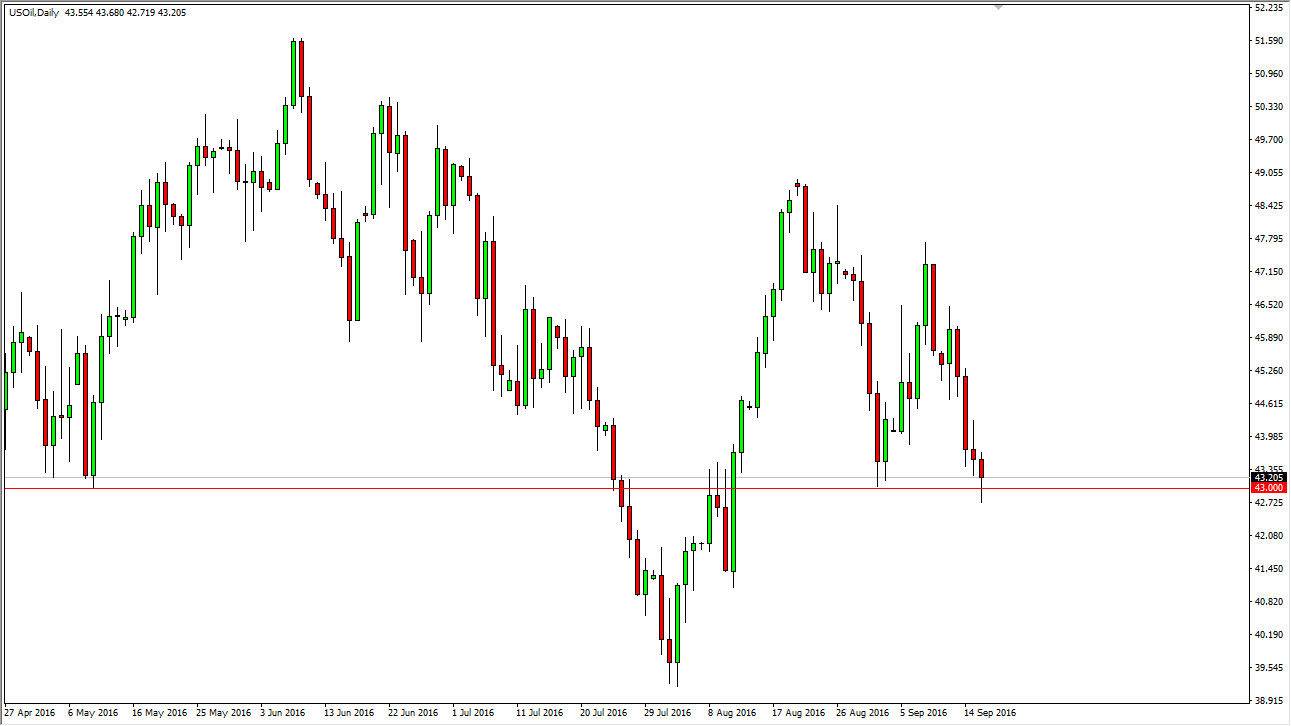

WTI Crude Oil

The WTI Crude Oil market initially dipped below the $43 level on Friday, but found enough support to turn things around and form a hammer. This of course is one of the more bullish candlesticks that you can form so I think that we are going to have a real fight on our hands. Further compounding the confusion is the fact that we have a shooting star from Thursday which of course is very negative so I think we’re going to bang around this area just above the $43 level for a while. Ultimately though, I do think oil markets are in serious trouble as the glut is expected to continue into 2017. At this point in time I would be very suspicious of any rallies it would be more than likely looking for selling opportunities when we do rally on signs of exhaustion. On entering, breaking below the bottom of the hammer of course is a very bearish sign and I think at that point in time oil will find itself falling towards the $41 level, and then eventually the $40 level.

Natural Gas

The natural gas market initially fell during the day on Friday, dipping below the $2.88 level. However, we did find enough support yet again to turn the market back around as we attempt to break through the barrier found out the $3 handle. I think at this point in time the markets going to continue to try to press the issue, and could very well find themselves breaking out eventually. With this in mind, even though I don’t like the longer-term outlook for natural gas, I have to admit that it seems that the buyers are very much in control at this point. In fact, I believe that the $3 level is crucial in determining the longer-term implications of natural gas pricing.