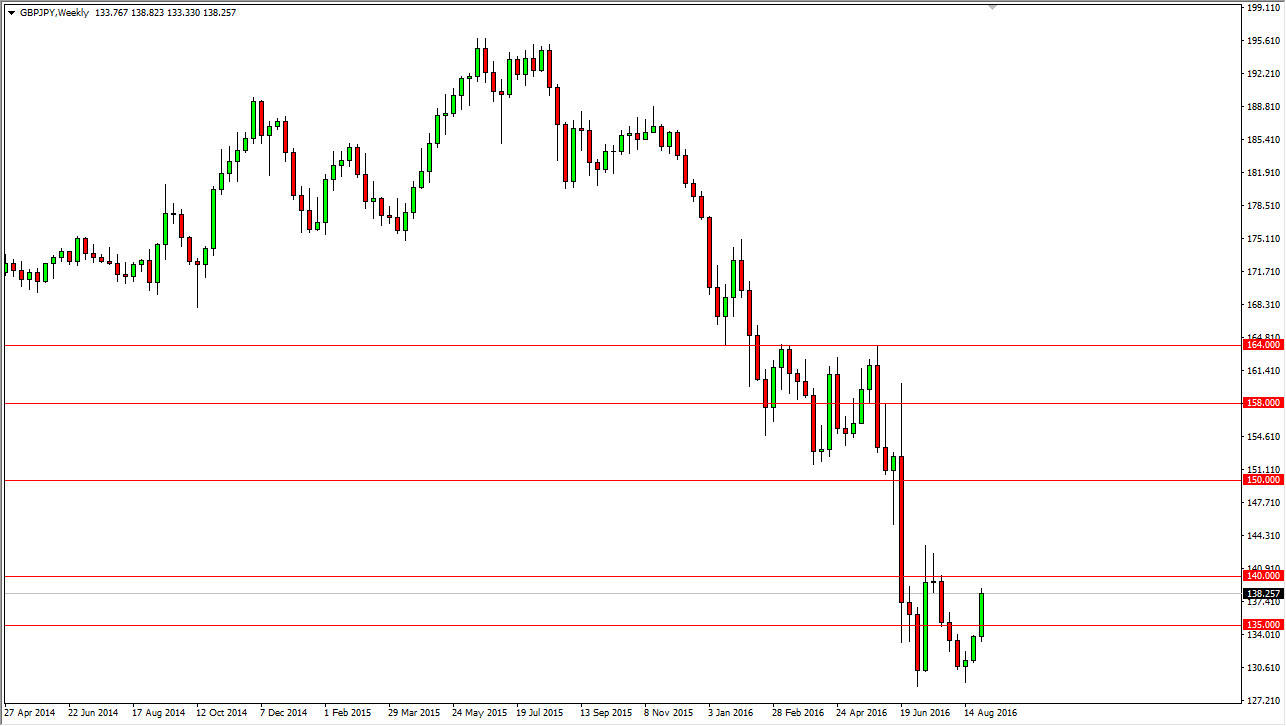

GBP/JPY

The GBP/JPY pair rallied during the course of the week, breaking well above the 135 handle. We also look as if the 140 level above is going to be targeted. Ultimately, any type of exhaustive candle in this general vicinity should send this market back down as it looks like we’re going to consolidate between the 130 level on the bottom, and the 140 level on the top.

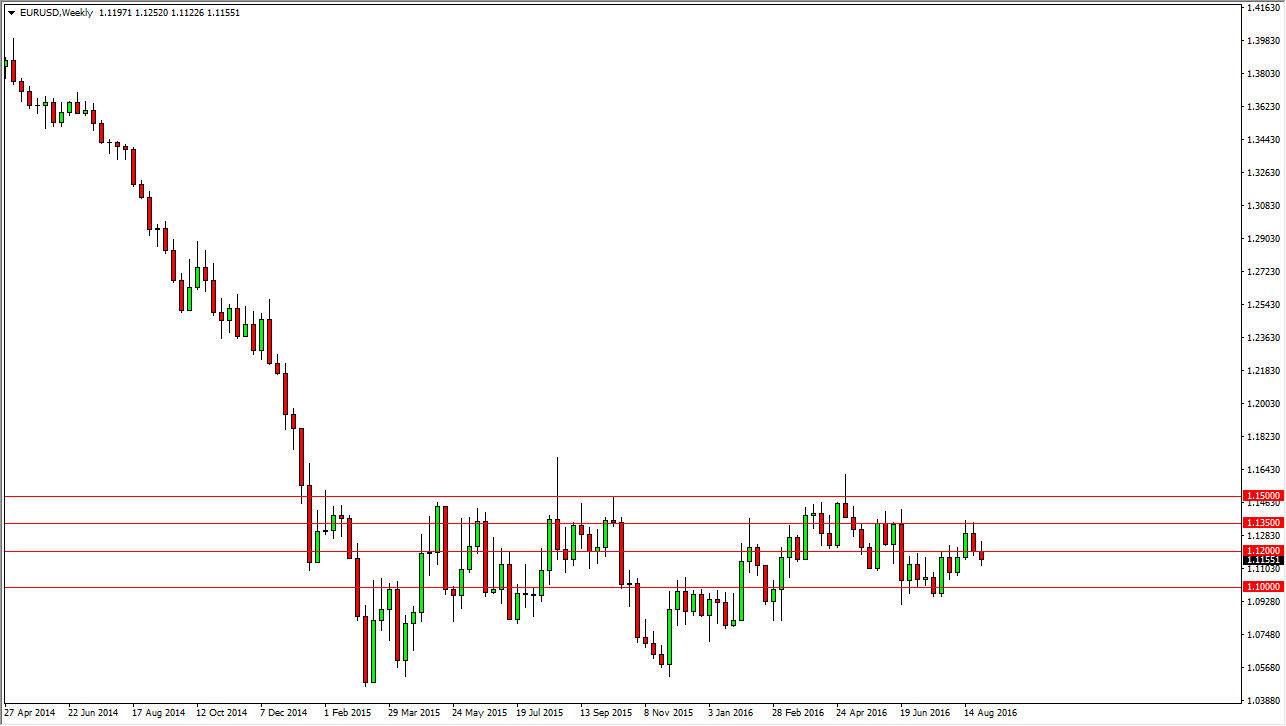

EUR/USD

The Euro went back and forth during the course of the sessions that make up the week, and as a result it looks like we’re getting continue to grind around in somewhat sideways action but I do feel that the downward pressure is fairly strong, and will probably continue to punish the Euro overall. Ultimately, the 1.10 level below could be the target.

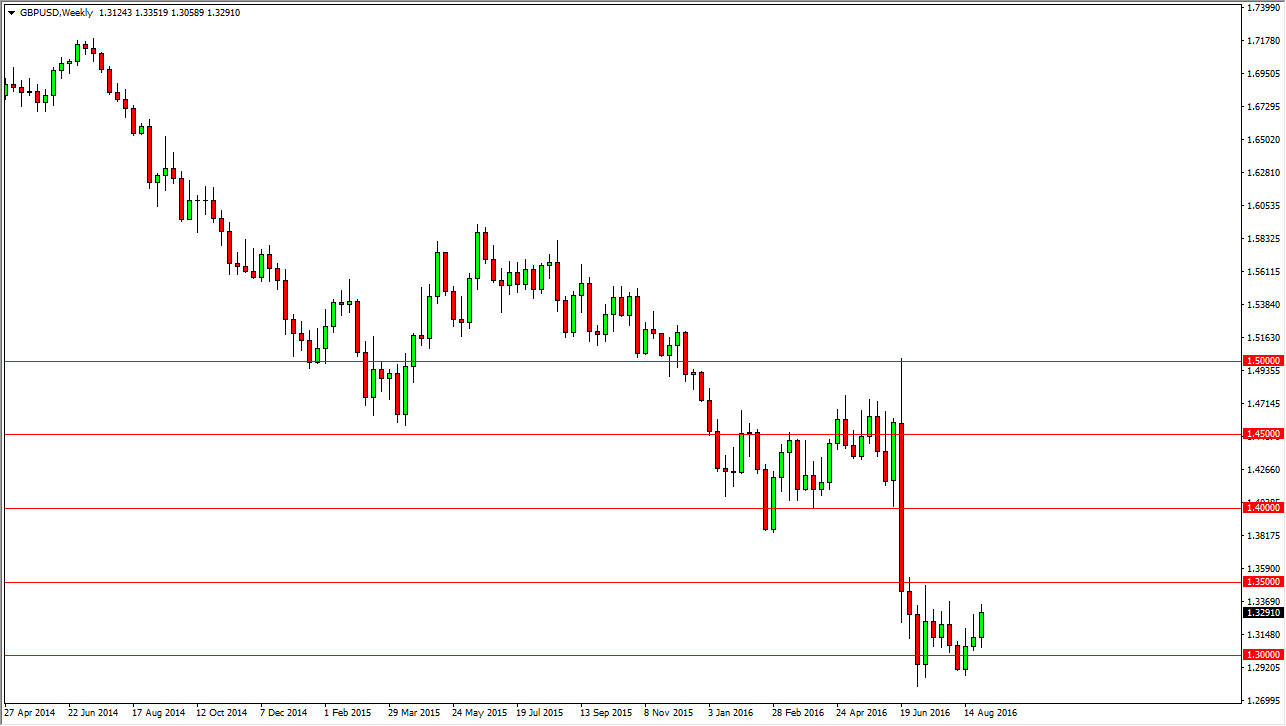

GBP/USD

The British pound initially fell during the course of the week but then turn right back around to rally significantly. We broke above the top of the shooting star from the previous week, and as a result we could continue to see quite a bit of bearish pressure above, extending all the way to at least the 1.35 level, if not higher than that. This is a market that has been in a downtrend, and with that being the case I feel that selling signs of exhaustion on short-term charts will continue to be the way going forward in the British pound.

NZD/USD

The New Zealand dollar initially rallied during the course of the week, but as you can see struggled above the 0.73 level. With most interesting to me is that the Friday candle was a shooting star there as well, so I think that we are going to pull back initially during the week but we may find buyers below, especially somewhere near the 0.72 handle.