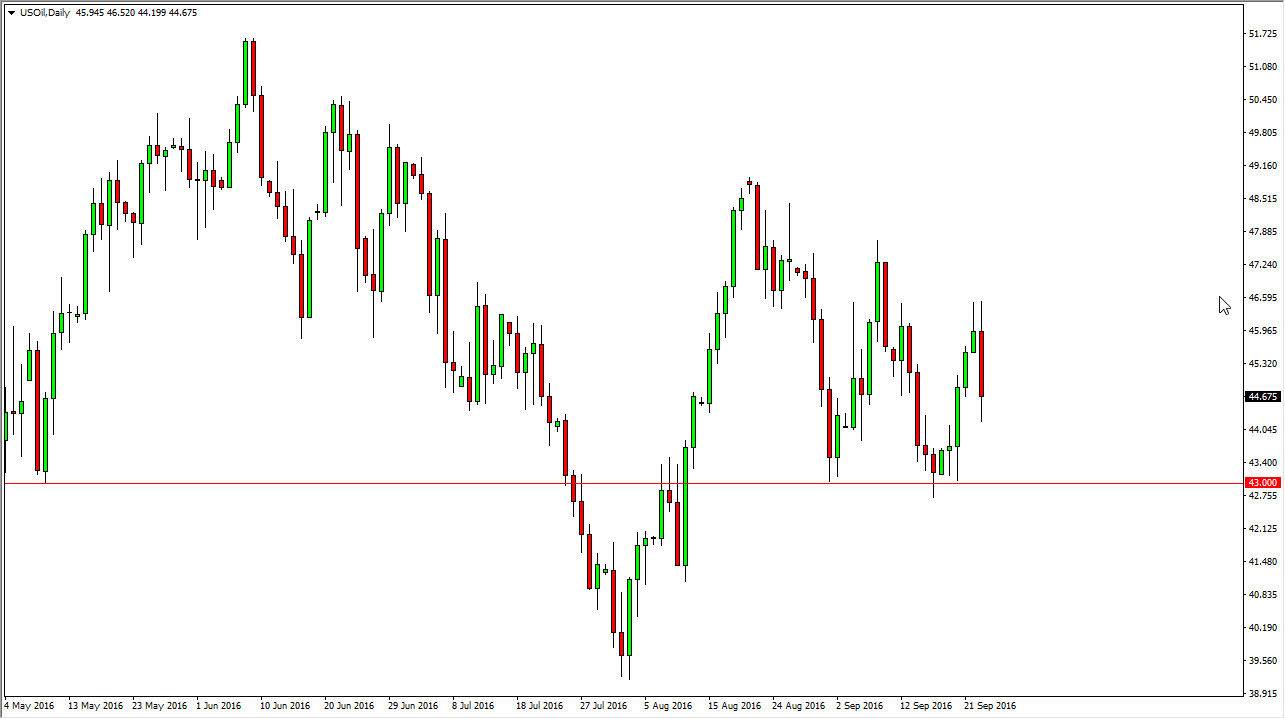

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Friday but turned around and fell rather significantly. As we broke through the $45 level, you have to believe that the sellers are starting to get a little bit more emboldened. At this point in time, I believe that the $43 level continues to offer significant support, but we will break down below there eventually. Quite frankly, this is a descending triangle that is just waiting to break, or at the very least a descending channel. I believe that once we break down below the $43 level, the market will really start to turn extraordinarily negative. At this point in time, I believe that anytime we rally in a short-term chart, you have to be looking for exhaustive candles in order to take advantage of what is starting to become a relatively decent negative move.

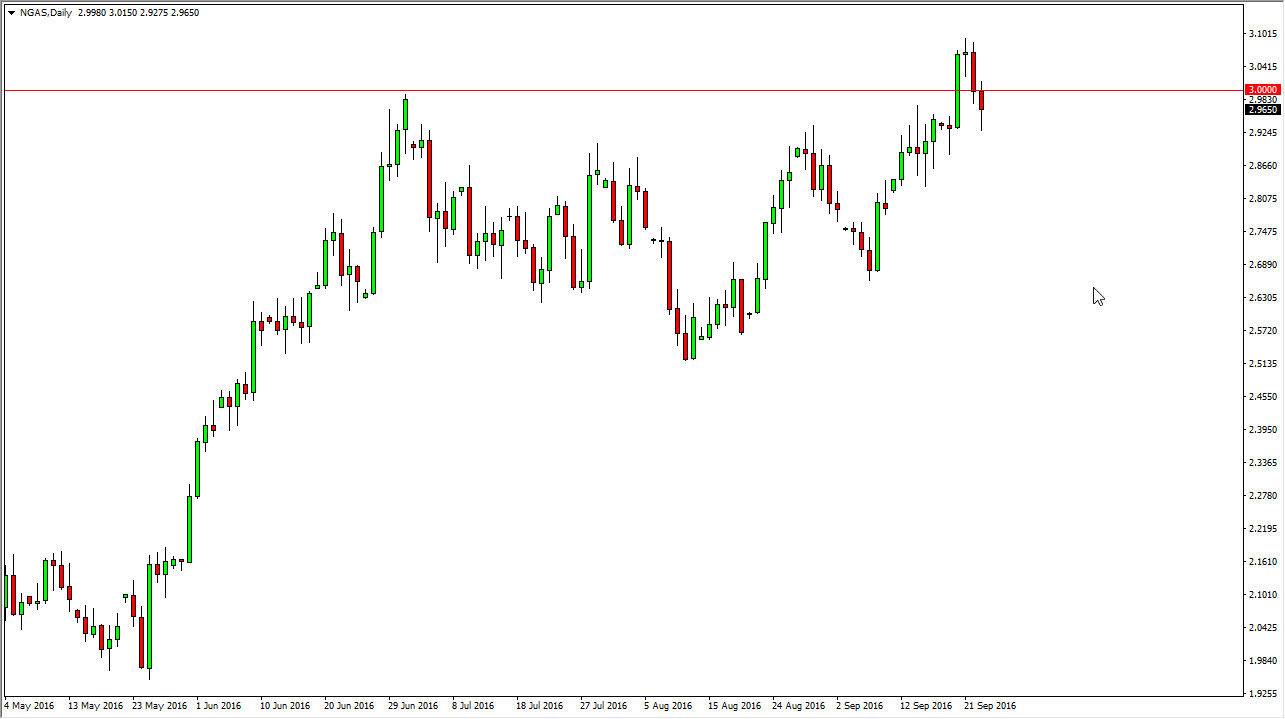

Natural Gas

The natural gas markets fell during the course of the day on Friday, but found enough support to turn around and form a hammer. We found support right about where we needed to find it, so we can break above the top the hammer I believe that this is a continuation of the recent breakout that we have seen. I think at that point in time, the market could very well go to the $3 level, and then perhaps even higher than that. Ultimately though, I do know that there is going to be a glut of natural gas as there is more than enough out there to handle any type supply. However, I feel that the market will probably go higher in the short-term, because obviously the buyers are in control. Remember, we have recently seen quite a bit of drilling stopped due to the fact that there wasn’t much in the way of pricing power. Eventually, drillers go back to the fields and supply picks back up.