Gold prices fell $9.59 on Friday, down for the third straight session to $1327.98 an ounce, as concerns that an interest rate increase may come sooner than expected and a strengthening dollar weighed on demand for the precious metal. The XAU/USD pair initially climbed above the $1332 level and reached the $1355/2 zone but the market reversed its course after the bulls failed to overcome this barrier. As a result, prices dropped back below $1332 and headed towards the support at around the $1327 level.

The focus remains on whether the recent batch of economic data is enough to warrant action from the central bank to tighten monetary policy later this month. Although soft data -including non-farm payrolls and ISM non-manufacturing reports- buoyed the precious metal, comments from top Fed officials boosted expectations for an imminent rise in interest rates. It appears that persistent talks about higher borrowing costs will prevent gold from significantly rallying but destabilization in the risk environment will certainly be something thing to watch as it may increase desire for safe haven diversification. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 307860 contracts, from 276341 a week earlier.

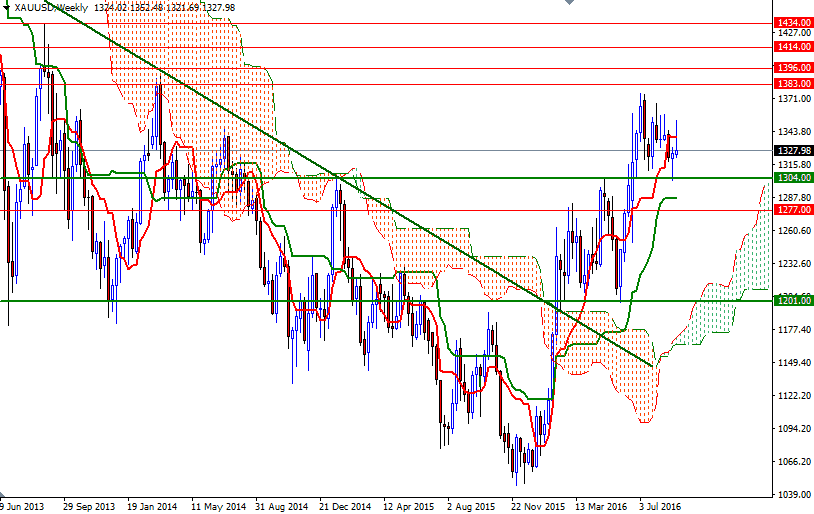

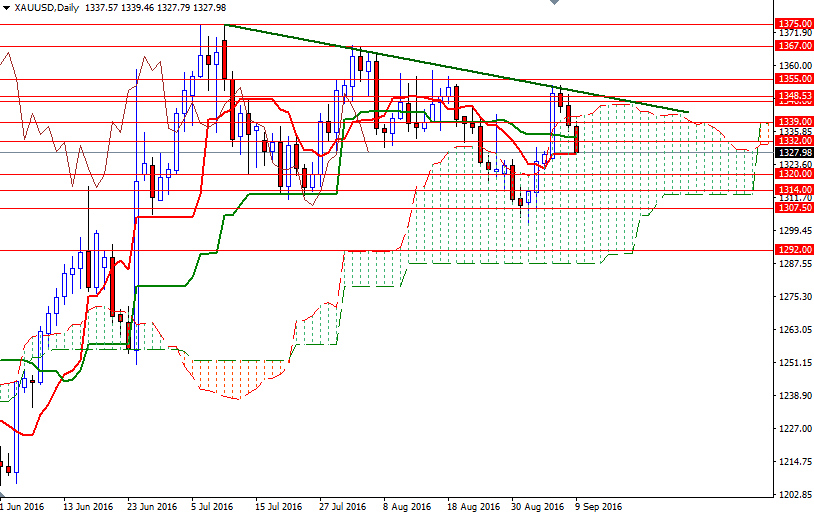

Gold is currently lacking a clear driver and as I pointed out in my previous weekly/monthly analysis the market will probably stay range-bound at these higher levels. On the weekly time frame, prices remain above the Ichimoku cloud and we have a positive Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) cross, suggesting that the medium-term outlook is bullish. However, the market is within the borders of the daily cloud and in addition to the negative Tenkan-Sen/Kijun-Sen cross, there is a bearish trend line blocking the bulls' way. The last two weekly candles (a hammer followed by a shooting star) indicate that buying interest emerges on dips but there will be resistance as prices move higher. To the downside, keep an eye on the 1320/19 area as closing at the bottom of the trading range implies that XAU/USD is likely headed that way. If that support is broken, the market will aim for 1314 and 1310. Below that, the bulls will be waiting in the 1304/4 zone. Closing below 1304 on a daily basis would open up the risk of a move towards 1297/5. In order to ease the downward pressure, the bulls need to lift prices above the 1339 level. Breaking through this barrier could trigger a reaction targeting the 1348.50-1346.60 area. If XAU/USD passes through 1348.50, we could see a push up to 1355/2. Once above that, 1360 will be the next stop.