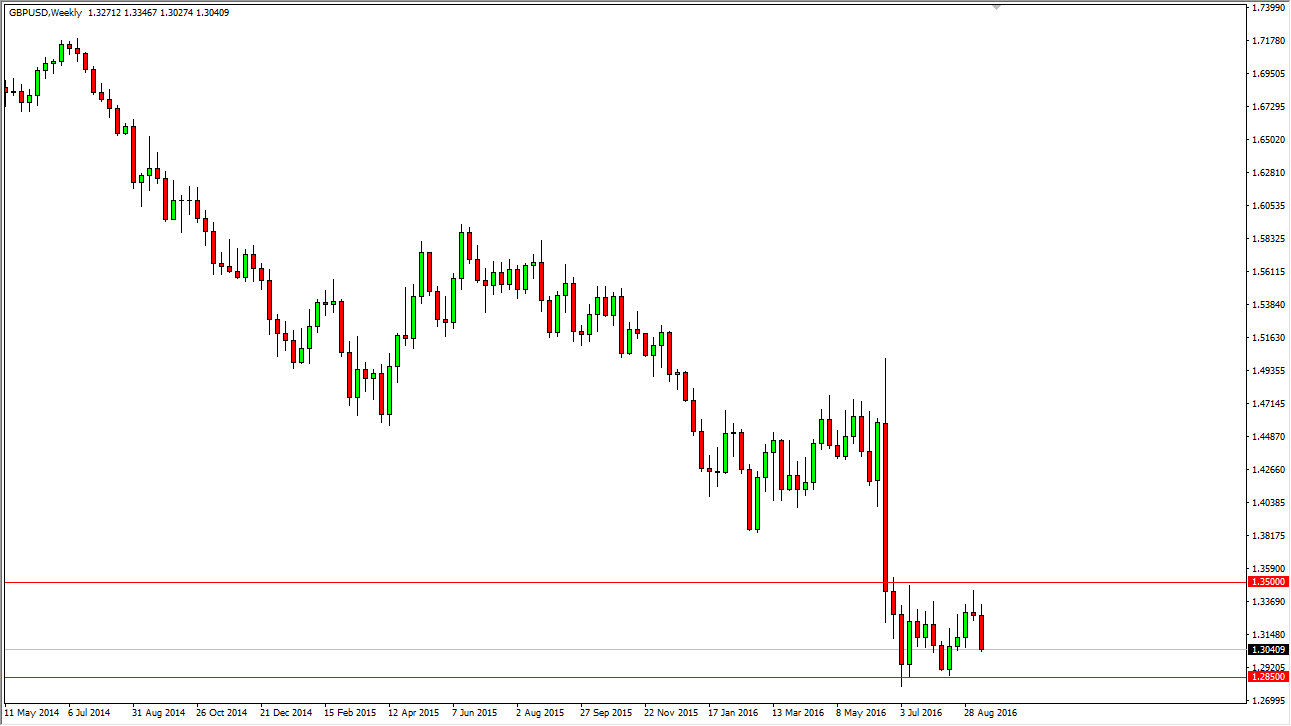

GBP/USD

The British pound continues to get absolutely hammered overall, but we are still in a larger consolidative area. I think that the 1.30 level could cause a little bit of a bounce, but I believe that it’s only a matter time before the sellers return and therefore should send the market down to the 1.2850 level. I sell, I don’t buy the British pound at this point.

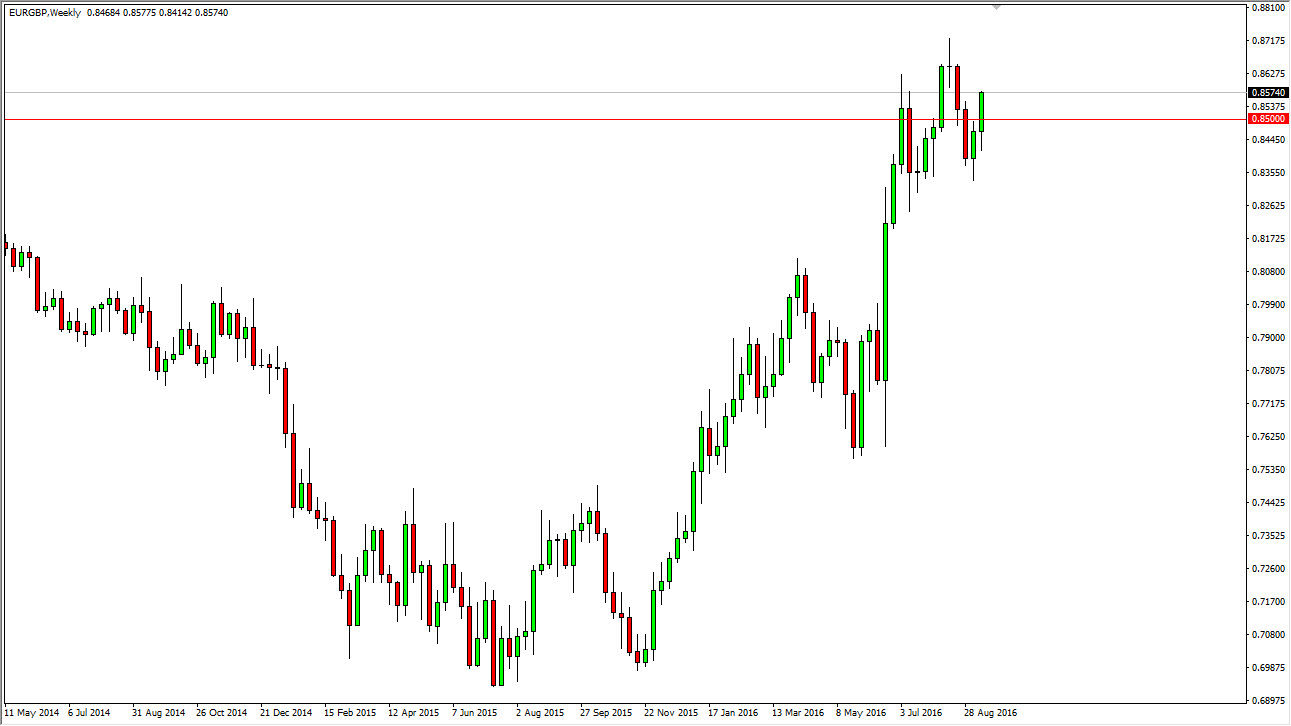

EUR/GBP

The Euro initially fell a bit during the course the week you can see that we broke well above the 0.85 handle. With this in mind, I believe that we are going to try to go back towards the highs out the 0.87 level, and then perhaps break out above there. A lot of this will come down to large traders coming back from summer holiday, so therefore the volume should pick up from here. I would be a buyer of dips as they should represent value.