By: DailyForex.com

GBP/USD

The British pound initially tried to rally during the course of the week but turned right back around to form a bit of an exhaustive candle. By doing so, looks as if we’re going to continue to try to break down and sliced through the 1.2850 level. If we can get below there, I think we could then go to the 1.25 handle. However, there is the possibility that we bounced, and if we do I would look for exhaustion to start selling yet again.

USD/JPY

The USD/JPY pair fell during the course of the week, slamming into the 100 level. By doing so, we found plenty of support, and we bounced enough to suggest that we will continue to see buyers given enough time. I believe that being long as the only way to go in this market as the Bank of Japan seems to be defending the 100 level below.

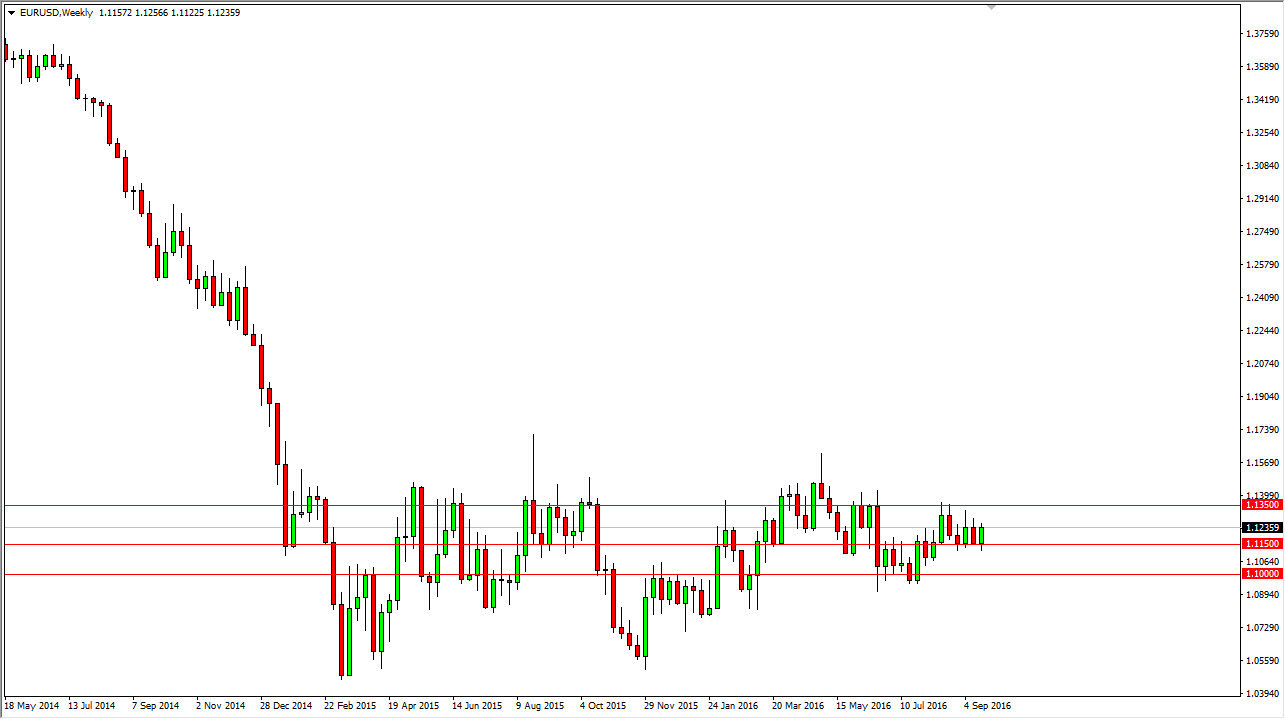

EUR/USD

The EUR/USD pair rallied during the course of the week but we are still very much in the consolidation area that we’ve been in for some time. I believe that the 1.1150 level below continues to be supportive while the 1.1350 level above is resistive. Ultimately, I believe that this is a market that can be very difficult to deal with, so having said that short-term scalpers could be enticed, but recognize that we have a lot of choppiness ahead of us.

USD/CAD

The US dollar initially fell during the course of the week, testing the 1.30 level for support. Now that we have formed support there, we ended up forming a bit of a hammer, and I believe that is a very strong signal. If we can break above the top of the hammer, the market should then reach towards the 1.35 handle. Because of this, I believe that buying is the only thing we can do, either on the breakout or short-term pullbacks and show signs of support.